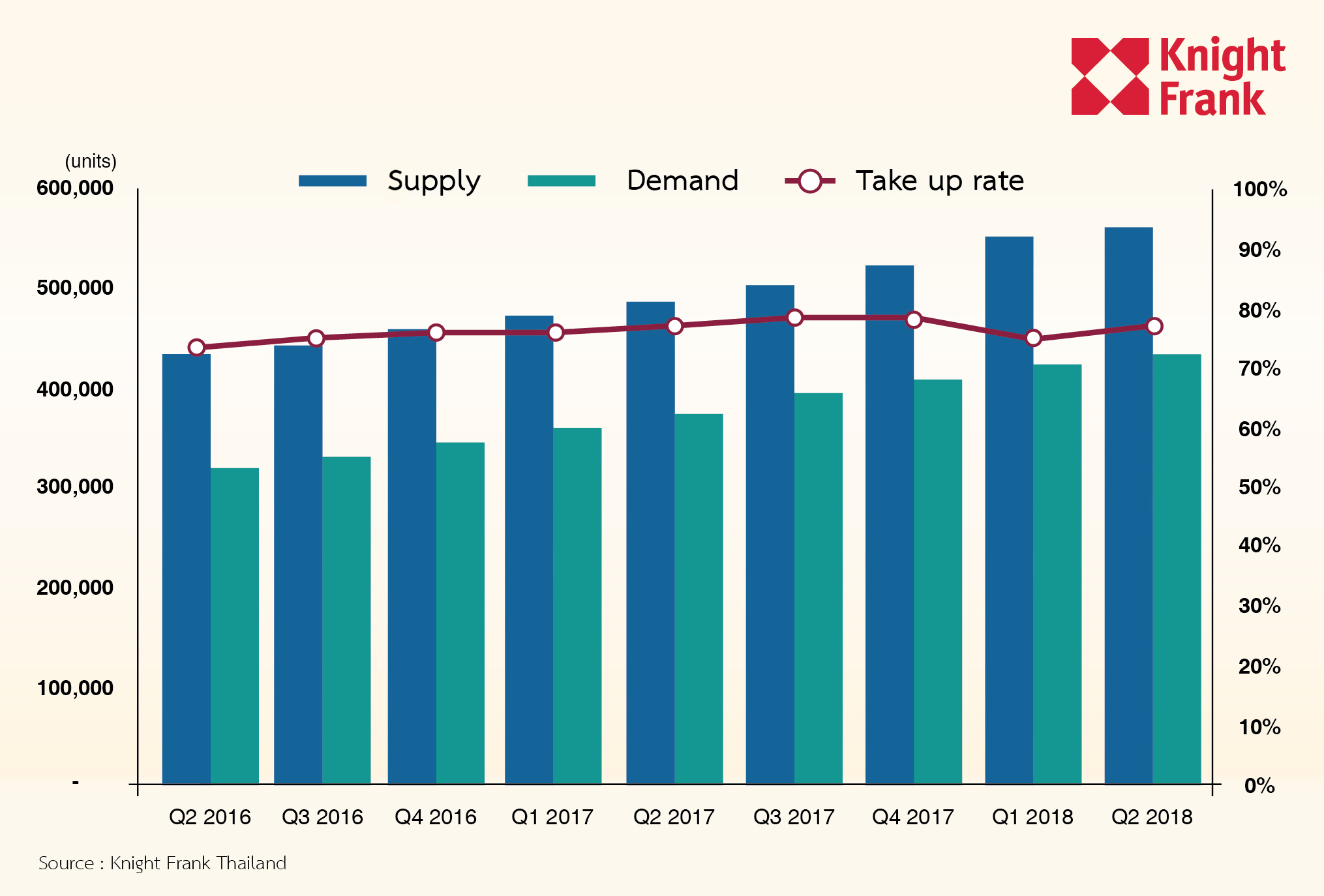

Knight Frank Thailand's latest condominium market research reveals the overall state of the market fared well in terms of demand and prices despite the fact that new supply declined by more than half compared to the previous quarter. This is primarily due to the fact that most operators have planned to launch new projects during the second half of the year.

At a glance:

- 8,894 new units entered the market during Q2, a 47% decrease from the previous quarter.

- Unit launches in CBD and suburbs increased by 6.5% and 2.2% respectively.

- Two new luxury projects in Asoke and Ekkamai brought 363 units to market.

- Average sales rate of newly launched units was approx 60%.

- High probability that new supply in 2H 2018 will include more than 22,000 units.

