Yangon continues to modernise its retail market, according to Colliers International Myanmar. The opening of St. John City Mall and Junction City Shopping Mall illustrate this trend. Colliers expects that supply will build up and more innovative trends will persist with strong growth potential for mid-tier F&B as well as entertainment and recreational facilities. It advises developers to aim for a tenancy mix appropriate to the market’s modest income levels.

Forecast at a glance:

- Demand The demand for modern shopping malls will continually increase. Lifestyle-oriented centres offering unique attractions will likely be the next trend.

- Supply Colliers estimates more than 70,000 sq m (753,474 sq ft) of new leasable space in the next two years. Future developments are continually led by shopping malls integrated in mixed-use developments.

- Occupancy rate The citywide occupancy rate sustained a healthy 95% and is likely to remain strong. This will be backed by improving business and consumer confidence alike.

- Rent Given the anticipated hike in new supply rental levels are likely to become competitive in the near term. However, the rates should gradually increase in the next two years as new supply declines.

Click here to download the Colliers Quarterly Review Yangon Retail Q3 2017 Report

Supply to Reach New Record High

Over the past year, retail centres have improved the consumer experience, and been rewarded with an overall rise in foot traffic. As developers gain more confidence, supply continues to keep pace with robust demand. Yangon's total retail stock for Q3 2017 reached more than 330,000 sq m (3.5 million sq ft) of leasable space, up by 12% QOQ. The increase is driven by City Mart's St. John City Mallwith more than 27,000 sq m of leasable space. The newest shopping mall is the second in Lanmadaw Township since the completion of Junction Maw Tin in 2010. Located along Pyay Road, St John City Mall is however closer to Taw Win Centre and Sein Gay Har, both in Dagon Township.

Source: Colliers International Myanmar

Also adding to this year’s supply are Golden Link by Htike Sin Co., Ltd, Junction Square Extension by Shwe Taung Development Co., Ltd., Min Ye Kyaw Swar Tower by Crown Advanced Construction Co., Ltd, and The One Shopping Mall by Creation Group of Companies Ltd. In total, these projects represent more than 50,000 sq m (538,196sq ft). By the end of the year, Colliers anticipates a record annual addition of stock of close to120,000 sq m, or an increase of 47% YOY. New supply may appear limited in the medium term but is likely to build up as the economy further open sup to the foreign market.

In fact, the Myanmar Investment Council (MIC) has recently expressed its stance on commercial activities likely to be encouraged and restricted. While the regulation appears loose, the majority of investments permitted with 100% foreign ownership include the retailing and wholesale services - subject to the Ministry of Commerce's approval. Generally, the enactment of this policy will streamline investment processes. It will also lift local retailers' optimism to expand businesses and to bring in more international brands-creating a more diverse tenancy mix in the future.

Innovative Retail Trends to Persist

The retail scene is now witnessing game-changing concepts following the entry of more modern developments. For example, water features and indoor pocket gardens are some of the unique inclusions in Junction City Shopping Mall. Moreover, the recently completed St John City Mall pioneered the first retail clerestory with a more appealing natural lighting. Along with better layout efficiency, higher floor to ceiling height, modern fixtures and fittings, and the continuous entry of foreign brands, Yangon’s retail market is now shifting towards global practices. Going forward, Colliers expects both interior and architectural designs to veer away from the typical box-type malls. Lifestyle-oriented centres offering unique attractions could perhaps be the next bigtrend. Meanwhile, given the market’s generally modest per capital income levels, we advise retail landlords to aim for a tenancy mix predominantly featuring mid-tier brands especially food & beverage along with fashion and IT. Entertainment and recreational facilities are also welcome additions given the lack of activities especially for families, and among the growing young population. This will be supported by the general increase in purchasing capacity. A survey conducted by Deloitte in 2016 revealed Myanmar’s positive consumer sentiments. In particular, the results showed that 62% of the respondents were optimistic about the economy, and 54% were planning to increase spending in the coming year.

