James Taylor Head of Research JLL Indonesia announced on Wednesday 4 April that, after a solid beginning, 2018 is looking positive due to lower interest rates (circa 4.25%) and relative mortgage rates, inflation at 3.18% in February; well within target range, cement sales increased by 7.7% y-o-y in Jan & Feb and Jakarta MRT has 332 days until completion (as of April).

A summary of the key Jakarta property markets are outlined below.

Office:

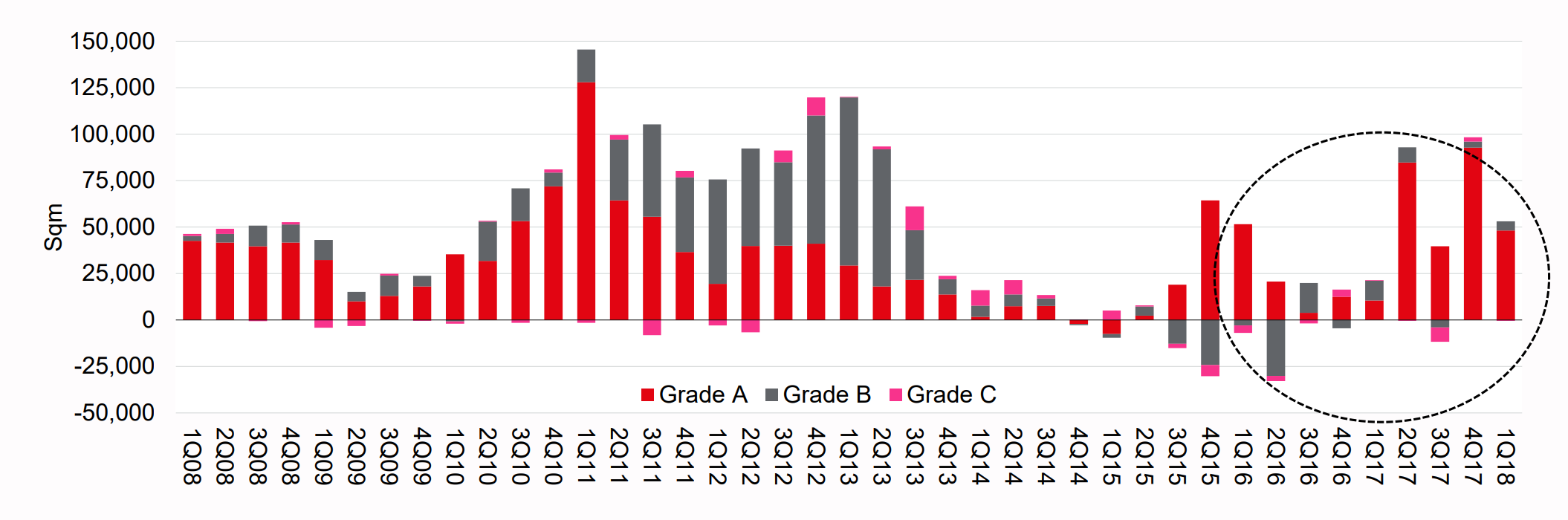

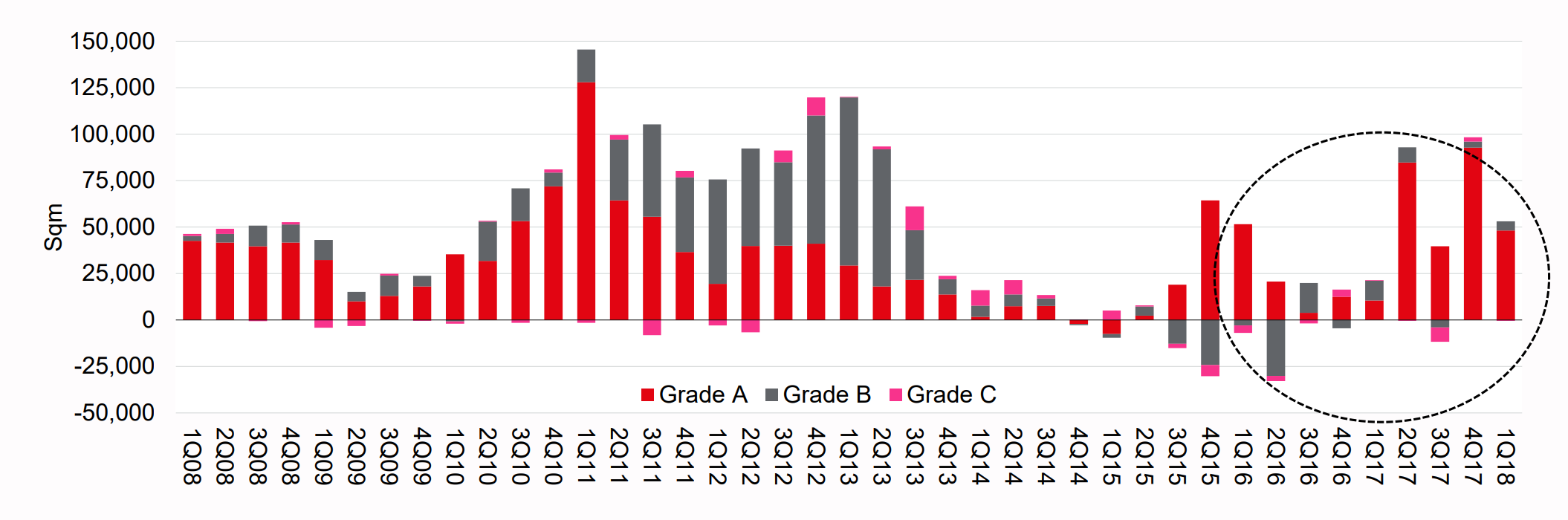

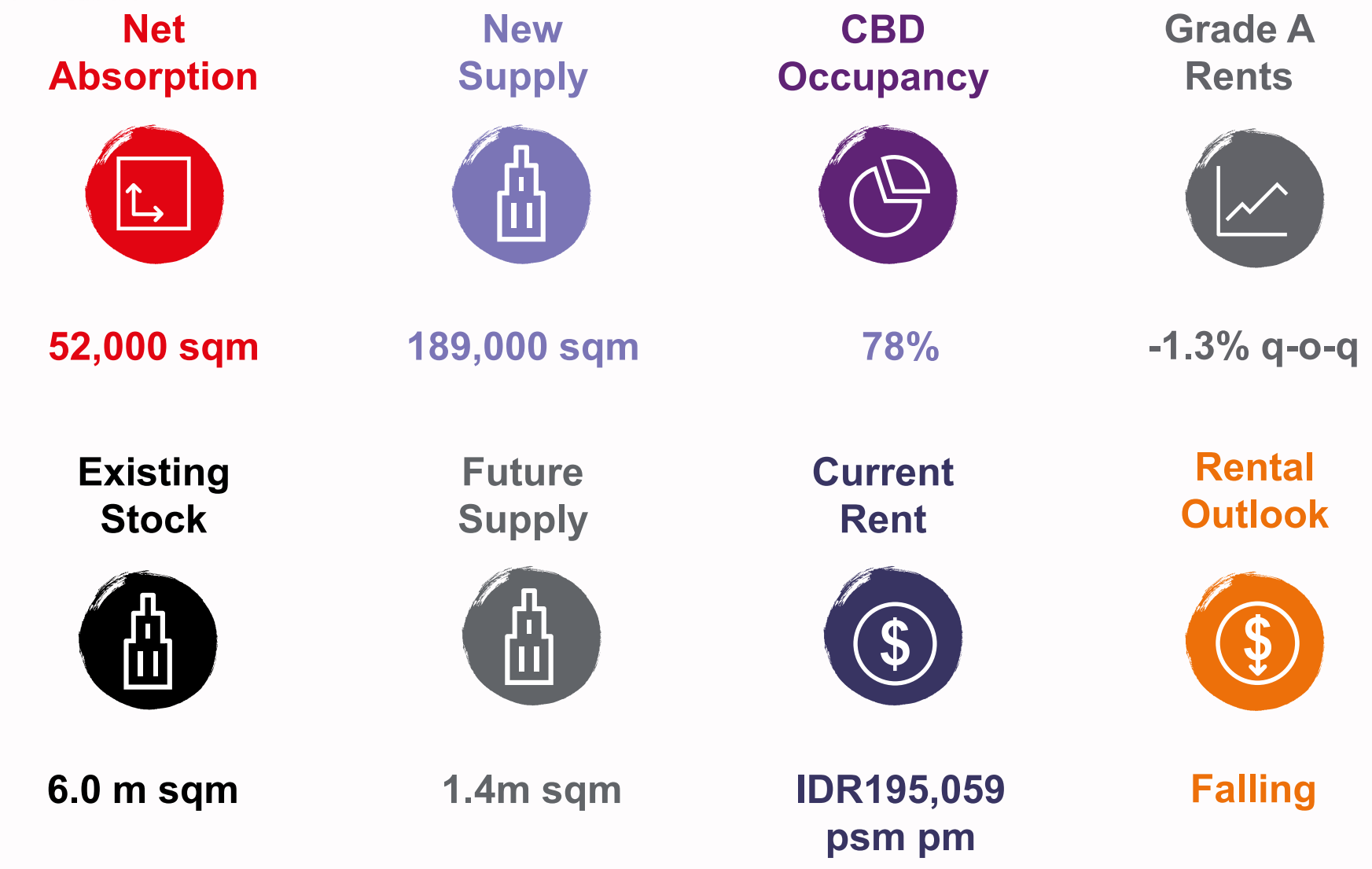

James Taylor reported that Jakarta office demand remains healthy and occupancy continues to fall on the back of new supply.

Grade A office demand remains strongest with 48,000 sqm taken up in 1Q18 and JLL noted that office demand was increasing and spiked in 2017.

Quarterly and Annual Net Absorption

Source: JLL Indonesia

Within the Jakarta CBD market, technology tenants are driving office demand from fintech and travel booking sites to online gambling and online marketplaces.

There is also a trend towards co-working spaces which is relatively new in Indonesia and growing.

"Within the CBD a noticeable trend of upgrading is showing a flight to quality office stock is taking place," Says James Taylor.

