Savills Singapore's Residential Leasing Briefing for Q1 2018 reveals collective sales market has caused rents to rise in Singapore as reducing supply spikes stronger demand.

Residential Leasing Briefing at a glance:

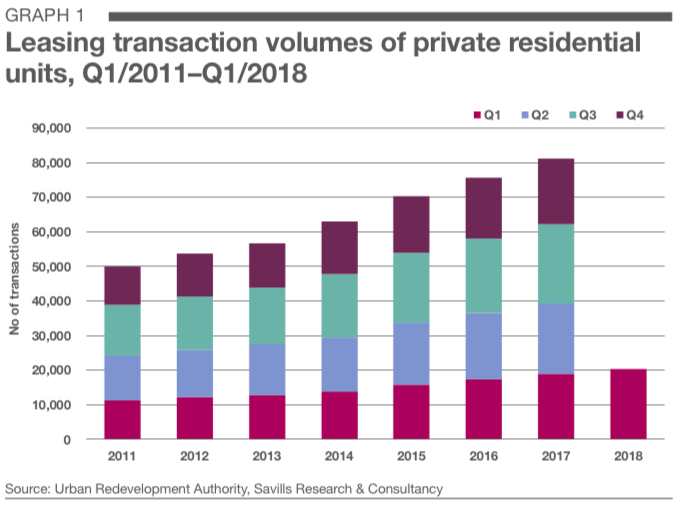

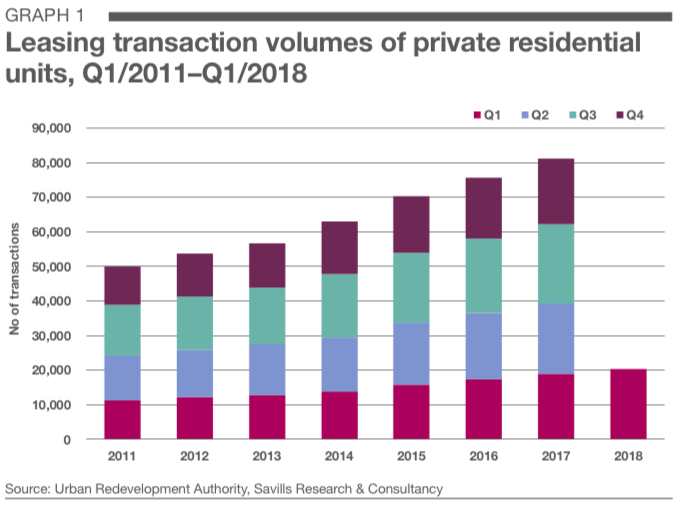

- Q1 2018 saw 20,251 leases registered island-wide, 6.9% higher than last quarter.

- The Urban Redevelopment Authority’s (URA) rental index for overall private residential properties reversed course in Q1/2018 to notch a small increase of 0.3% QoQ.

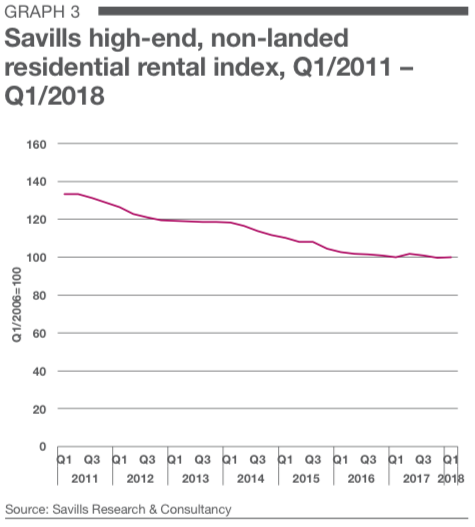

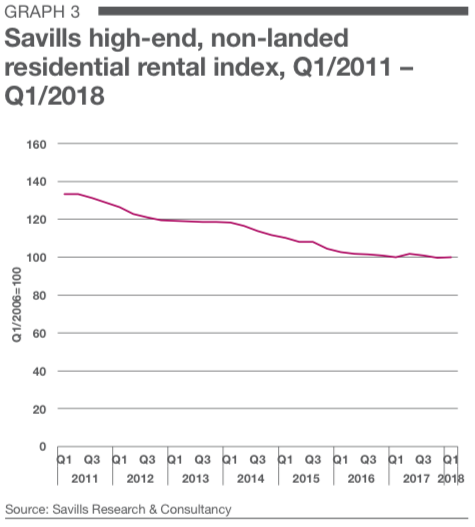

- From Savills basket of high-end non-landed private residential units, rents posted a marginal increase of 0.6% QoQ in Q1/2018, after two successive quarters of decreases.

