Seoul leads the annual rankings with the prime area of Gangnam defying policymakers' efforts to control price growth.

At a glance:

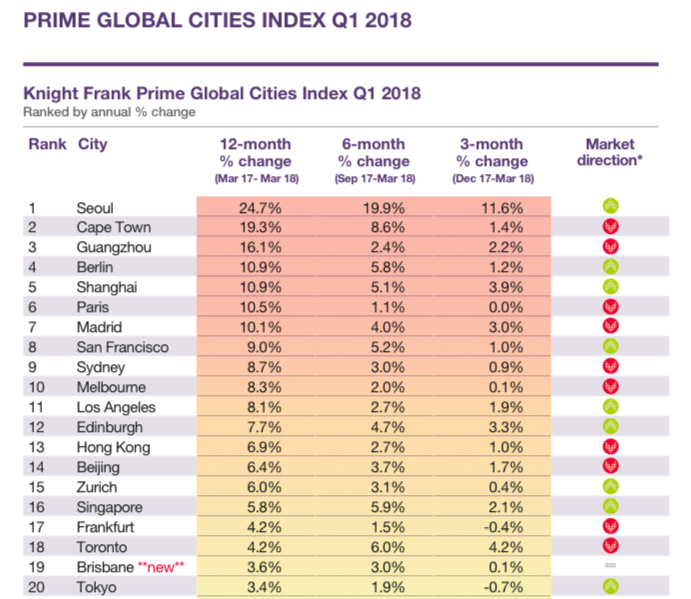

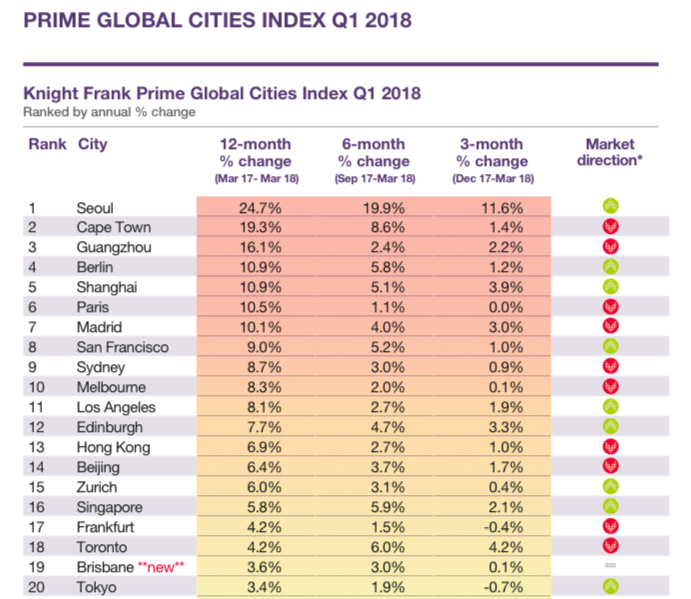

- Seoul registered an annual growth of 24.7%.

- The Index increased by 4.8% for Q1, marginally lower than the 4.9% of December 2017.

- The gap between strongest and weakest performing city has dropped from 39% to 33%.

- Hong Kong prime prices accelerate 6.9%.

Knight Frank's Q1 2018 index represents the first update since the Wealth Report analysis and is a valuable means of gauging where luxury prices are headed at a time when, despite the global economy being in robust health, there are significant risks ahead in the form of rising debt, inflation, and greater housing market regulation.