"We are seeing Landlords now competing to attract tenants as rents have been decreasing since the first quarter of 2015 and a decrease was noticed again in the first quarter of 2018" continued Mr Taylor.

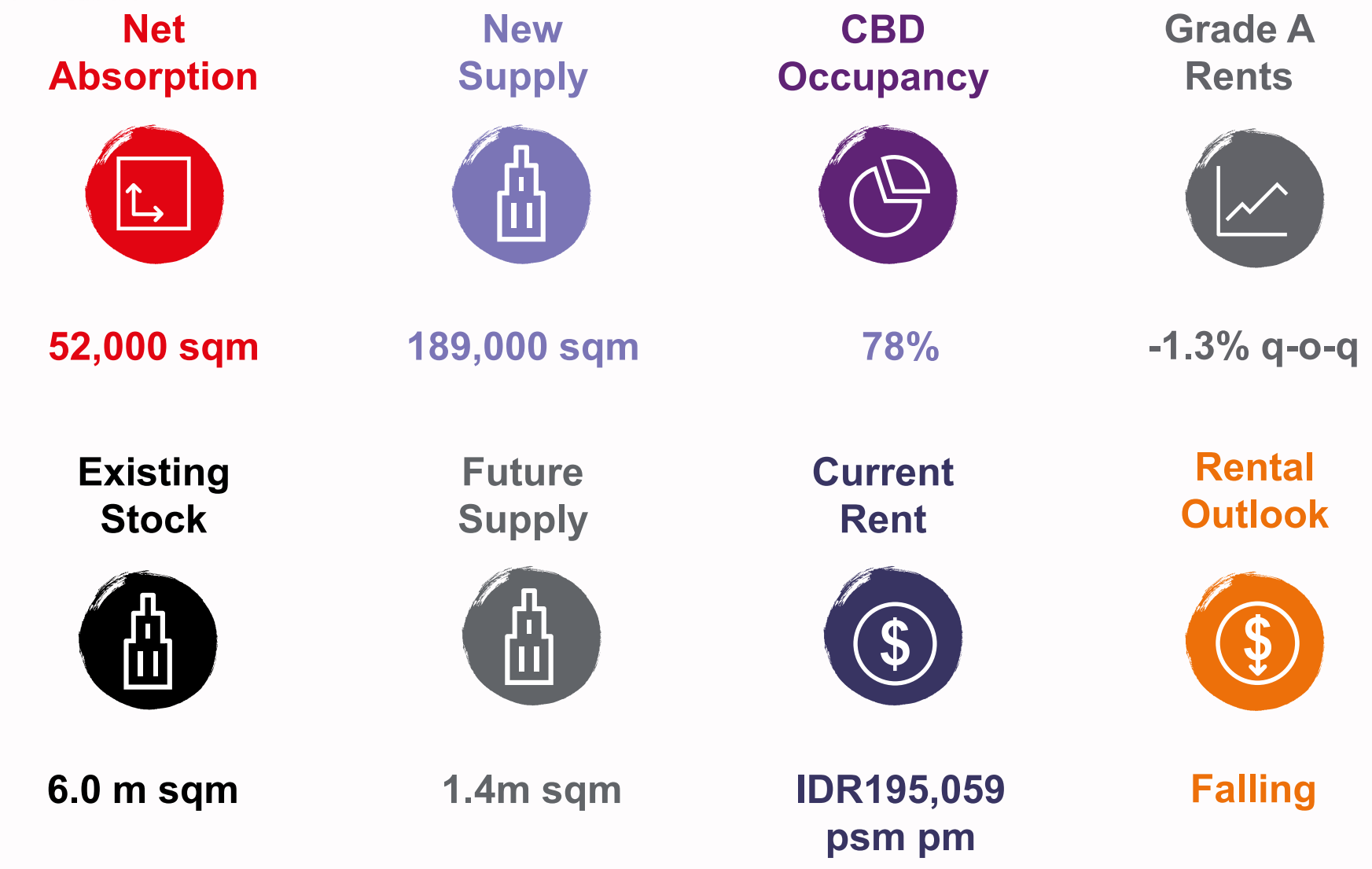

CBD Office Market in a Nutshell

Source: JLL

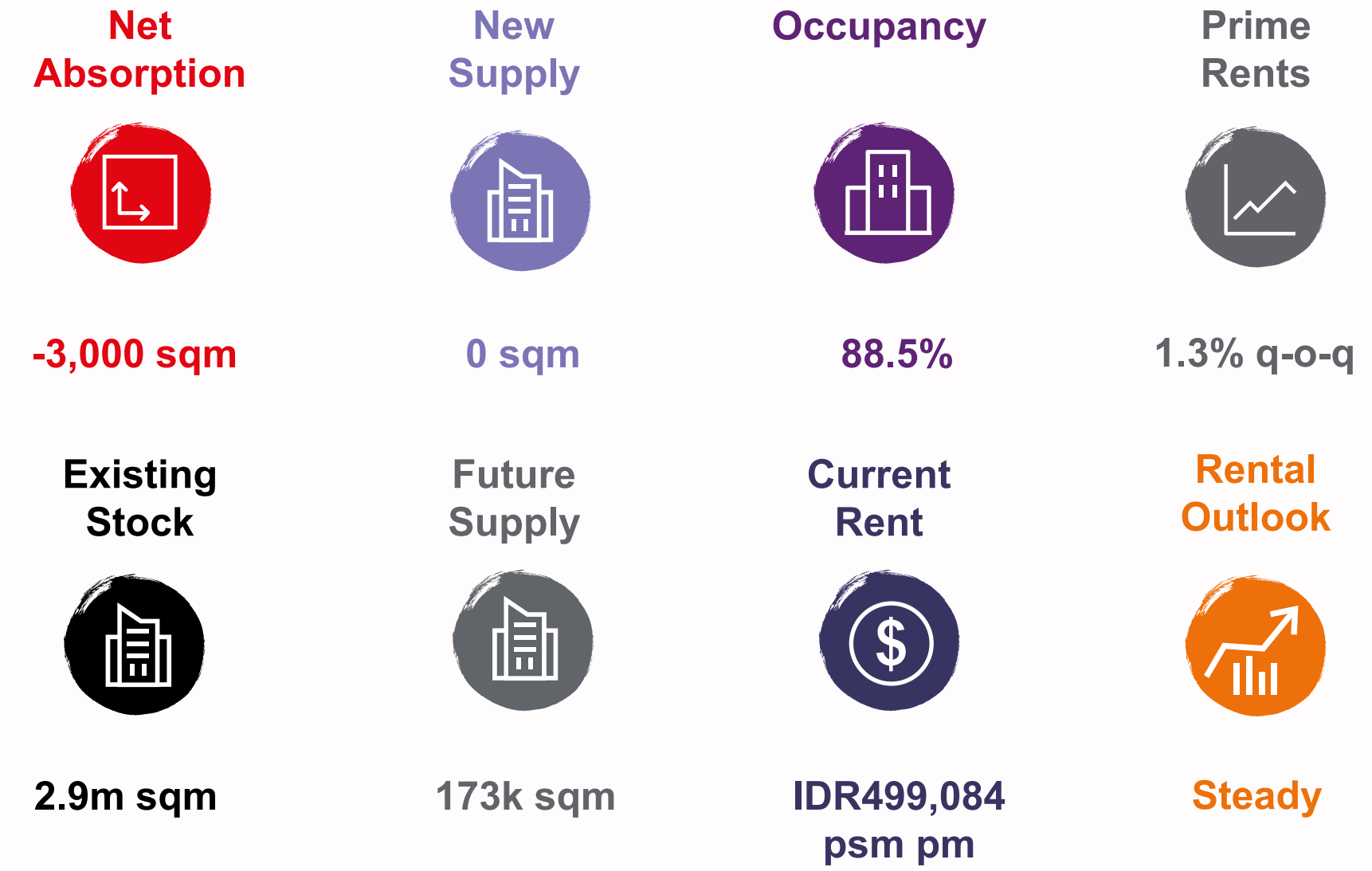

The non CBD office market experienced a positive flow of tenant demand with positive infrastructure projects including the MRT and LRT and new supply coming online. The new residential and office projects in these areas coupled with existing international and high-quality schools in the area are helping to sustain the non-CBB office market according to JLL.

Mr Taylor stated that "most of the office supply in this area has been delivered and been absorbed while a reduction of rents has been reported every quarter since 2015."