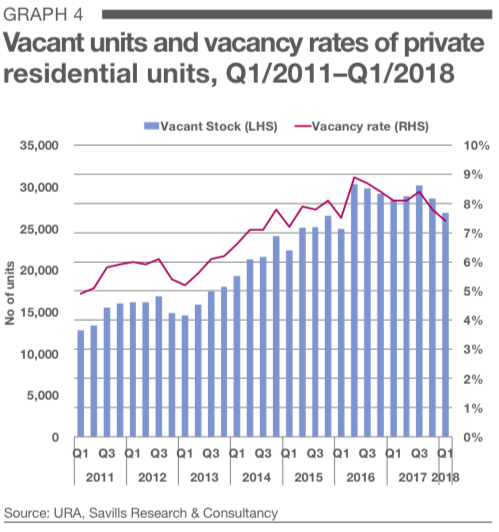

- Completed private residential units stock continues to rise in Q1/2018, albeit at a slower rate of 0.4% QoQ to a total of 365,591 units.

- As of end, March 2018, overall vacancy rates of private residential units fell by 0.4 of a percentage point (ppt) partly due to limited new completions in the reviewed quarter.

- Rabid collective sales market may cause rents to rise 2% to 3% YoY by end-2018.

“The collective sales process has done wonders to turn around the rental market by increasing demand and reducing supply.” Alan Cheong, Savills Research

Market overview

Source: Savills Singapore Residential Leasing Briefing Q1 2018

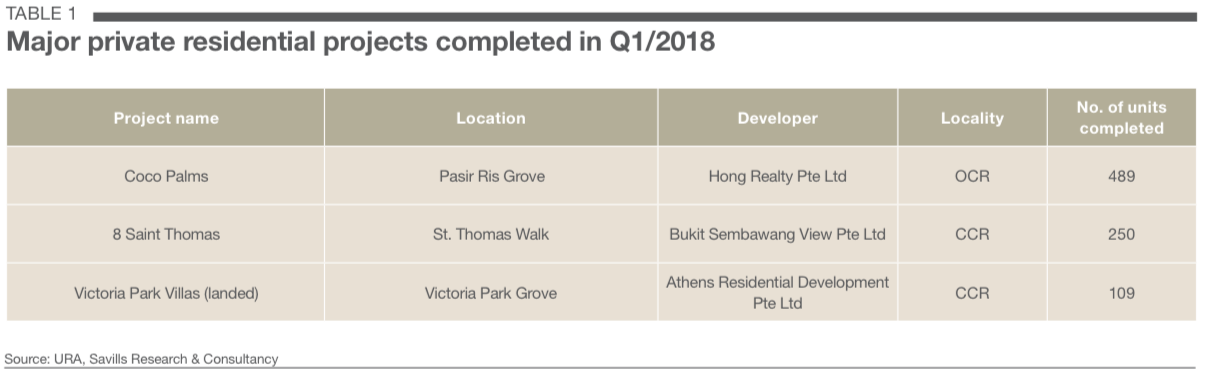

The private residential leasing market achieved another buoyant quarter with 20,2511 leases registered island-wide in the first quarter of 2018, 6.9% higher than last quarter. For the rise in transaction volumes, change can be attributed to factors such as increasing demand from owners and tenants who have been displaced from private residential projects, that were sold through collective sale.

Broken down by housing subtypes, leasing deals for island-wide landed houses increased by 3.7% QoQ, while leasing transactions of condominiums and private apartments posted a higher growth of 7.1% QoQ, supported by board-based increases in all the market segments – up 5.3% in the Core Central Region (CCR), 10.3% in the Rest of Central Region (RCR), and 5.9% in the Outside Central Region (OCR).

According to data from the URA, the top five projects with the highest leasing deals signed in Q1/2018 were:

Source: Savills Singapore Residential Leasing Briefing Q1 2018

Leasing demand in newer developments, especially in desirable locations, is strong. For example, Sims Urban Oasis has recorded 218 leasing deals since its Temporary Occupation Permit (TOP) in Q4/2017, accounting for 23.0% of its 1,024 units. Duo Residences, which has been in the top list for two consecutive quarters, has rented out 308 units, or 46.7% of the 660 units in the project, since its completion in Q2/2017.