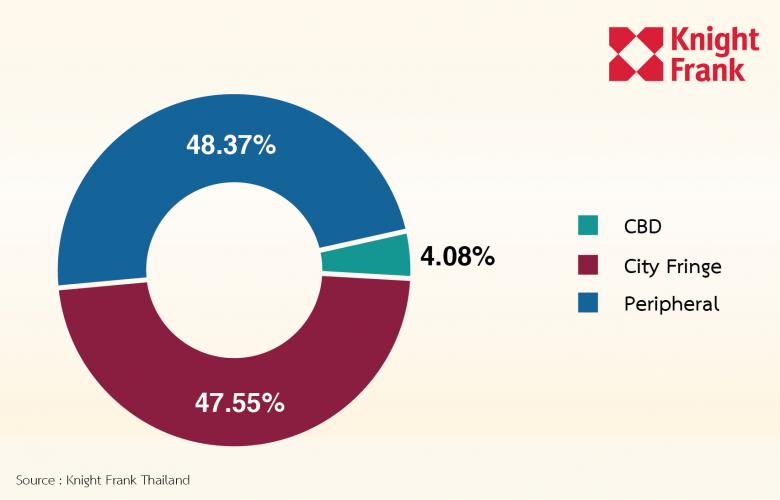

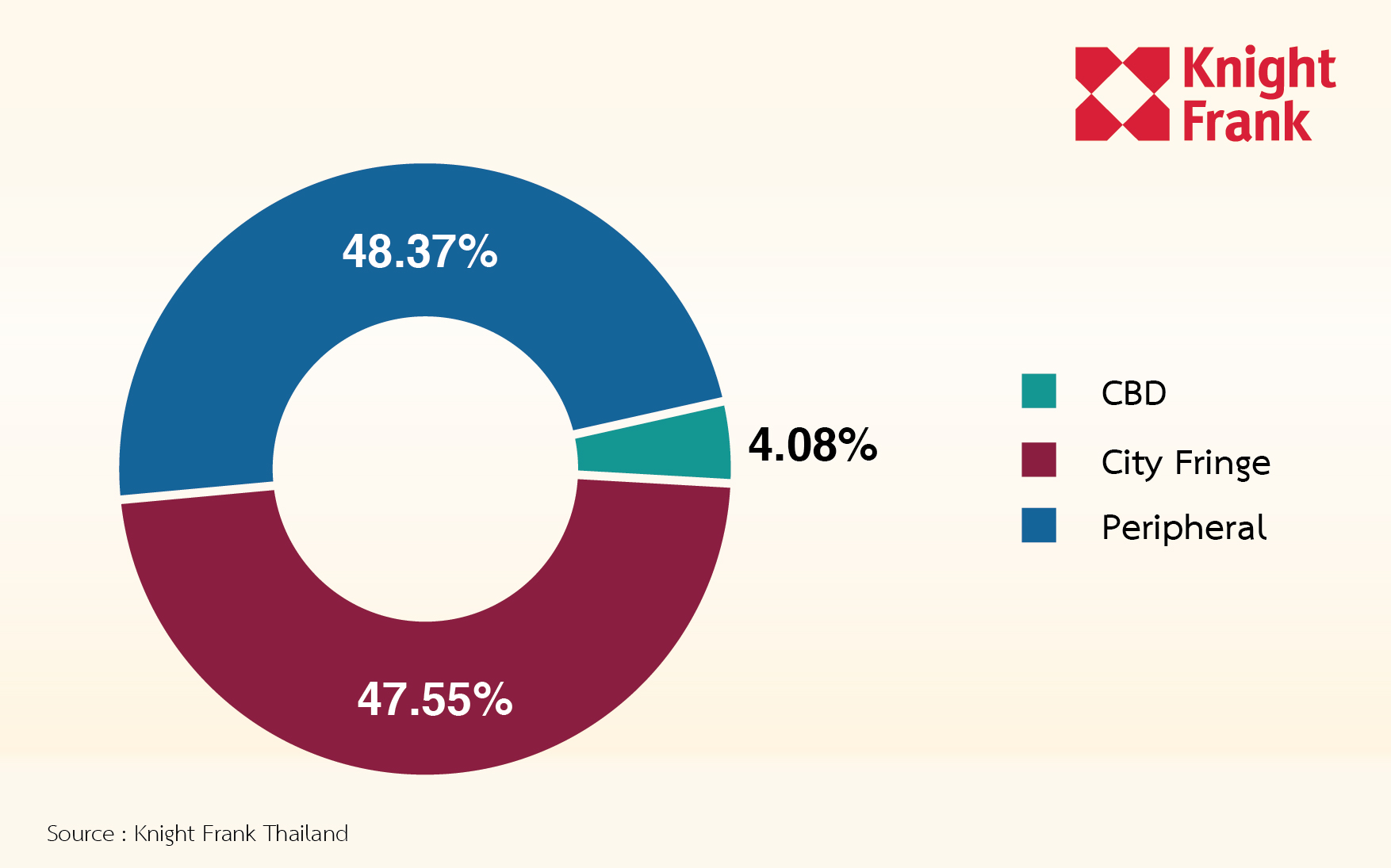

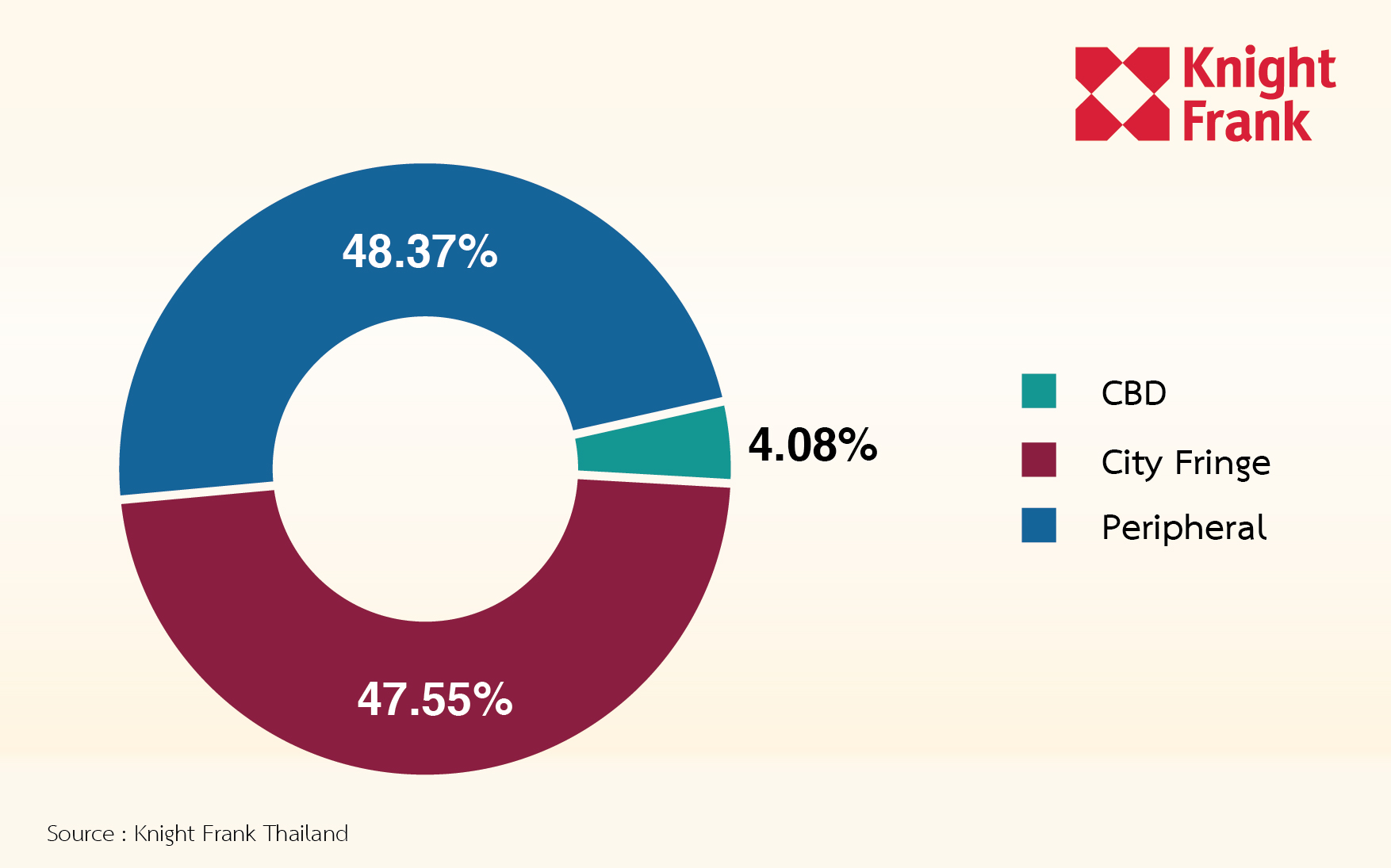

The second quarter of 2018 saw a total of 8,894 new units entering the market, a decrease of 47% from the previous quarter. It is clear that industry operators are increasingly turning their attention to the development of areas around the CBD and in the suburbs. This is reflected by the number of new units launched in these two areas, which increased by over 6.5% and 2.2%, respectively, compared to Q1 2018.

The most popular locations were along the train extension lines, especially the Light Green Line, Blue Line, and Yellow Line. This quarter, Ladprao, Phaholyothin, Petchkasem, and Charansanitwong all saw many new projects launched around the same time. Meanwhile, the CBD in the Sukhumvit area remained the most popular locale among operators during the second quarter of 2018, with two new luxury projects in Asoke and Ekkamai, totalling 363 units.

