Beijing-Ulaanbaatar-Beijing-Ulaanbaatar. Round after round of talks, convened and reconvened, ever since Mongolian independence. "This is a relationship not without friction – only two years ago the visit of the Dalai Lama prompted an effective closure of the border." says Asia Pacific Investment Partners (APIP).

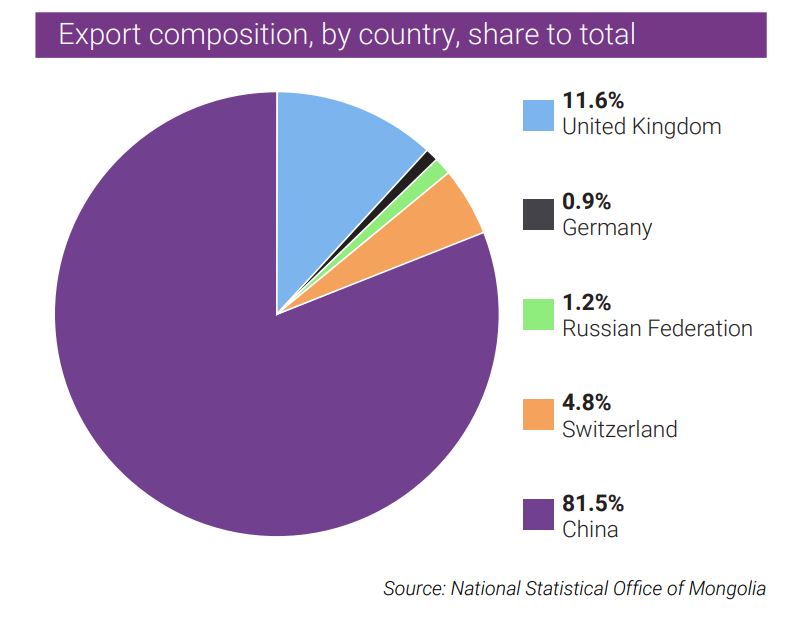

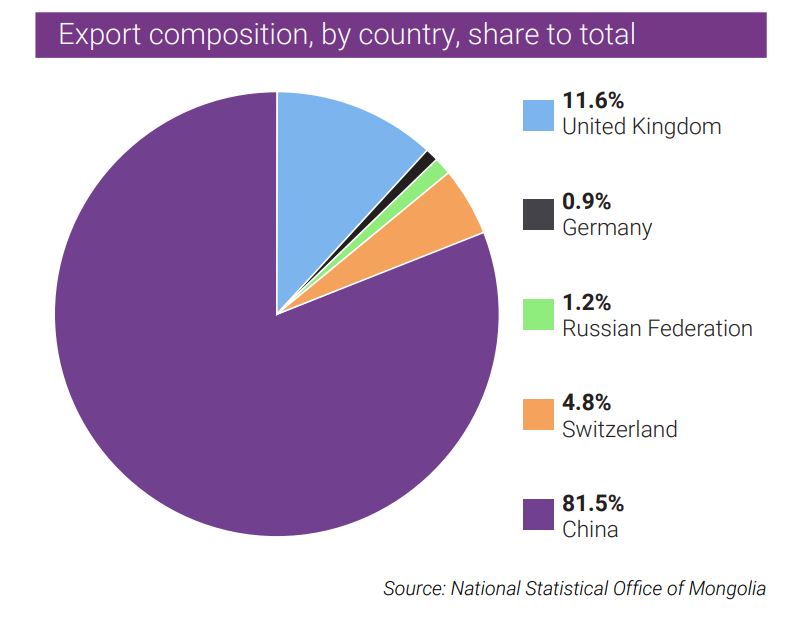

A border where a substantial proportion of Mongolian exports transit. As the chart below shows, in 2016, 82% of Mongolia’s total exports went to its powerful southern neighbour. China’s nearly 1.5 billion population requires resources far exceeding those its own territory can provide. "Not only this, but its role as the world’s largest industrial park, has heightened demand. Mongolia has huge natural resources – from copper to coal, gold to uranium. Even zinc and silver. Though imperfectly balanced, China needs Mongolia, and Mongolia, China." says APIP.

2017: A new dawn in relations

"After the wrangling of 2016, China, South Korea, Japan and the International Monetary Fund (IMF) worked together to help Ulaanbaatar get back on its feet. A particularly cruel commodities cycle had led to world beating growth (exceeded only by South Sudan), followed by an almighty slump." Says APIP "But as the ink was drying on a new agreement in February 2017, only the most observant were aware of the massive uptick in exports to China in late 2016. This trend continued apace, equating to a fourfold increase in coal exports in the first half of 2017"

Click here to read our recent article: Why is mining giant, Rio Tinto, ramping up operations in Mongolia?

Production shortage in China

Who’d have thought Beijing would begin to let environmental issues drive public policy? APIP say that "Self-interest, and the precariousness of Beijing, forced the closure of hundreds of mines in Inner Mongolia, leaving Chinese industrialists sourcing alternative sources of coal."

"Simultaneously, decrees restricting the delivery of coal to smaller ports, further exacerbated an already troubling situation. Step in Mongolia. With a vital need to revive industry, a queue of trucks began to form at the border, allowing Mongolian producers to serve the Chinese market."

Ban on North Korean imports

Many industrialists working in the coal business in Mongolia could not believe their luck. But, more was to come. A bellicose North Korean dictator, and a Twitter-happy US President, let tensions flare to an extent not seen in recent years. The latter, promised ‘fire and fury,’ and the former used state media to mock the American ‘dotard’. Against this backdrop, sanctions began to bite on North Korea, not least by limiting, and then stopping, its coal exports to China which had amounted to 20 million tonnes in 2016. Mongolia, again happily appeared on the horizon and helped fill the void.

How to benefit?

APIP says that "For a lay investor it’s difficult to directly benefit from the coal story. One option could be to buy equities listed on the Mongolian Stock Exchange – a market that was one of the best performing globally last year. And a market at record highs. Another option could be real estate."

"There is a real demand for logistics space but this may price out all but larger investors. For retail investors, high quality apartments, are still at a cyclical low in terms of capital values, but are in high demand by renters – both expat workers and Mongolian staff. With yields in excess of 10%, many savvy purchasers are using real estate as their vehicle to benefit from the Mongolian mining story." reports APIP.

For more information or to discuss the Mongolia property market email Oliver Nicoll from Asia Pacific Investment Partners via the contact details below.

Source: Asia Pacific Investment Partners (APIP)

Similar to this:

Why is mining giant, Rio Tinto, ramping up operations in Mongolia?

Central, high-end design yet affordable Circus Residence in Ulaanbaatar, Mongolia

Mongolia’s hospitality industry is ripe for development, needing more hotels and better online services