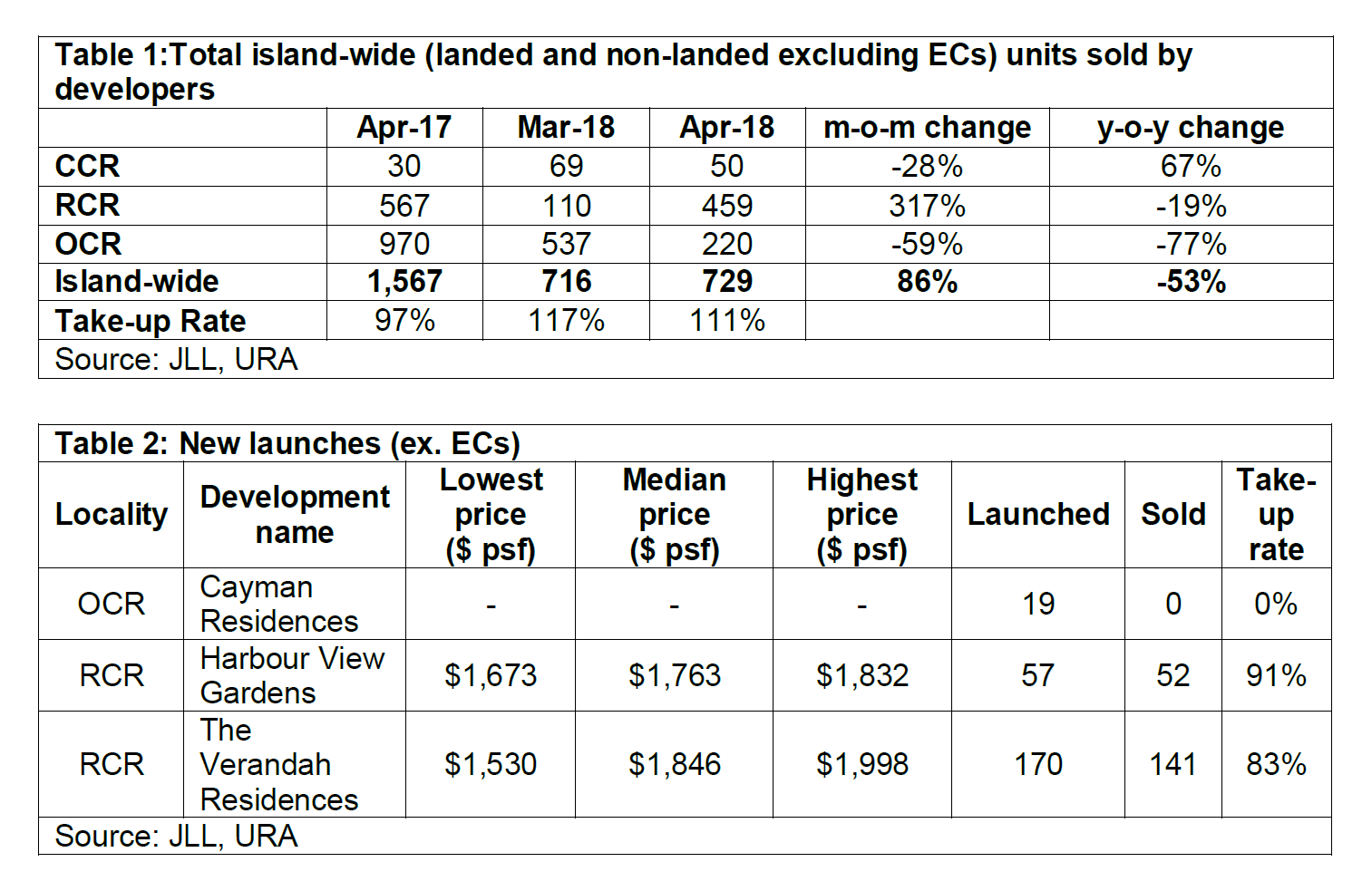

In April 2018, developers sold 729 private residential units, just 1.2 per cent marginally higher than March and less than half of the 1,567 units sold in April last year. The tally for the first four months of the year is estimated at 2,310 units, about half of the 4,529 units which developers sold for the same period in 2017.

Only 654 new private homes were launched during the month, continuing the leisurely pace of 614 units placed on the market in March and a mere 40 per cent of the 1,616 units launched last April. From January to April this year, an estimated 1,575 were launched for sale, 56 per cent less than 3,565 launched during the same period last year.