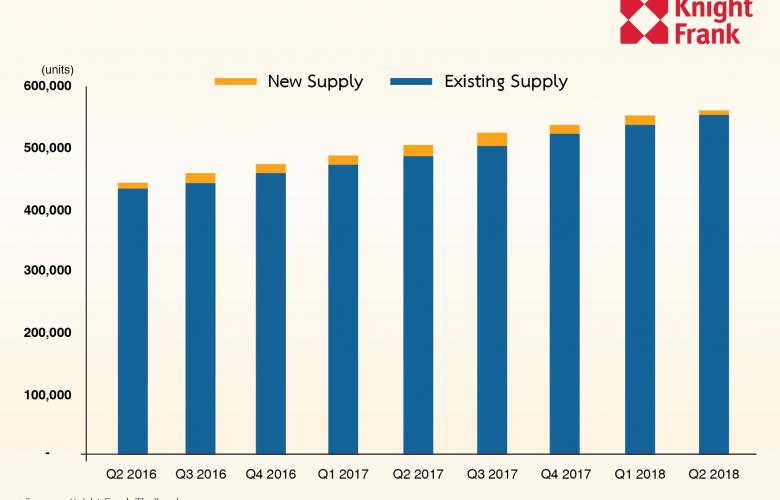

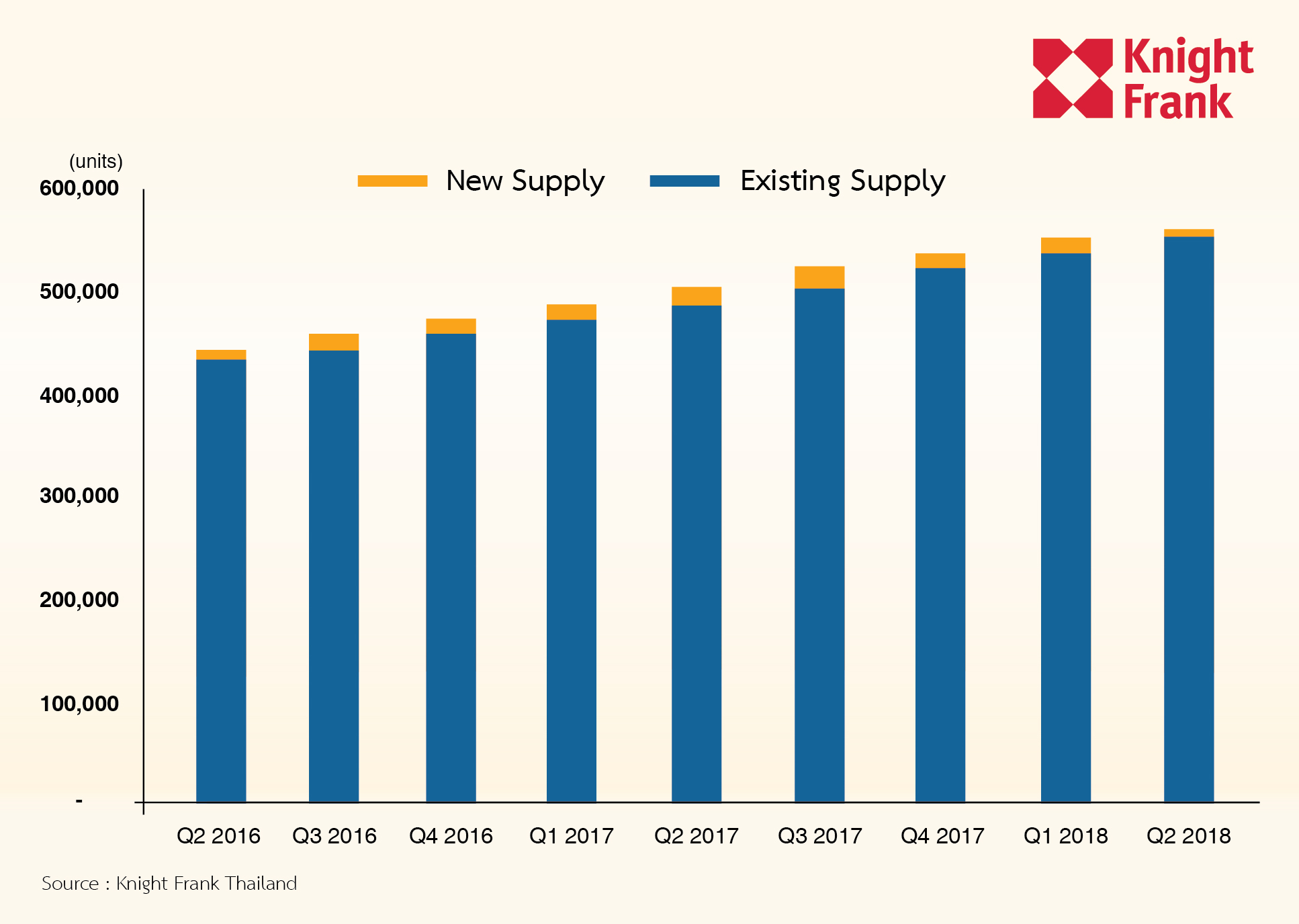

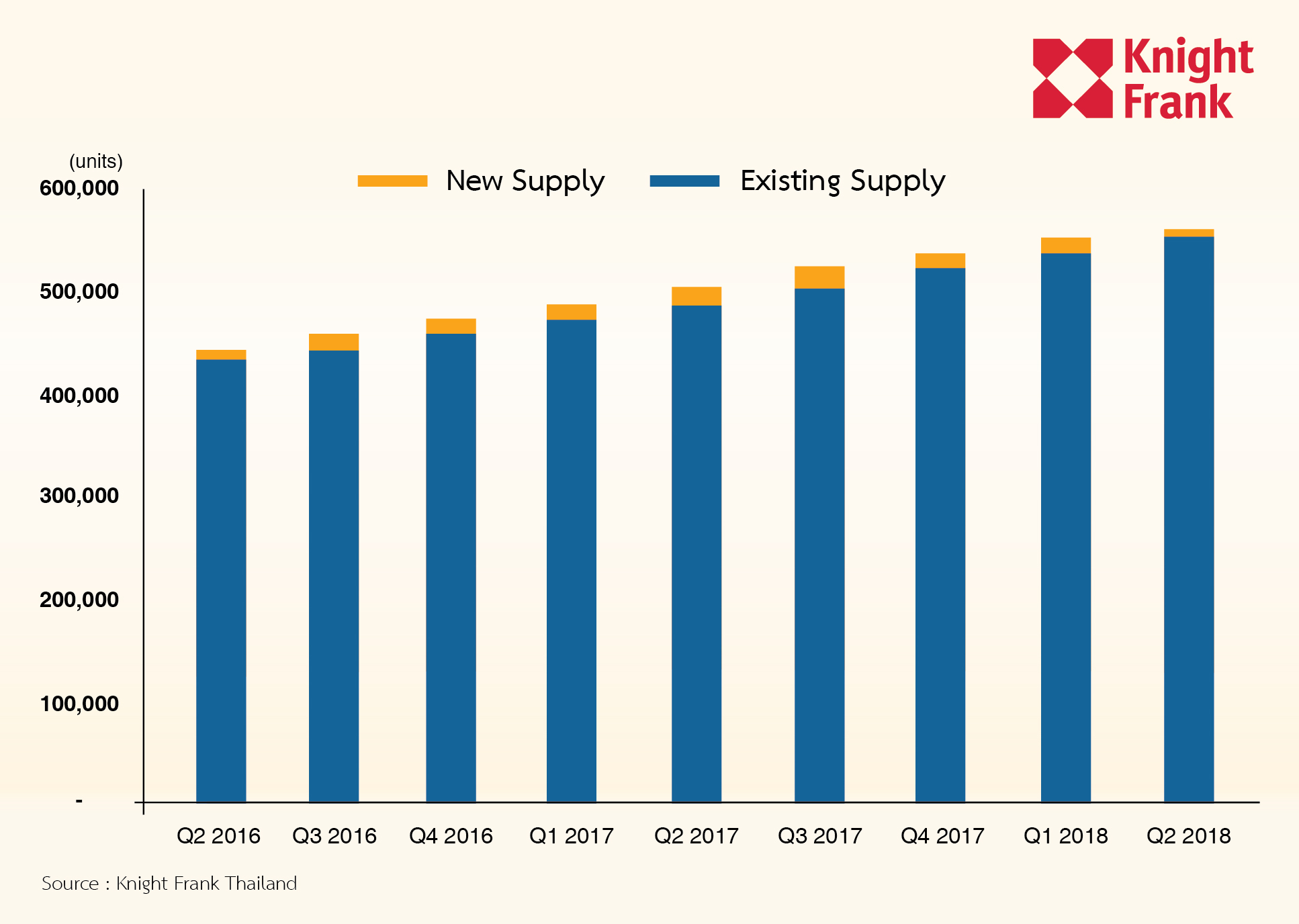

Supply of Condominiums in Bangkok, Q2 2016 to Q2 2018

Source: Knight Frank Thailand

New Supply in Bangkok, by Zone, Q2 2018