Co-living space has begun to take root in Singapore, particularly with young professionals and millennials for its affordability, flexibility and convenience. Hmlet, a co-living company established in 2016, is operating about 50 apartments in locations such as Shenton Way, River Valley and Joo Chiat. It just announced the launch of its second co-living station in Newton, an entire 30,000 sq ft condominium block called Hmlet @ Sarkies.

Rents

Source: Savills Singapore Residential Leasing Briefing Q1 2018

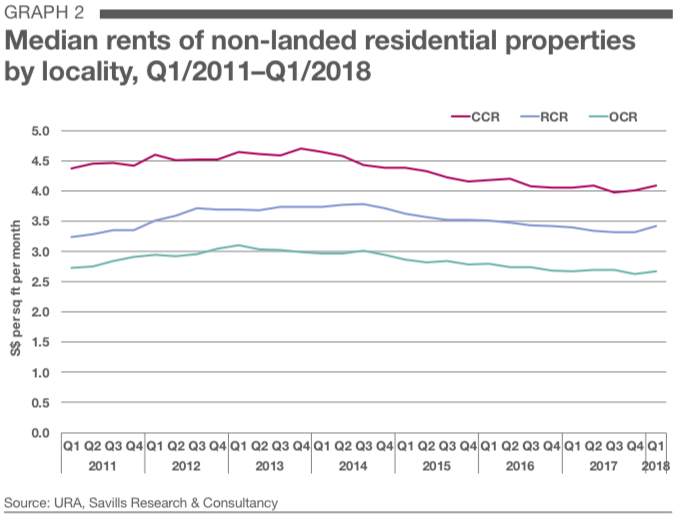

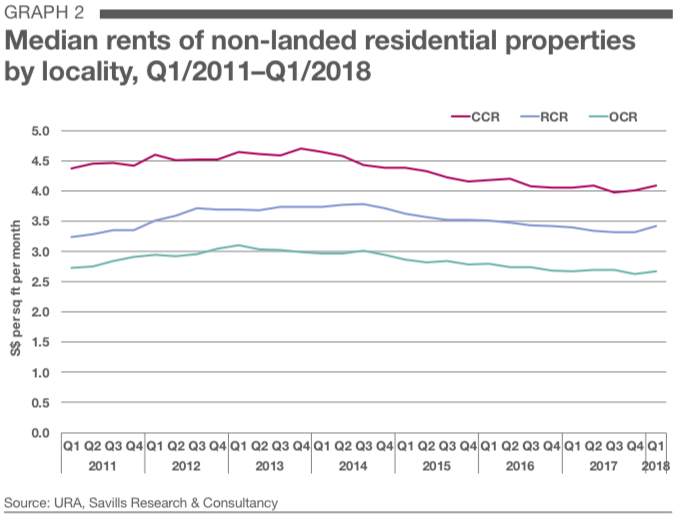

The URA rental index for overall private residential properties reversed course in Q1/2018 and recorded a small QoQ increase of 0.3%. This was the first quarterly growth in the last four and a half years since Q4/2013 and was supported by the non-landed private residential properties in the CCR and OCR, which inched up by 0.6% and 0.7% QoQ respectively. In contrast, rents for non-landed units in the RCR dipped by 0.3% QoQ, while rents for landed houses island-wide remained unchanged.

The modest rental growth could partly be due to the feverish collective sales market. On the ground, Savills have identified that leasing demand from displaced residents in the developments which were sold collectively has increased. This is because both owner-occupiers and tenants in these projects have to find alternative housing after the properties sell. Rabid activity on the collective sales front has also caused the island-wide vacant stock of private residential properties to decrease from Q4/2017, as the buildings that were sold on a collective-sale basis are being torn down. All of these signs point to declining supply. Consequently, the merging of supply and demand has resulted in a mild rental recovery.

Amid the surge of collective sales and limited new supply in the high-end market segment, the market has tightened up and landlords are in a better position to raise their asking rents; while tenants, especially in renewal cases, have to accept the higher rentals which are still lower than when they signed two years ago.