Retail / Shopping Malls

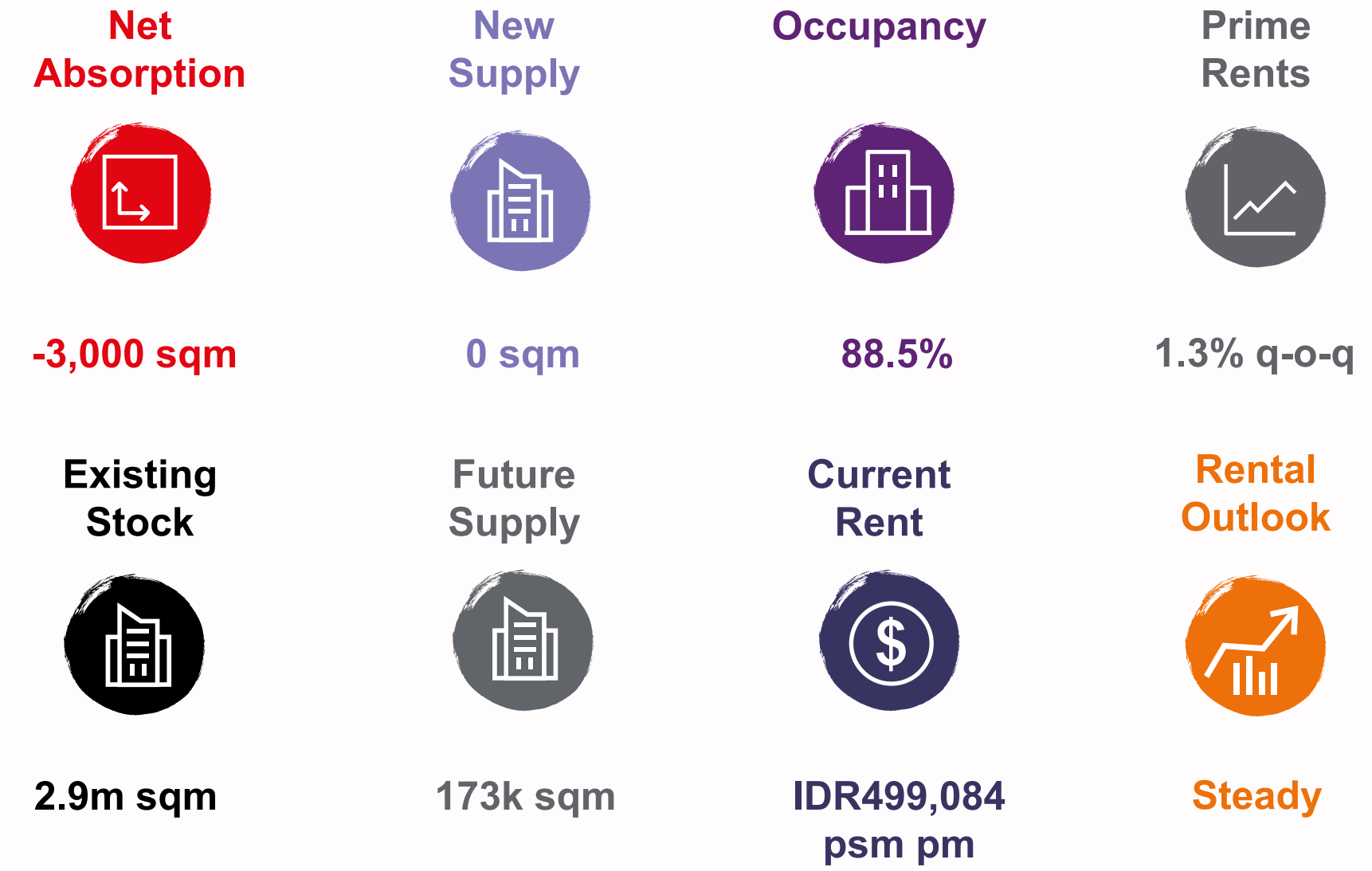

JLL report that more activity from tenants providing entertainment, food and beverage and fast fashion groups like H&M is driving the demand for prime retail space as retai consumers are demanding excellent food, meeting points, WiFi, “Instagrammable” experiences and attractive designs.

"On the other hand we are seeing less department stores with some closing down recently," says Taylor.

"Retail supply has dropped off recently with much less in the pipeline looking forward as there has been pretty healthy occupancy levels (around 90%) and with limited supply coming up it will stay about the same."

"Prime malls in the city are seeing occupancy higher than 90%, probably 95% plus in some of those malls, and experiencing 5 - 6% rental growth per year and this trend is likely to continue to 2022"

"Middle and middle lower retail segments are the ones getting hit by e-commerce and consumer preferences with fewer bars and tenants providing social experiences."