Source: Knight Frank Thailand

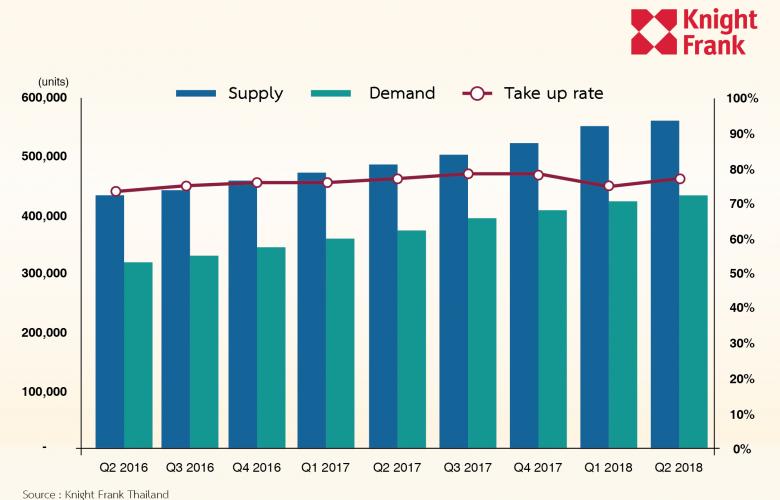

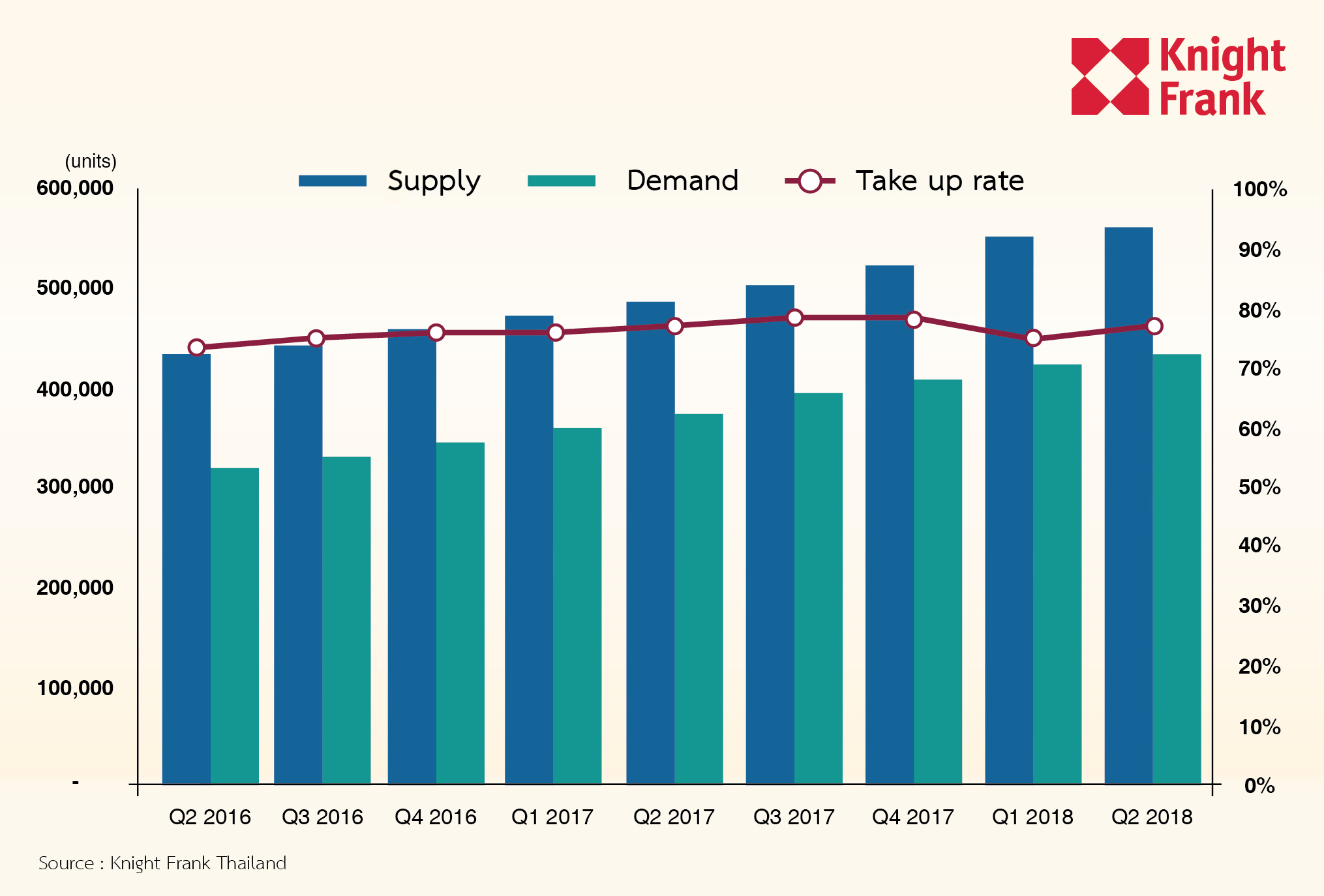

The sales volume showed that the average sales rate of newly launched units was around 60%. On the whole, the condos that enjoyed brisk sales this quarter were located in the CBD and the suburbs, with sales of around 70% and 50%, respectively. Specifically, areas that were popular among buyers this quarter included Sathorn-Tha Phra, Rama 9-Ratchada, and Paholyothin-Viphawadi.

