Market competition for upper scale hotels took on a more challenging landscape, as latest statistics from the Ministry of Hotel and Tourism revealed that foreign arrivals decreased in the fiscal year of 2016, a first in almost 9 years according to the latest Q3 2017 Upper Scale Hotel report from Colliers International Myanmar. Data shows that there were roughly 1.8 million travellers during 2016, lower by around 8.4% from the year before. As supply continues to grow with more modern hotels offering a wider range of facilities, property consultants, Colliers urge developers to take more creative measures to improve declining occupancy levels. “Older hotels need to look into modernizing their offerings such as revamping decorations and upgrading facilities while reinstating and highlighting the building’s original unique character.” said Mr. Karlo Pobre, Research and Advisory Associate Director of Colliers International.

On the other hand, business arrivals broke a record high with more than 203,000, an increase of roughly 17% from the previous year. Despite the new record, the growth rate is still lower compared to those during 2011 to 2014 when the market first opened up. Business interest in the country has been strong since 2011 save perhaps during 2015 while awaiting the results of the national elections. “Supported by the government’s increasing use of visa free entry to ASEAN countries, the latest numbers reflect the continuous foreign interest towards Myanmar’s business prospects.” said Ms. Joan Mae Lee, Analyst of Colliers International. Mr. Pobre added that it is advisable for hotel owners to focus on design functionality being a key feature in enticing business clientele. He also noted that shuttle services to and from the airport, strong internet access, as well as business facilities (i.e. business lounge with complimentary afternoon drinks, on-site conference and meeting rooms,) and services (i.e. concierge, secretarial and translation services) are also value-added essentials.

For upper scale and luxury hotels, Ms. Lee recommends hotels to start tapping domestic demand through “staycation” packages. Better quality developments with wider ranges of amenities and facilities are well positioned to provide such offering. These bode well for locals opting to save travel costs and time especially during the holidays.

The report also stated that as of Q3 2017, the citywide occupancy rate increased for the first time in at least the past three to four years, perhaps driven by the substantial reduction in average daily rates while average occupancy improved by 5% annually.

Click here to download the Q3 2017 Upper Scale Hotel report from Colliers International Myanmar.

For more information or to discuss the report email Karlo Pobre Research and Advisory Associate Director of Colliers International.

This article was previously published on The Mingalar Real Estate Conversation

Similar to this:

The Myanmar tourism sector is seeing necessary reforms and legislation put in place that will facilitate its sound development in the future

Yangon’s retail market gains further momentum

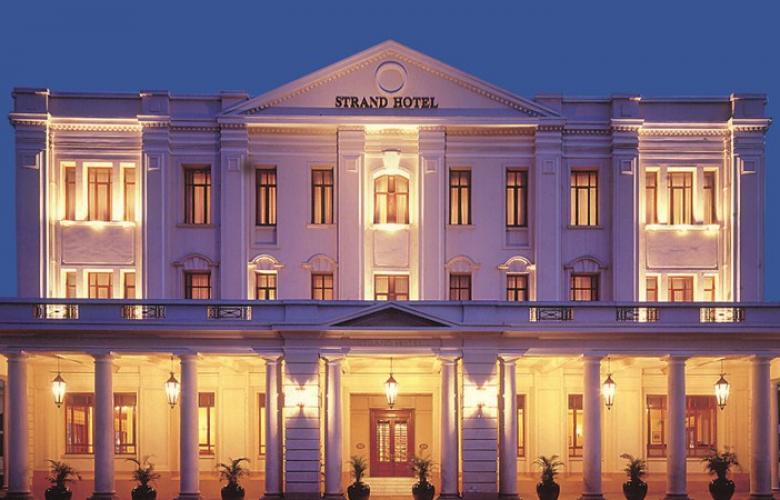

Yangon’s new upscale hotels must fuse colonial charm with modern comfort