Retail Market in a Nutshell

Source: JLL

Condominiums

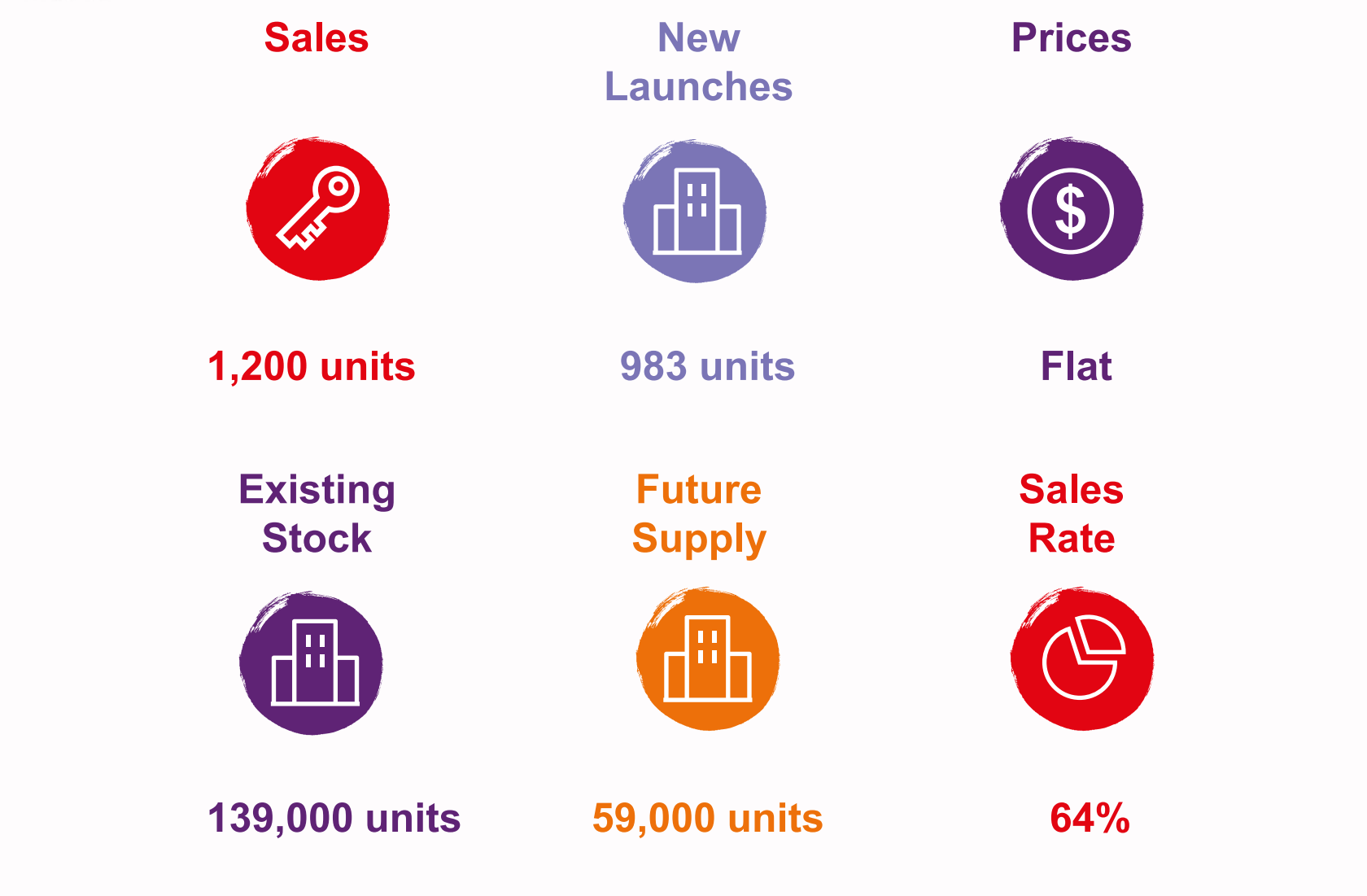

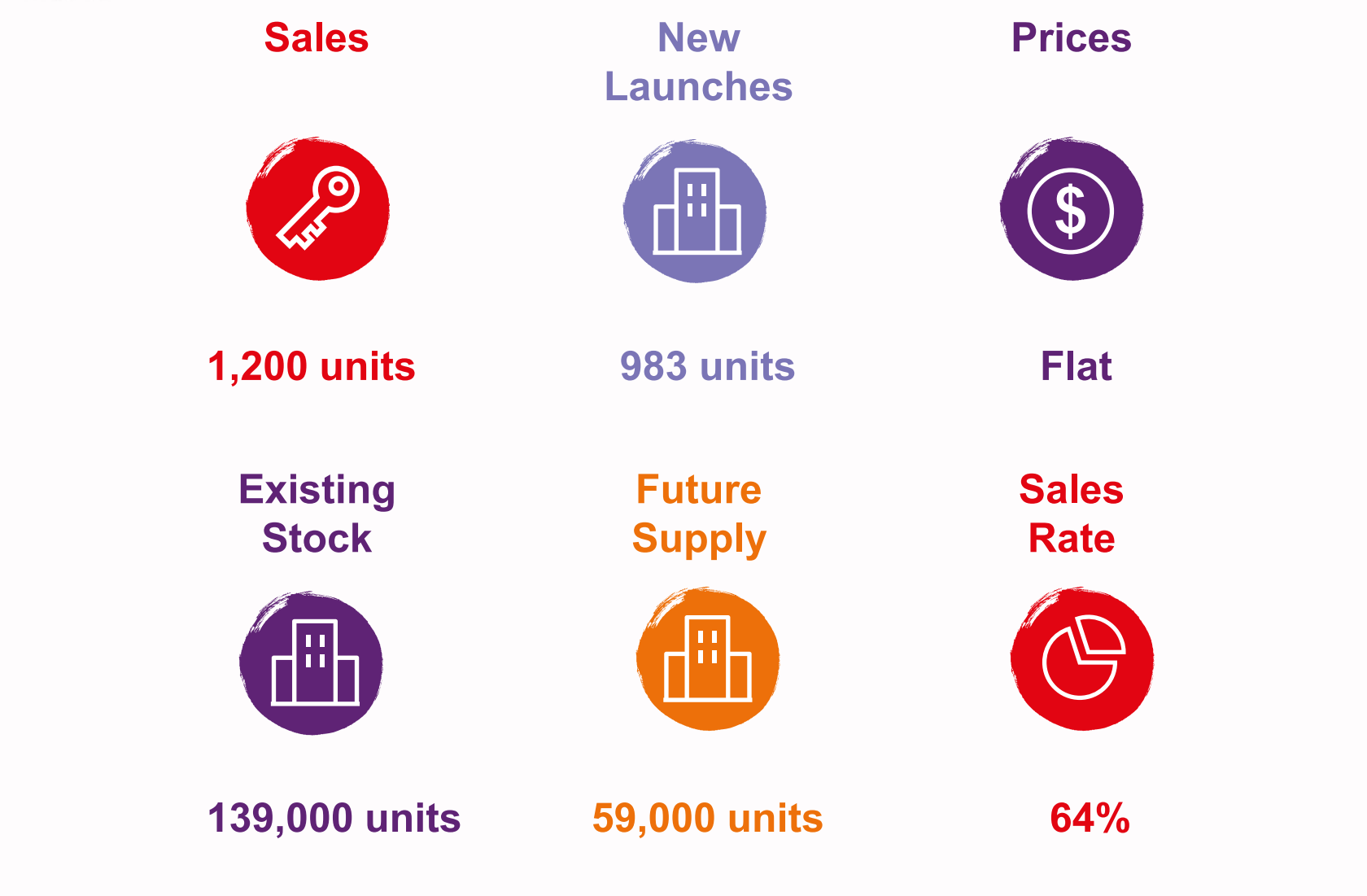

After experiencing challenges within the economy in 2015 (rupiah depreciating and the market adjusting to luxury taxes) and weaker sales continuing in 2016 JLL saw some improvements in consumer sentiment in the second half in 2017. JLL now see 2018 being a much better year for condominiums where developers are creating smaller cheaper units in good locations with good access to existing and upcoming infrastructure.

James Taylor reported that "Within DKI Jakarta several new launches in 2018 - Astra HK land development and 2 local developers targeting the lower end of market and sales rates were around 20-30% in the quarter Q1 2018. "

These projects were Arumaya, Apple Apartment – Avocado & Blueberry and Solterra Place - Wasaka Residence.

DKI Jakarta Condominium Market in a Nutshell

Source: JLL

"We are seeing that demand is stronger on the smaller cheaper units as the tax burden is smaller and the market is conscious of this." Says Mr Taylor.

The greater Jakarta markets (where most units are priced below IDR 20M per sqm) are experiencing a similar trend as unit sizes become smaller and lower prices lead to more sales.