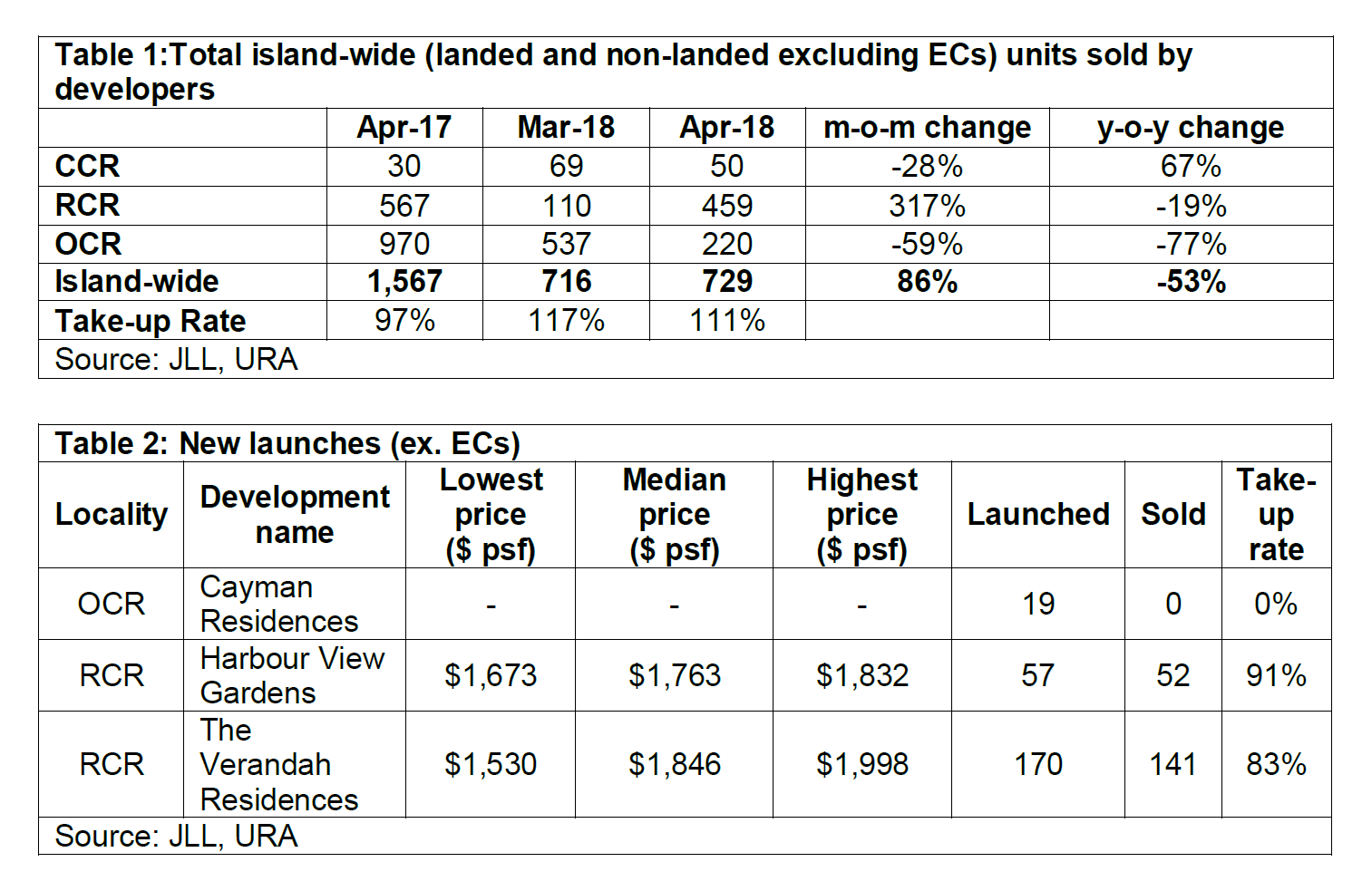

Three new private residential projects were launched in April. Cayman Residences placed all its 19 units on the market without selling any. Harbour View Gardens’ 57 units were available for sale and 52 units were taken up at a median price of $1,763 psf. The Verandah Residences launched all of its 170 units, selling 141 at a median price of $1,846 psf.

The top selling private residential projects in April were:

New executive condominium (EC) sales:

The launch of the 628 unit Rivercove Residences in April boosted new executive condominium (EC) sales to 596 units, more than eight times the 72 units sold in the previous month.

Top selling EC projects in April were

Mr. Ong Teck Hui, National Director of Research & Consultancy at JLL, commented: “Contrary to what was expected earlier, only a few new projects were launched for sale in April, contributing to the low sales figures. Typically, when the market is upbeat, there tends to be a pick-up in activity in April as we saw last year when 1,616 private homes were launched and 1,567 sold. The 654 units launched and 729 units sold in April 2018 are in stark contrast to a year ago, despite the current buoyant market.

With much publicity on the keen demand from buyers, strong take-up at launches and robust pricing, market interest is being drummed up to the benefit of projects awaiting launches. The 3.9 per cent rise in the URA property price index in 1Q18 suggests the possibility of a good upside in prices which would encourage an unhurried stance towards launches in order to capitalise on the price increase. An examination of projects that were previously launched with unsold units shows many did not launch or launched judiciously in April notwithstanding the upbeat market.

However, several private residential projects have already been launched for sale in May and we expect improved launched and sales figures for this month.

In the absence of other new EC launches and existing EC projects at the tail end of their marketing, Rivercove Residences was able to capitalise on the lack of supply and dearth of competition to launch its 628 units and sell 512 at a median price of $970 psf, which is a record price for new ECs.

With only the Sumang Walk EC project in the future launch pipeline and only one EC site scheduled to be out for tender in June, the EC market will remain under-supplied so the upward pressure on prices will continue.”

Source: JLL

Similar to this:

Encouraging sales pick-up in Singapore a prelude to stronger activity in April

Singapore sees low key sales and launches in February due to festive month

Signs of a Singapore pick-up notwithstanding usual slower sales in January