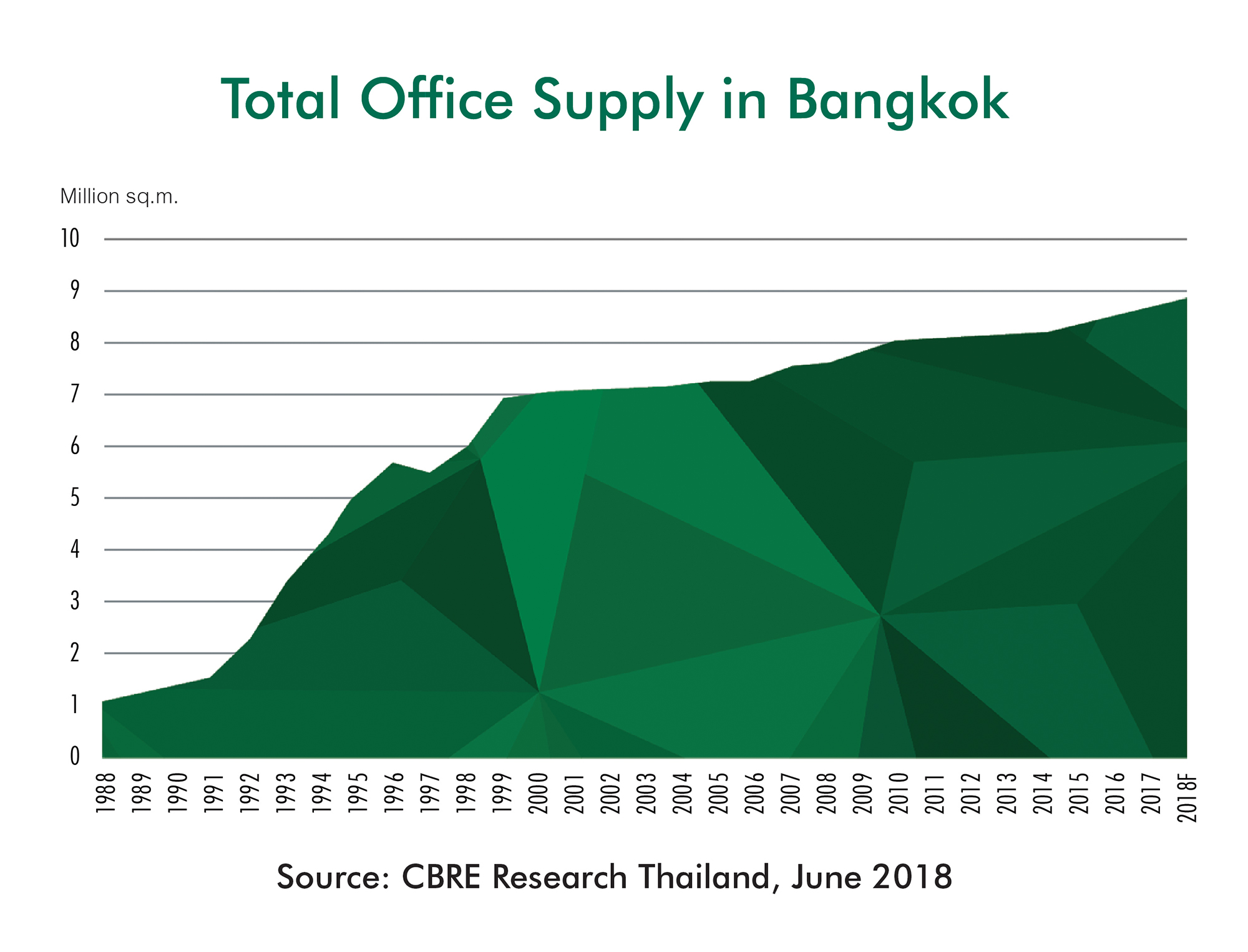

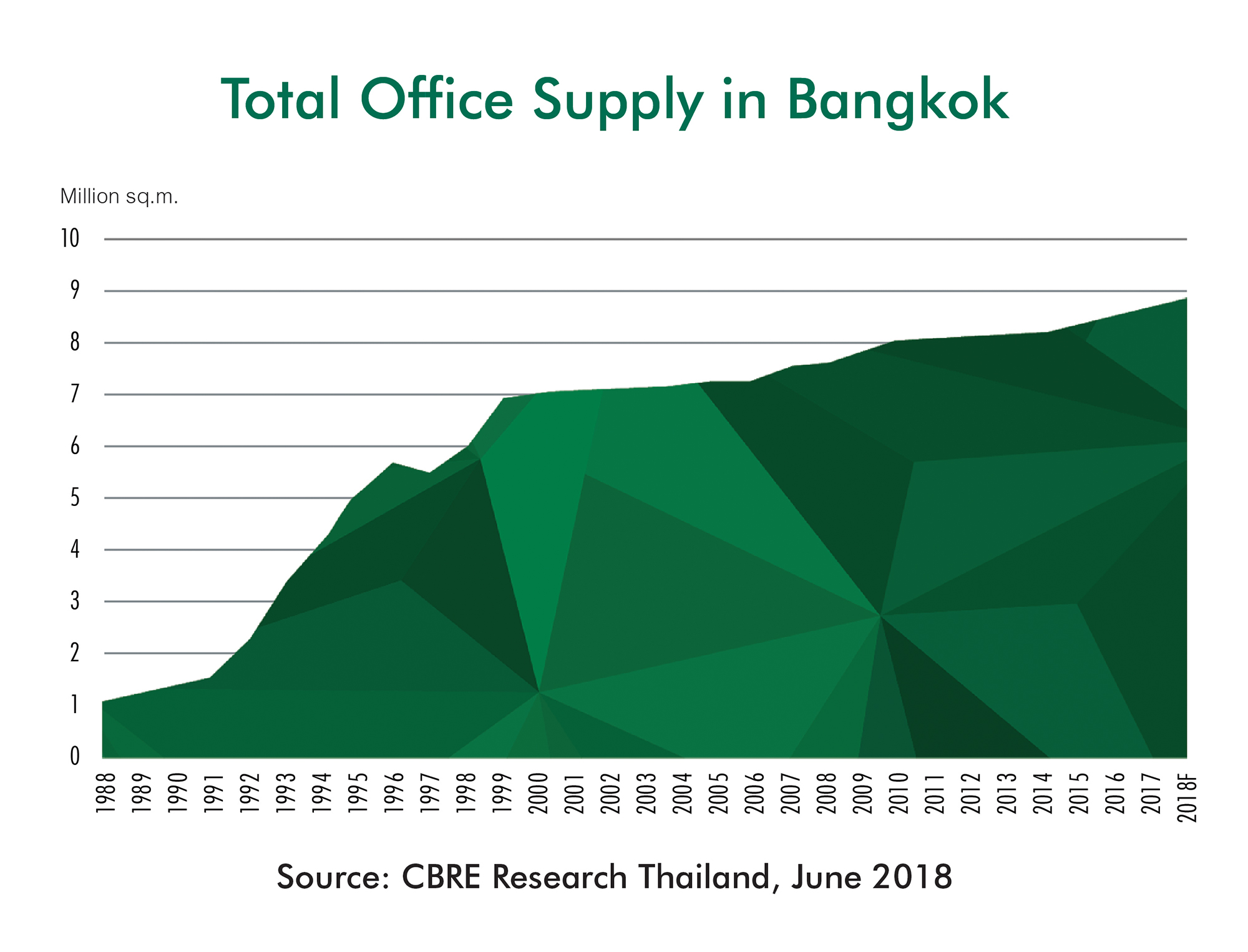

In 30 years, CBRE has seen Bangkok's office market evolve from no grade A office buildings, less than one million square metres with rent at THB 250 per square metre per month to almost nine million square metres with average grade A central business district (CBD) rents at just under THB 1,000 per square metre.

Current top three buildings based on rent levels are:

Source: CBRE Research Thailand

The first grade A building in Bangkok was Diethelm Towers, now called GPF Witthayu Towers, on Wireless Road which was completed in 1992 and achieved rents of over 800 baht per square metre per month. This was the first building to have variable air volume, air-conditioning improving the ability to keep all parts of the office floor at a constant temperature.

The 1997 Financial Crisis had a huge impact on the Bangkok office market, the closure of the finance companies and downsizing of other tenants meant that in 1998 the total amount of occupied office space fell by almost 300,000 square metres and vacancy rates rose to almost 40%.

Rents in most buildings halved when leases came up for renewal. It was only in 2004 that grade A rentals were able to reach the levels that they were at in 1994.

Some of the biggest changes have been in the design and specification of office buildings. Thai developers have listened to tenants’ requirements in terms of providing column-free, regular-shaped floor plates, ceiling heights of more than 2.8 metres, adequate lift provision and sophisticated air-conditioning systems. The highest specification office buildings in Bangkok such as Gaysorn Tower, AIA Sathorn Tower and Park Ventures Ecoplex match the quality of the best office buildings in other countries.

