Vietnam has become an attractive destination for many foreign investors largely due to the country’s friendly policies encouraging FDI, its political stability and strong economy.

Foreign direct investment (FDI) disbursements rose 8.4% year-on-year to US$8.37 billion in the first six months of 2018, according to Foreign Investment Agency statistics.

Furthermore, JLL explains that Vietnam remains one of the most favourable destinations for foreign investment in South East Asia.

Within the first half of 2018, the Vietnamese real estate market continued to appeal to foreign investors and continued to witness high-value merger and acquisition (M&A) transactions in a variety of sectors such as residential, commercial and industrial.

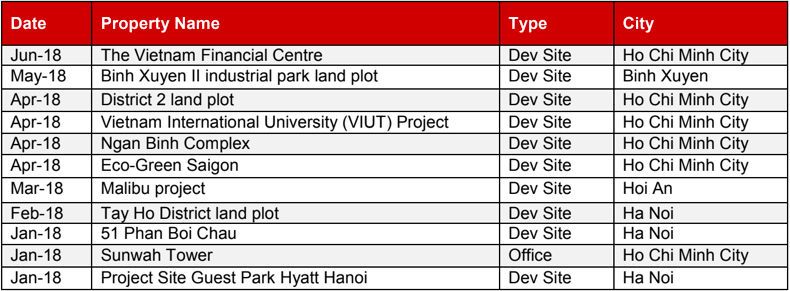

List of some M&A transactions in Vietnam 1H 2018 Source: Real Capital Markets. Supplied: JLL Vietnam.

M&A transactions in 1H 2018:

- In January, acquisition of Sun Wah office tower by Nomura Real Estate Development. Nomura acquired a 24% stake in the Grade A office building located in District 1, Ho Chi Minh City. The company also invested in the condominium project “Phu My Hung Midtown” in District 7, Ho Chi Minh City.

- In March, CapitaLand announced that its wholly-owned subsidiary CVH Nereus Pte. Ltd. acquired 16.9 million ordinary shares, representing 99.5% of the charter capital of Hien Duc Tay Ho Joint Stock Company (HDTH), for a total cash consideration of approximately VND 685 billion (approximately US$29.8 million), subject to usual post-completion adjustments.

- In April, Frasers Property entered into a conditional share purchase agreement with Tran Thai Lands Company Limited to acquire 24 million ordinary shares, representing 75% of the issued share capital of Phu An Khang Real Estate Joint Stock Company (PAK).

- In June, another major mixed-use residential development deal was the divestment of Keppel Land’s stakes in Quoc Loc Phat JSC (QLP)’s development project in District 2, Ho Chi Minh City.

- Also in June, Malaysia’s Berjaya Land Berhad announced that its wholly-owned subsidiary, Berjaya Leisure (Cayman) Limited (BLeisure Cayman), had divested its entire resultant 32.5% of the capital contribution in Berjaya Vietnam Financial Center Limited (BVFC) to Vinhomes Joint Stock Company (Vinhomes) and Can Gio Tourist City Corporation for a cash consideration of VND884.9 billion (approximately US$38.4 million).

Investment deals in 1H 2018 were diversified with a good variety of asset and property types transacted.

JLL expects foreign investors to continue showing a keen interest in the Vietnamese real estate market. Incoming foreign investors are actively hunting for “clean” and “clear” projects that can meet their required returns and conditions. Due to the strong focus on Vietnam from regional investors, JLL anticipates M&A activities to reach record levels in 2018.

For more information on Vietnam's M&A activities, phone or email Khanh Nguyen, Associate Director for Capital Markets, JLL Vietnam via the contact details listed below.

Similar to this:

In Singapore "overall real estate investment sales remained healthy" during Q2

Knight Frank say Malaysia's property market is picking up

Hong Kong's retail market regains lost momentum - Colliers International