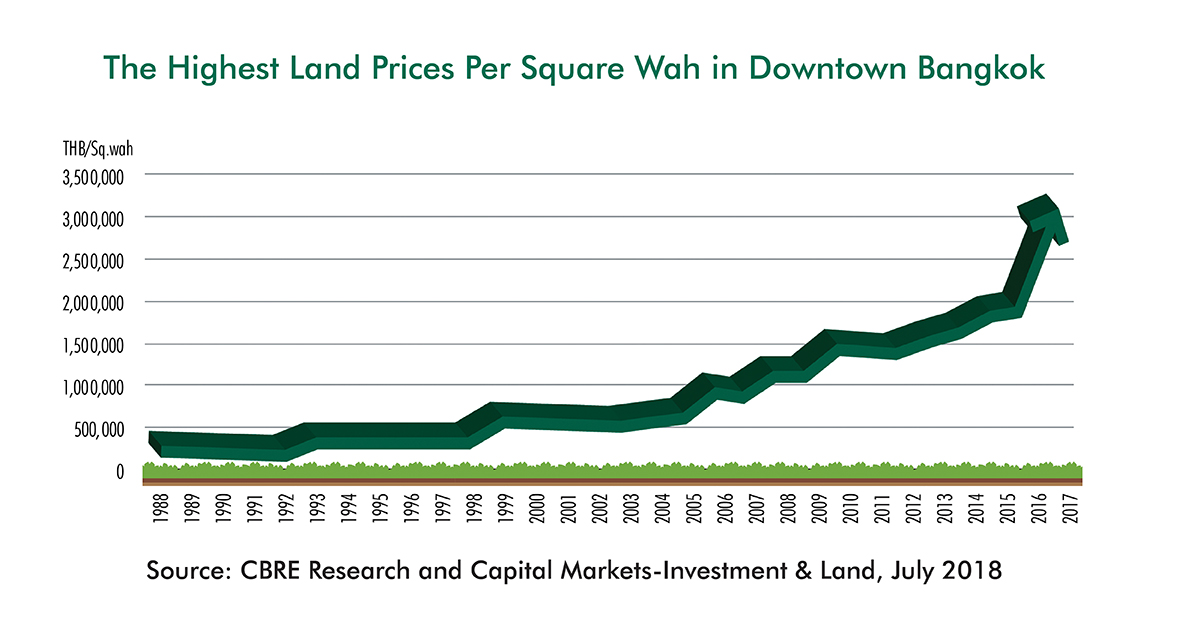

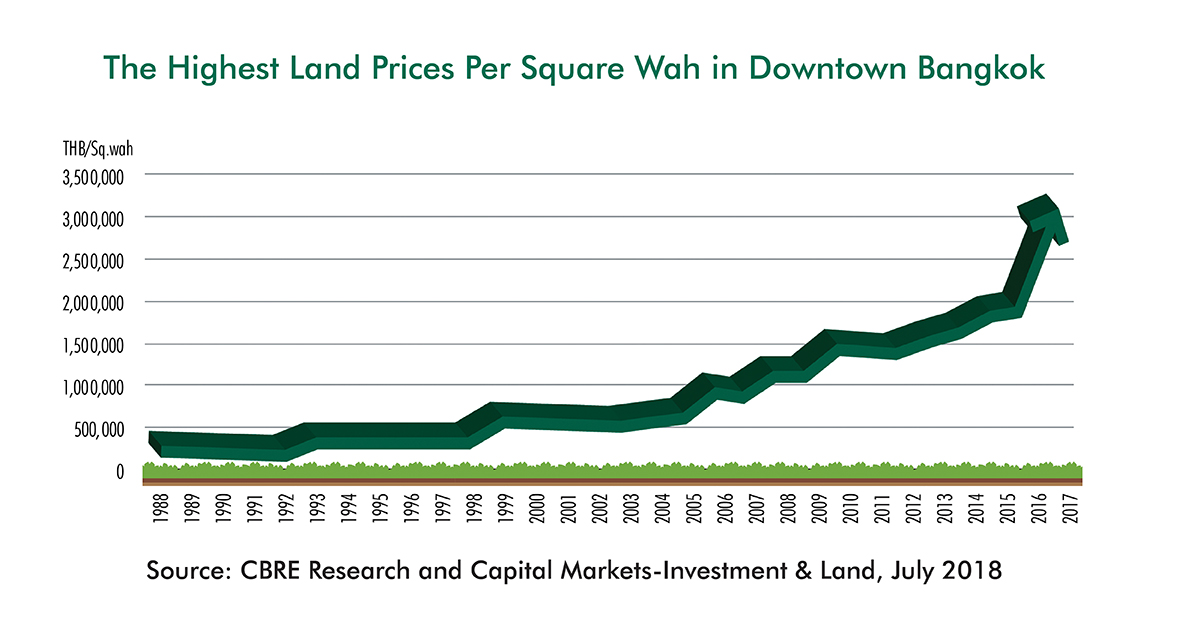

Since setting up an office in Bangkok in 1988, CBRE Thailand have identified a 1,000% increase in land prices across the city over the last 30 years.

Land Price Growth at a glance:

- Land prices rose dramatically during the Asian Tiger boom years from 1988-1996 before the market came to a grinding halt in the 1997 financial crisis.

- Land price growth resumed in the early 2000s and there has been a rapid escalation of prices over the past two years for prime central business district (CBD) sites.

- Two landmark transactions in the late 1980s were the acquisition of:

- an 8-rai (3.17-acre) site on Sathorn by the original developer of Empire Tower for around THB 125,000 per square wah and,

- a 21-1-08 rai (8.5-acre) site on Wireless Road, (which was the Standard Chartered Bank manager’s house, now the All Season Place development), by the M Thai Group for around THB 250,000 per square wah.

- The latest sale in Sathorn was the 8-rai site of the Australian Embassy for THB 1.45 million per square wah in 2017.

- In Lumpini, SC Asset paid THB 3.1 million per square wah for an 880-square-wah site on Soi Lang Suan.

- The largest land sale in terms of value was the sale of the 23-rai British Embassy site in 2018 to the Central Group / Hongkong Land joint venture.

Source: CBRE Research and Capital Markets - Investment & Land, July 2018

The increase in land prices has not been uniform and there has been a huge change in the development patterns in Bangkok.

The popularity of Bangkok’s mass transit routes with over 1.2 million users a day has increased land values next to stations, but not every line or station is equally attractive. Land values have been partially determined by the popularity of a line and a station.

“The other big determinant of land prices has been urban planning and building regulations, particularly those governing how much space can be built, obviously if less space can be built on a site then the land is worth less,” commented Ms Kulwadee Sawangsri, Executive Director, Capital Markets – Investment and Land, CBRE Thailand.

Planning and building regulations have become increasingly stricter and more sophisticated and are now a key factor in determining land price.