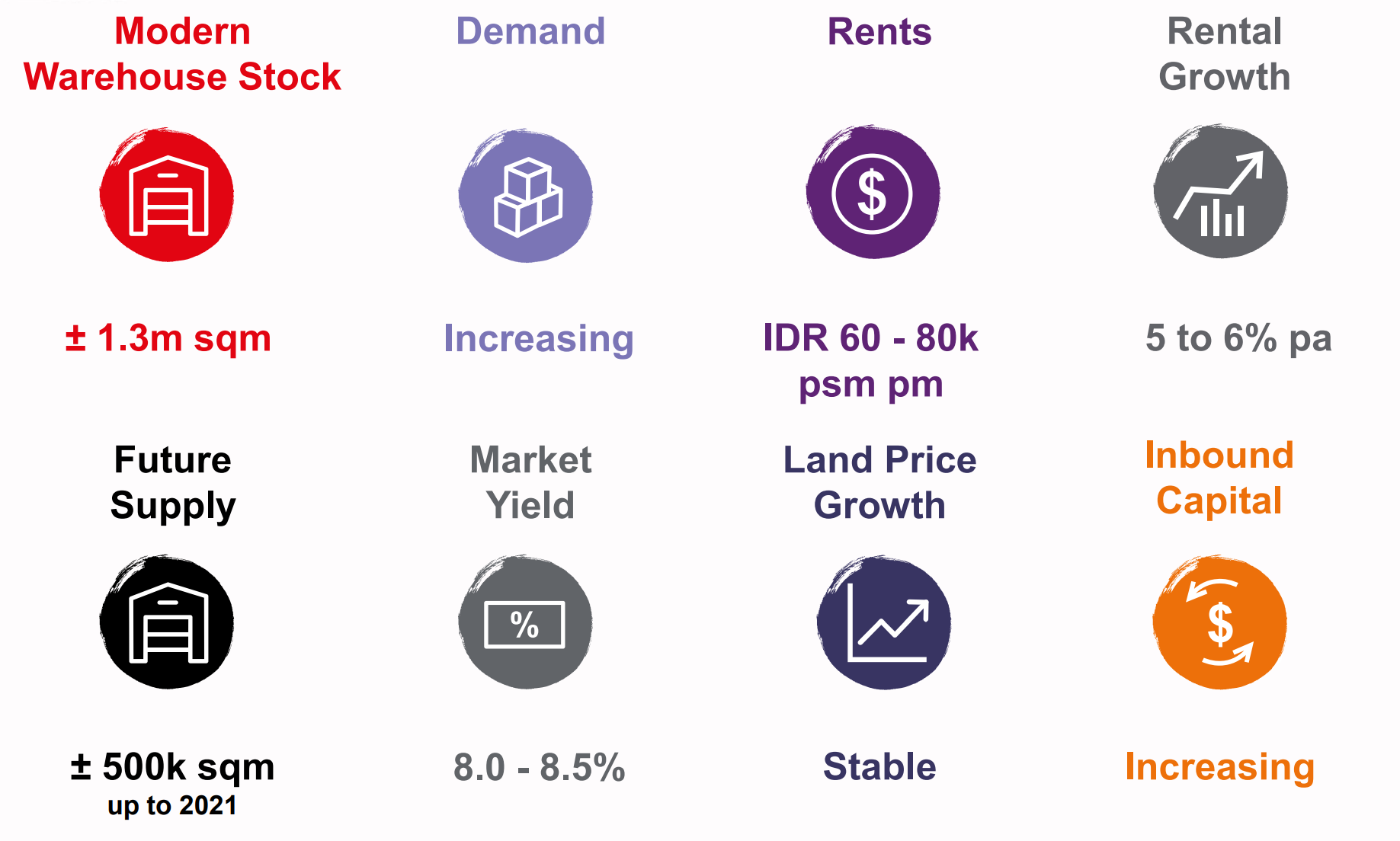

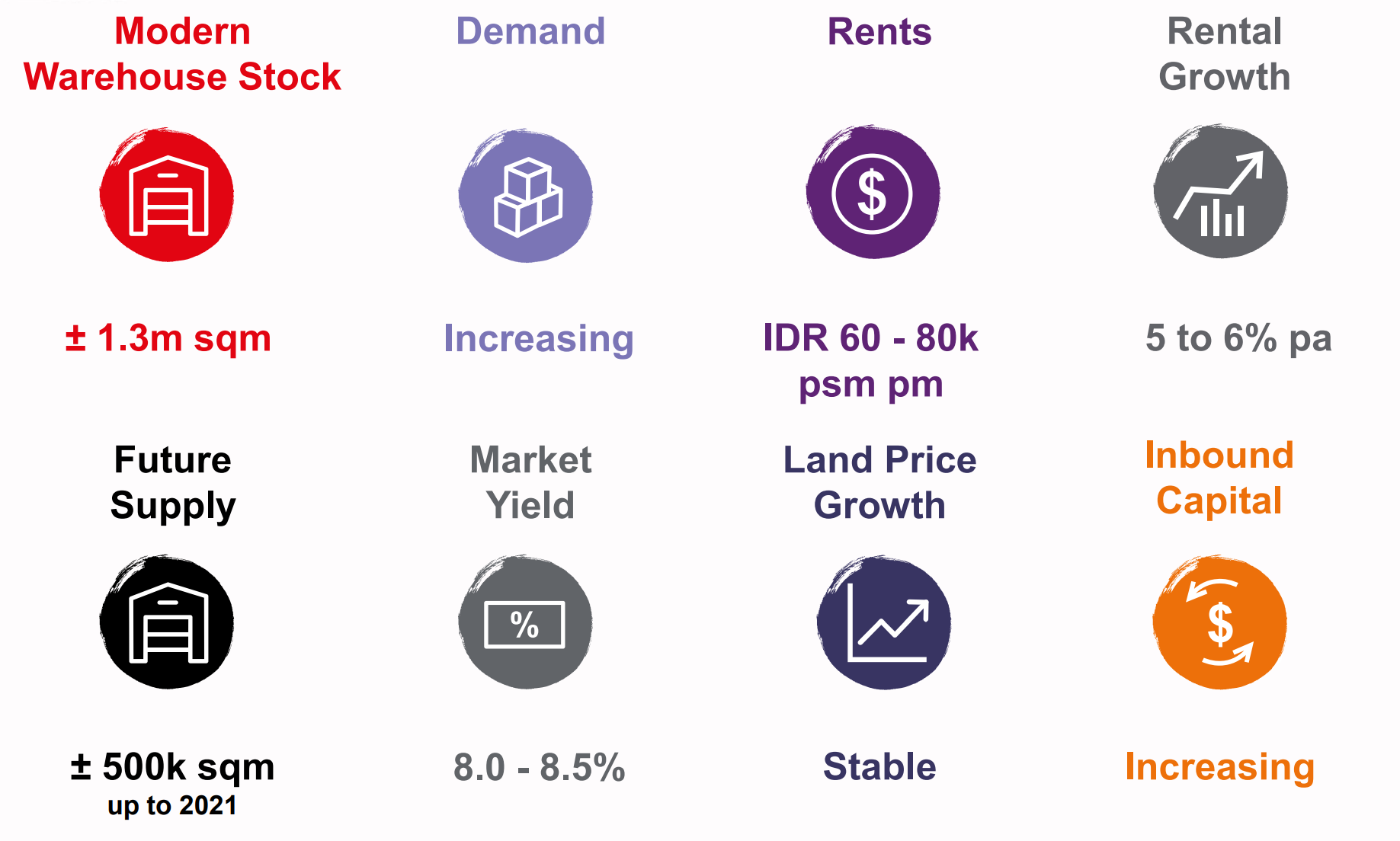

Industrial / Logistics

JLL reports of a low supply of traditional modern logistics warehouse stock, however, new developers are entering the marketplace to create more industrial space.

James Taylor announced that "there is more industrial supply coming up until 2021 with a lot of investor interest being seen in this space."

Industrial/Logistics Market in a Nutshell

Trends to look for in 2018

James Taylor concluded in saying that there is a growing trend towards co-living accommodation, data centres, elderly care, self-storage and student accommodation being seen in Jakarta. Although all of these sectors do currently exist in Jakarta, they are all very much in their infancy and almost none are being participated in by international investors. This may change in 2018 and the following year."

Click here to download the JLL 1Q 2018 Jakarta Property Market Review & Outlook.

For more information about the Jakarta market email James Taylor Head of Research at JLL Indonesia via the contact details below.

This article was first published on Gapura Jakarta

Similar to this:

Smaller, cheaper units reported strongest sales in Jakarta's high rise residential market

JLL Announces Key Leadership Changes in Indonesia

Southeast Asia increasingly in the investor spotlight, reveals data from real estate firm JLL