Savills Singapore's Residential Sales Briefing reveals that after a quiet first quarter, developers increase their new launches in Q2 2018. However, the pace was below market expectations.

Key findings:

- Leasing activity of private residential homes, excluding executive condominiums (ECs), soared to another quarterly high with 22,421 leasing transactions, up by 10.7% quarter-on-quarter (QoQ) and 10.2% year-on-year (YoY).

- After a marginal increase of 0.3% QOQ in the first quarter, the latest statistics from the Urban Redevelopment Authority (URA) showed that the overall rental index for private residential properties rose by 1.0% QOQ in Q2 2018, signalling that the rental market is stabilising.

- Average monthly rents of high-end, non-landed residential properties tracked by Savills climbed for the second consecutive quarter by 0.5% QOQ to S$4.11 per sq ft.

- The limited new supply, coupled with strong leasing demand, has caused island-wide vacancy levels of private homes to decline for three straight quarters to 7.1% in Q2 2018.

- We forecast rents to rise 2-3% YOY for 2018.

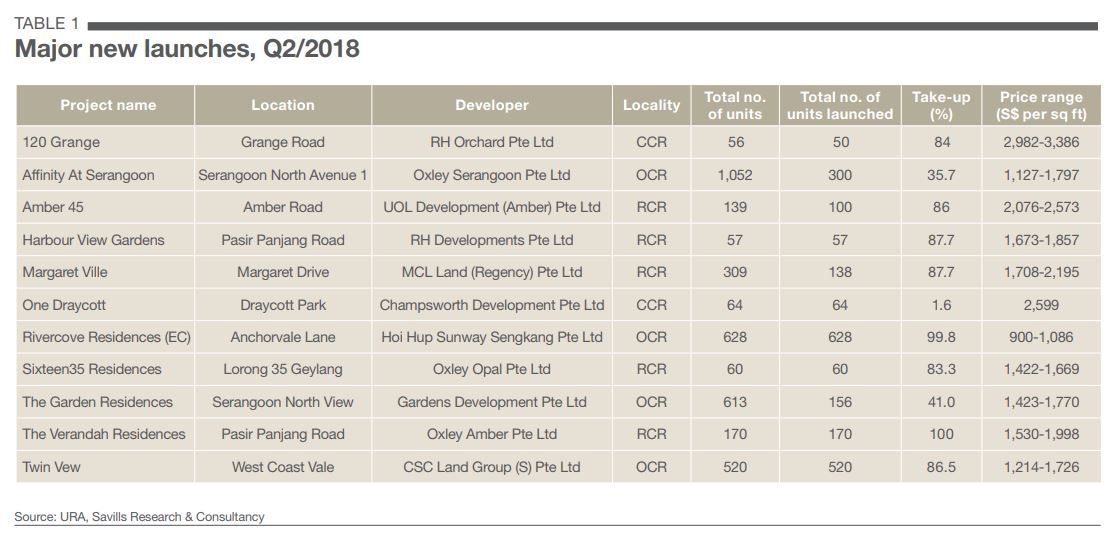

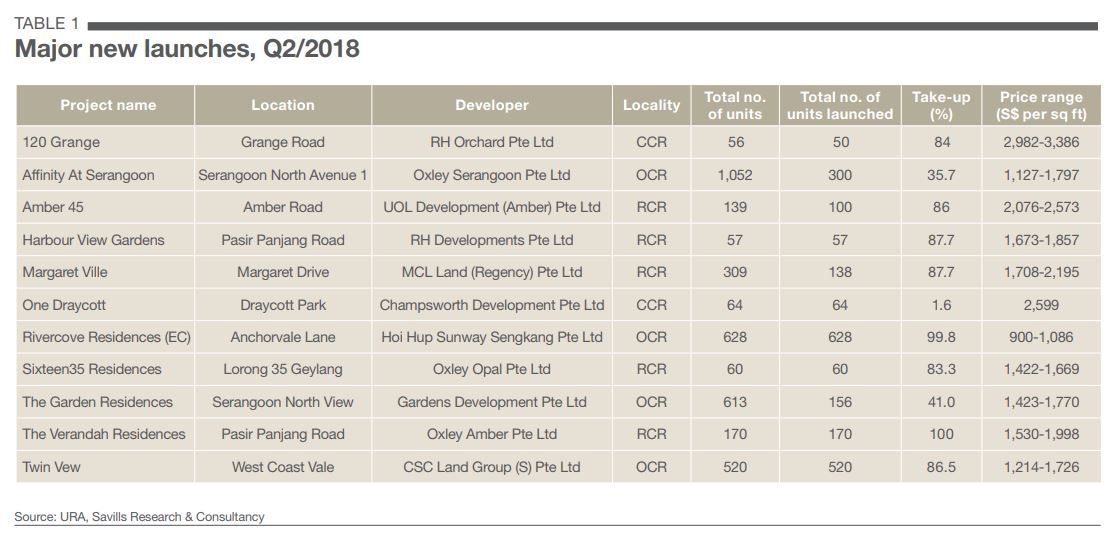

Most developers tried to avoid launching their projects during the school holidays in June. They also continued to hold back new launches in order to ride along with the general price increase.

Overall according to the URA's latest data, a total of 2,437 private homes, excluding ECs, were released for sale, up a sharp 164.6 per cent from the 921 units released a quarter ago.

Source: Savills Singapore Residential Sales Briefing

New launches of private homes, excluding executive condominiums (ECs), rose 164.6 per cent quarter-on-quarter (QOQ) to 2,437 units Q2.

The number of private homes that developers sold in Q2 2018, about 2,366 units, was 49.7 per cent higher than the preceding quarter. In the secondary market, the transaction volume of private homes also jumped 28.6 per cent QOQ to 4,820 units, the highest level since Q2 2011.

Based on caveats registered in Q2 2018, a total of 4,801 non-landed private residential units were purchased by Singaporean buyers, up 38.7 per cent QOQ. The market share of this group of buyers also rose by 4.4 percentage points (ppts) QOQ to 77.4 per cent, the highest since Q2 2012.

Source: Savills Singapore Residential Sales Briefing

A check of caveats for new sales of non-landed private residential units showed that some 3,178 units or 85.4 per cent of the total units sold in the first half of 2018 were priced below S$2.0 million each.

The URA's island-wide private residential price index continued to rise for the fourth straight quarter, in Q2 2018, although the quarterly growth rate moderated slightly. A similar pattern was found in the prices of high-end non-landed residential properties tracked by Savills.

Prices for the 2H 2018 batch of launches are re-vectored to end-2019, thereby slowing the price increase for 2018 from 15 per cent - 20 per cent year-on-year (YOY) to 10 per cent - 12 per cent.

Cheong concludes, "Rents have entered a new leasing cycle and it will take more than a trade war to reverse this upward trend."

Click here to view Savills Singapore Residential Sales Briefing.

For more information or to discuss the report phone or email Alan Cheong Senior Director Singapore Research, or Simon Smith Senior Director Asia Pacific Research at Savills, via the contact details listed below.

Similar to this:

Strong price momentum and increases in launches and sales for Q2, Singapore

Best locations for tech enterprises: Bangalore, Singapore & Shenzhen

Cushman & Wakefield Singapore appoint Dennis Yeo as Chief Executive