Land prices are starting to form a much greater proportion of total development costs as they have risen at faster rates than construction costs. The total development costs, mainly due to the increase in land prices, have risen, driving condominiums prices higher and raising the revenue needed to make rental projects feasible.

CBRE expects that Central Bangkok will continue to be the most preferred location for the best hotels, offices, retail centres, residences and other types of buildings such as hospitals. Bangkok will have a clearly defined city centre with extended development along the mass transit line routes concentrated in clusters around the stations.

The rate of increase in land prices will depend on the level of development activity and the returns that can be generated from development; which will vary depending on what can be built and how much customers can afford to pay either to buy or rent in the completed developments.

As the number of freehold potential development sites in Central Bangkok declines, CBRE expects that land prices will continue to rise. And in some cases, land prices will be higher than the value of the existing building on the plot and increase number of older will continue being demolished, and the sites redeveloped.

At the moment, the condominium law requires that 100% of co-owners agree to revoke the condominium enabling it to be sold and redeveloped. This has not happened to date although there are now some condominiums where the total value of all the units is less than the vacant possession value of the land on which the condominium has been built. CBRE thinks it will be very difficult to get 100% of condominium owners in Bangkok to agree to sell all the units to a developer.

“Assuming that planning regulations do not change and the amount of space that can be built on sites remains the same, then Bangkok’s CBD land prices are likely to continue to rise,” concluded Ms. Aliwassa Pathnadabutr, Managing Director of CBRE Thailand, who has worked for the company for 30 years since its establishment in Bangkok.

The increases will not be constant and will be in stages in line with the economy and property development cycle.

For more information or to discuss Bangkok's land price increases, phone or email Ngamjai Jearrajarat Head of Marketing and Communications, CBRE Thailand via the contact details listed below.

Source: CBRE Thailand

Similar to this:

Rising U.S. hedging costs decrease Asian real estate investment

Ho Chi Minh City registers positive growth in Q2 - JLL

Location, design and services rate highly for office tenants - CBRE Thailand