Supplied: Knight Frank

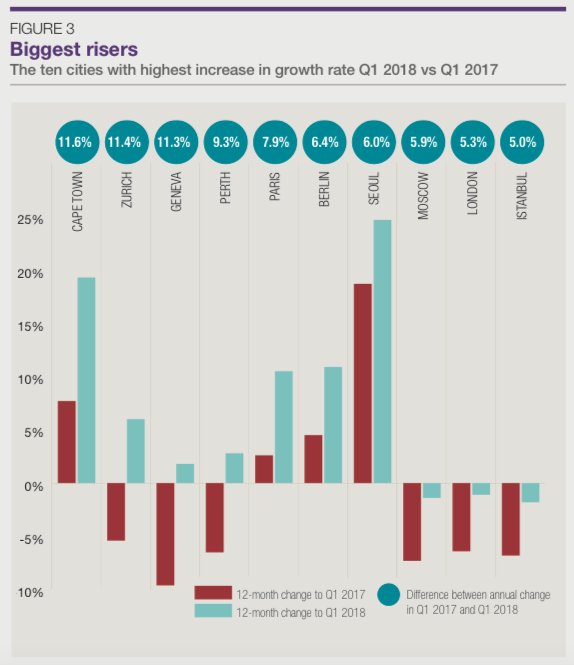

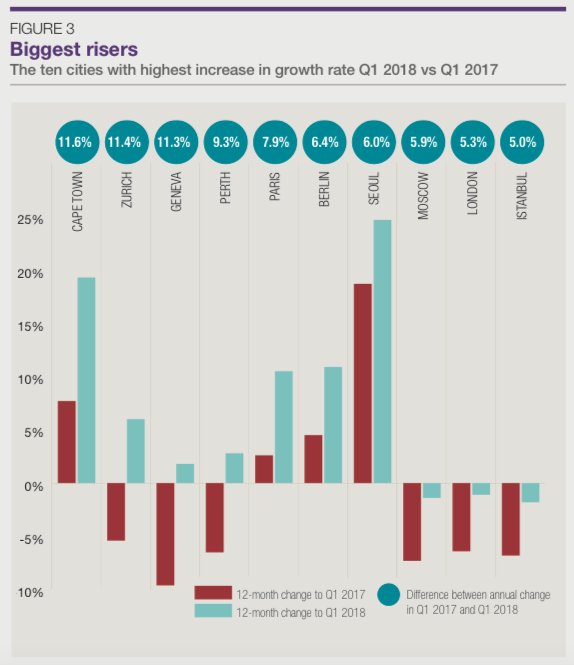

The index increased by 4.8% in the year to March 2018, marginally lower than the 4.9% in December 2017. As borrowing costs start to increase across some of the world's major economies Knight Frank expect prime price growth to moderate further. Already, the gap between the strongest and weakest-performing city has slipped from 39% to 33% in the last three months and the number of cities that saw their rate of annual growth decline has risen from 16 to 23 over the same three-month period.

Seoul has overtaken Guangzhou this quarter, registering 24.7% annual growth. Across a large part of the city new macro-prudential measures, including new taxes for owners of multiple properties and tighter lending restrictions, are cooling growth, but the prime area of Gangnam is still seeing strong speculative activity.

Supplied: Knight Frank

Cities in Asia Pacific now account for five of the top ten rankings.

The world’s top-tier cities – London, New York and Hong Kong – all saw annual price growth dip marginally compared with last quarter. In London, while the market remains sensitive to political events there is a sense of (relative) stability being restored.

In Hong Kong prime prices accelerated 6.9% although mainstream prices continue to outperform. Despite China’s capital controls, there remains a strong appetite for USD-pegged assets from the Chinese Mainland.

At the bottom of the table, Moscow no longer holds the title of weakest-performing market. Instead, Stockholm (-8.4%), Taipei (-7.4%) and St Petersburg (-4.0%) registered the largest prime price declines over the 12-month period.

Click here to view Knight Frank's Prime Global Cities Price Index Report.

For more information or to discuss the report phone or email Liam Bailey or Kate Everett-Allen of Knight Frank via the contact details listed below.

Similar to this:

CBRE forecasts strong economic growth for Korea in 2018

Southeast Asian cities dominate as top investment destinations in JLL report

Where are the foreign investment hot spots in Singapore?