The third quarter of 2017 registered US$4.77 billion worth of investment transactions with a total of 115 properties changing hands across ten countries in Asia-Pacific. Collectively, the transaction amount in the third quarter of 2017 recorded a quarteron-quarter (QoQ) increase of 55.2% compared with Q3/2016, making Q3/2017 the most active quarter in 2017 so far.

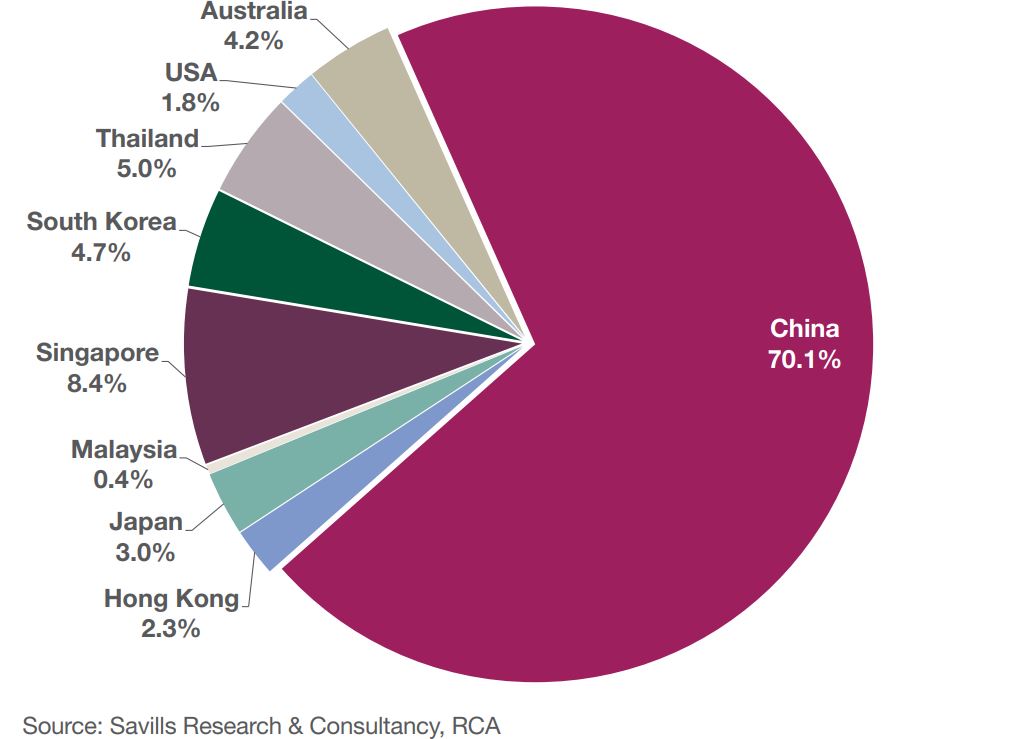

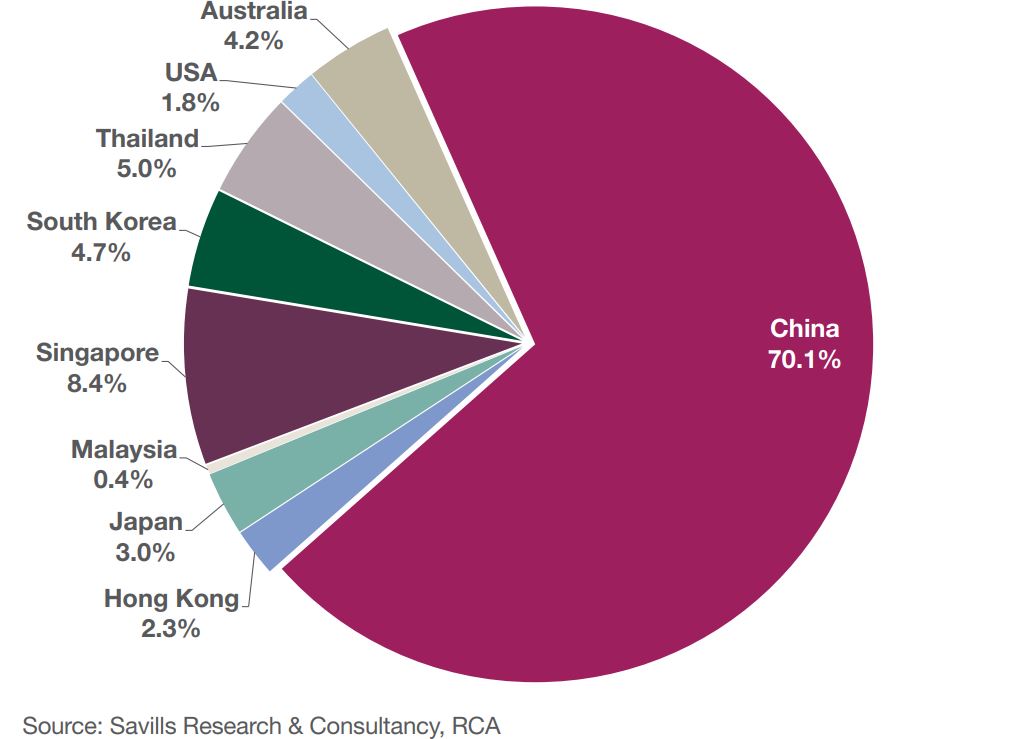

By purchaser origin, China-based R&F properties was the single biggest purchaser this quarter. Excluding Chinese buyers, Singaporean buyers represented 28.1% of the rest of the investors, followed by Thailand and South Korea-based buyers at 16.7% and 15.8% respectively.

These buyers outperformed traditional purchasers such as those of Hong Kong and Japanese origin.

Investment sales transaction volumes by buyer origin, Q3/2017

Chris Hobden, Thailand Head of Research at Savills commented "Thailand’s increasing regional hospitality investment follows a growing trend of Thai companies exploring international opportunities. With the Thai Baht having strengthened against regional currencies, coupled with a desire among prominent Thai groups to diversify their holdings, we expect Thai capital to become ever-more prominent across Asia-Pacific over 2018."

While Singapore is always a key entry market for investors and brands who are keen on entering Southeast Asia, deals are few and far between due to high prices and limited yields.

Given market conditions, Singapore is generally more suitable for investors who are looking at more stable long-term holdings. In Q3/2017, two limited-service hotels, Sloane Court Hotel and Chinatown Hotel, were sold for SG$80.5 million and SG$31 million respectively. The former is set for a residential redevelopment and the latter will continue to operate as a hotel after concept repositioning.

Selected investment transactions, Q3/2017

Source: Savills

Indonesia saw two hotel transactions as a portfolio sale. Thailand-based Strategic Hospitality F&L REIT purchased the two properties, located in Jarkata and Bali, from Agung Podomoro Land for IDR2.97 trillion or US$233.4 million. This cross border transaction is one of the few transactions recorded in Indonesia in recent years.

In Malaysia, Kingdom Holding Company and EHC International Limited sold the Four Seasons Resort Langkawi to Hotel Properties Limited, a Singapore listed company for MYR384.4 million, or US$90 million.

Although real estate prices have dropped for overseas investors, due to a weakened Malaysian Ringgit, investor interest in the market is lukewarm due to generally poor hotel performance in Malaysia.

Similar to this:

Asia Pacific’s hotel transaction volumes: areas of growth and decline

Japan’s Prince Hotels launches Policy and Leisure Inn Plus hotel brands

Singapore the top Asia Pacific tourism spending destination