Stock and vacancy

Source: Savills Singapore Residential Leasing Briefing Q1 2018

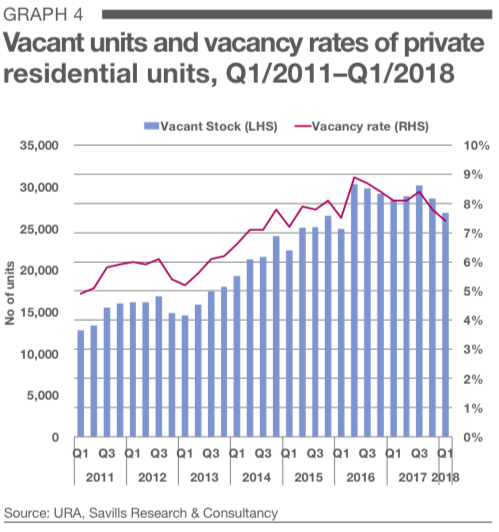

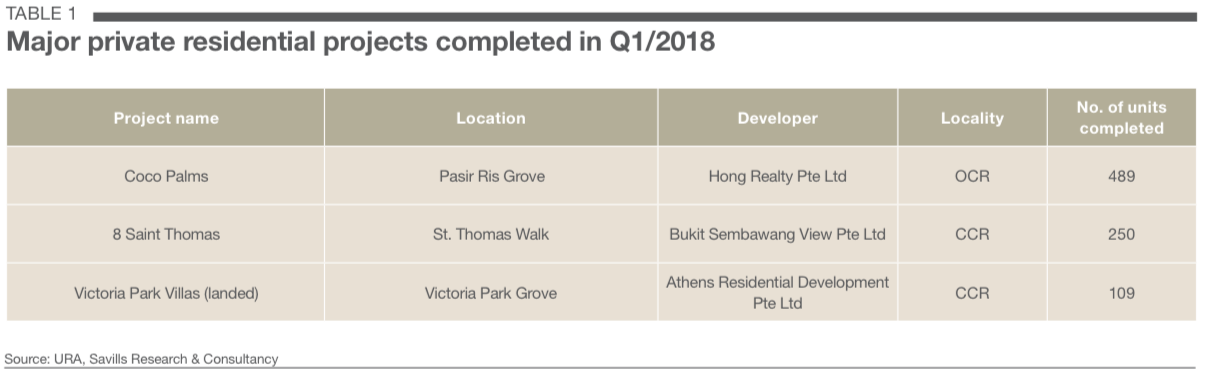

The stock of completed private residential units continues to rise in Q1/2018, albeit at a slower rate of 0.4% QoQ, to a total of 365,591 units. In the reviewed quarter, there were relatively limited new completions entering the market.

As of end March 2018, the overall vacancy rate of private residential units fell by 0.4 of a ppt over the previous quarter. Together with a 0.6% decline in Q4/2017, the vacancy rate has improved by 1.0 ppt to 7.4% over a six-month period. There were a total of 26,906 vacant private homes island-wide, a decrease of 3,230 from the recent peak in Q3/2017.

In individual sectors, private residential unit vacancy in both the RCR and OCR dropped, down by 0.2 of a ppt and 1.0 ppt, respectively, while the rate in the CCR rose by 0.4 of a ppt. On the supply side, limited new completions in the reviewed quarter are partly the cause for the improved occupancy in the RCR and OCR.

Market Outlook

Savills believe it may take a few more quarters before the rental market shows any convincing signs of recovery. However, recent evidence suggests that the inflexion point for rents across all segments - CCR, RCR and OCR - may be coming sooner than expected. Since 2016, over 7,000 units have been or will soon be displaced once the existing developments on the site are demolished. The rush by affected owner-occupiers and tenants to find replacement residences has been the main reason for the recent boost to leasing demand.

Source: Savills Singapore Residential Leasing Briefing Q1 2018

Savills believe that come Q2/2018 or latest Q3/2018, rents for all the three regions - CCR, RCR and OCR - should start to improve on the back of demand and supply curves shifting closer together due to increased collective sales.

Click here to view Savills Singapore Residential Leasing Briefing.

For more information or to discuss the report phone or email Alan Cheong of Savills Singapore via the contact details listed below.

Similar to this:

New law creates demand for formal workers’ accommodation - Malaysia

Investment from online players in offline markets set to benefit consumers - Savills reports

Bangkok office rents reach record highs - CBRE