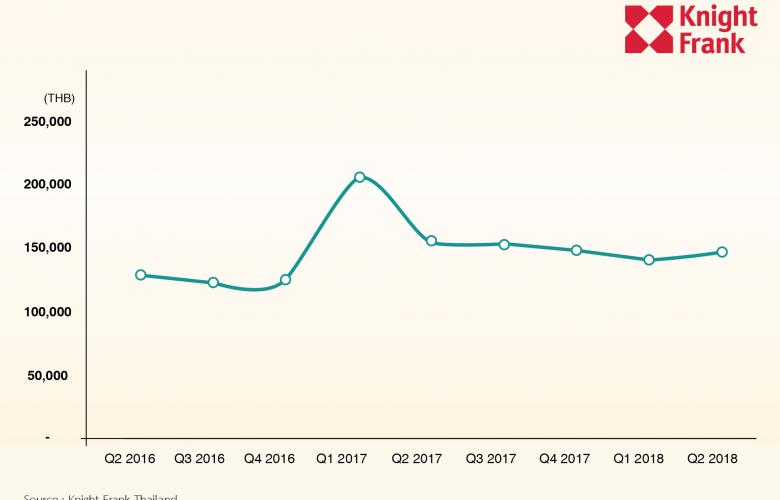

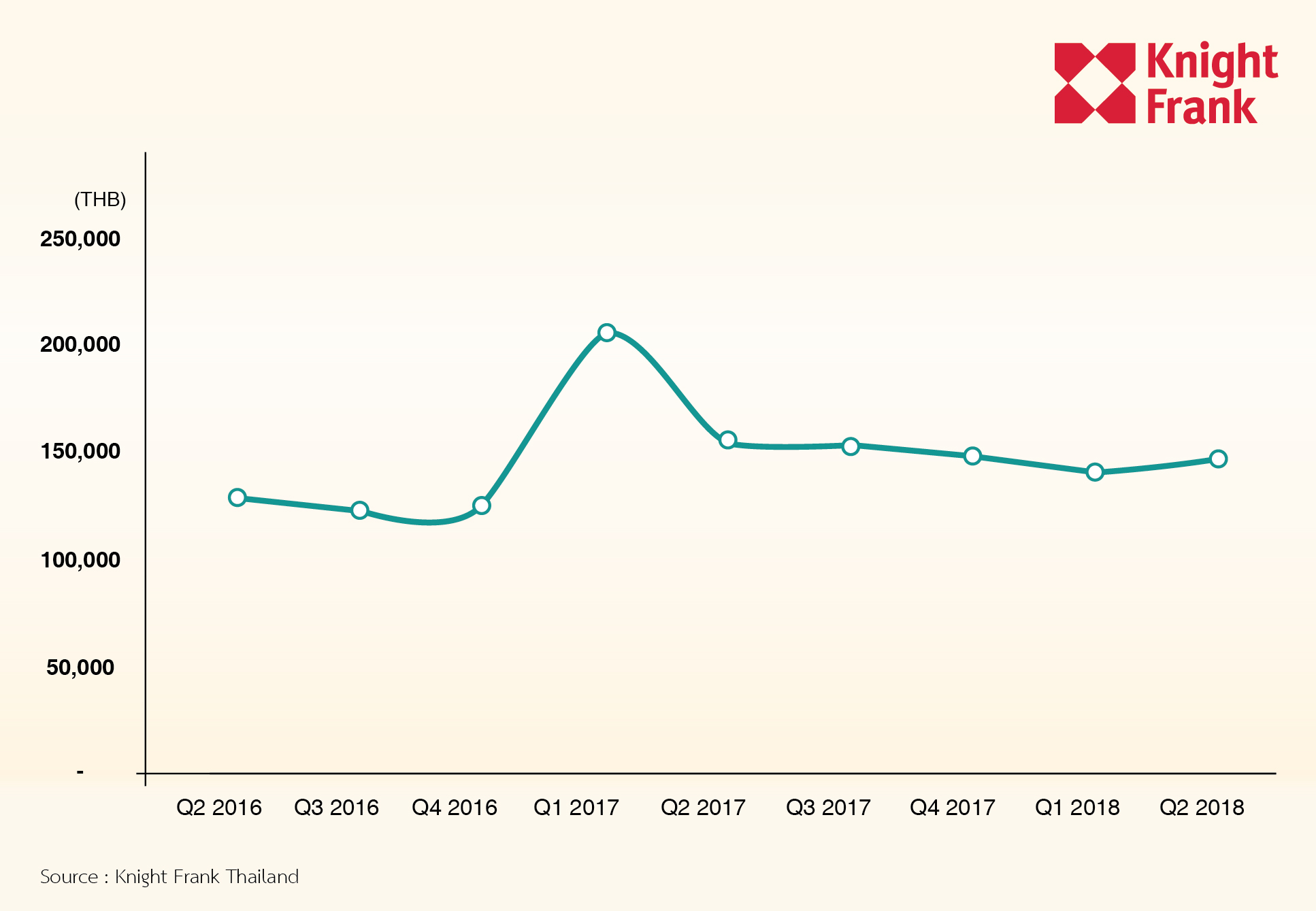

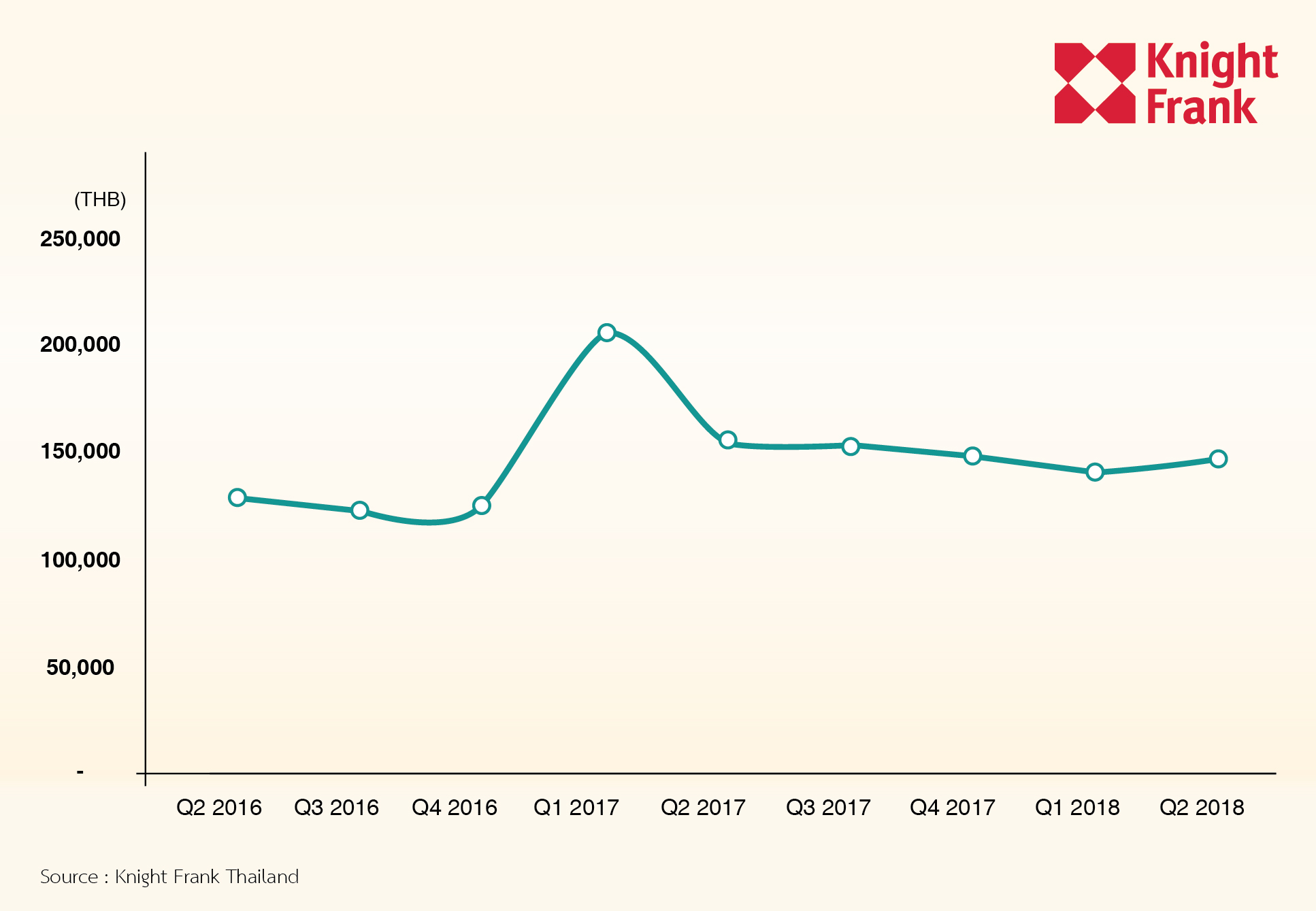

Overall, the asking price per square metre for new units during the first quarter of 2018 was 147,800 baht, up 5% from the previous quarter; this was driven by new condo prices in the CBD where average prices were at 248,000 baht, reflecting a 16% increase from the previous quarter.

Cumulative Supply, Demand and Take-Up Rates for Condominiums in Bangkok, Q2 2016 to Q2 2018

Source: Knight Frank Thailand

Asking Price Per Square Metre for Bangkok Condominiums, Q2 2016 to Q2 2018

Source: Knight Frank Thailand

The market situation in the near future warrants close watching in the second half of the year. There are many operators launching projects during this time period. There is a high probability that the new supply in the second half of 2018 will include more than 22,000 units entering the market. If that is indeed the case, the supply in 2018 will reach nearly 50,000 units. Prices in the second half of the year have the chance of breaking a record after six quarters, as over 40% of the new supply is located in the CBD.

For more information about Bangkok's condominium market, phone or email Marciano Birjmohun, Associate Director of Knight Frank Thailand, via the contact details listed below.

Source: Knight Frank Thailand

Similar to this:

Singapore leads outbound APAC investment - CBRE

E-commerce growth presents new challenges for retail in Thailand

APAC investment volumes hit record USD 81 billion in H1 2018