The way that tenants use office premises has also changed dramatically, in most cases the days of each manager having their own enclosed office are gone and the move has been towards open-plan, flexible workspace.

“Tenants are demanding a greater range of services from landlords and do not just want to pay rent for a concrete box,” said Roongrat Veeraparkkaroon, Director of Advisory & Transaction Services - Office at CBRE Thailand.

A new generation of office buildings are now being designed in Bangkok with construction due to start from 2018 onwards and these buildings will have to cater to the increasingly complex demands from tenants who want higher specifications and a greater range and level of services within the building.

Rent is still one of the most important factors for tenants when choosing their new office premises, followed by the location, which is how close the office building is both to the CBD and a mass transit station.

Selecting an office building is now not just about location and cost. Recruiting the best employees is challenging and providing an attractive workplace in terms of location, building quality and the workspace itself can provide companies with a unique selling point to help attract talent. Meaning that quality of design, specification, facilities and building services are becoming increasingly more important.

For more information on Bangkok's office market, phone or email Ngamjai Jearrajarat, Head of Marketing and Communications, CBRE Thailand via the contact details listed below.

Source: CBRE Thailand

Similar to this:

Bangkok ranked 92nd most expensive city

Vietnam economic overview bodes well for 2018 - Colliers reports

CBRE appoints Tom Moffat as Head of Capital Markets, Asia