All-time High Occupancy Rate

Source: Colliers International Myanmar

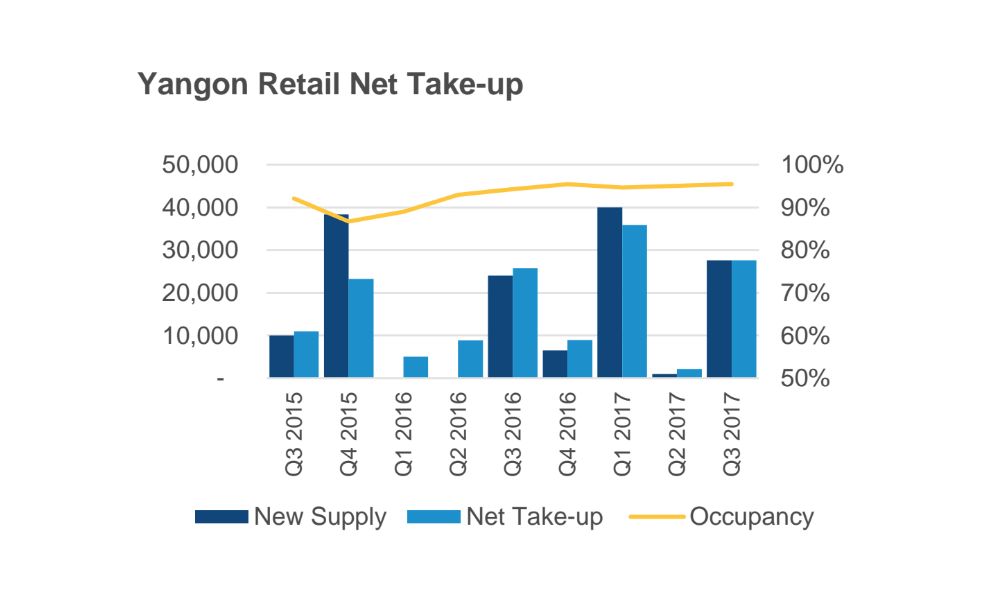

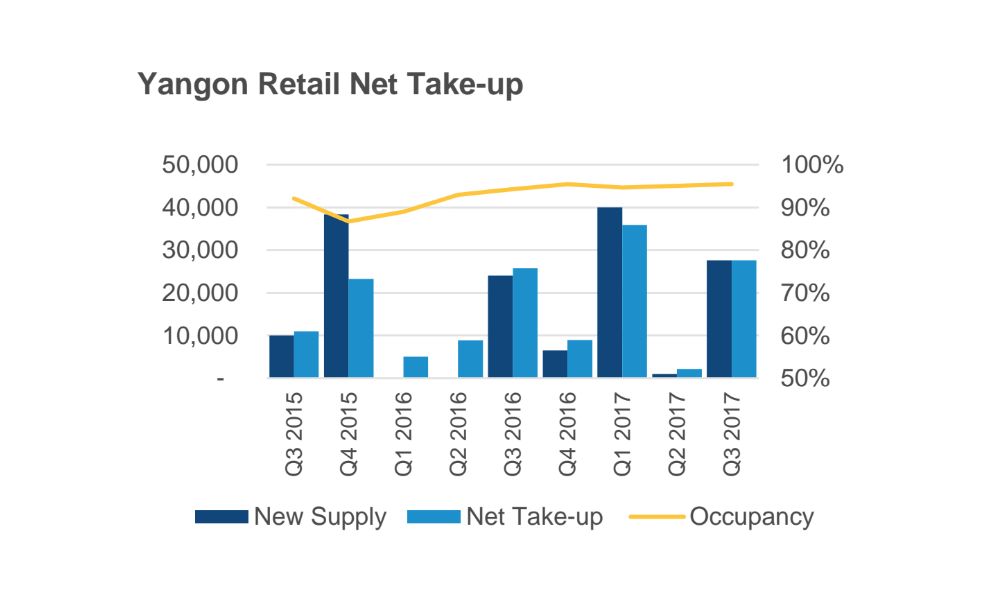

A vibrant consumer population reinforced by a booming economy bodes well for the retail market. In turn, Colliers predicts occupancy levels to remain at an alltime high. Despite the continuous rise in supply, the citywide occupancy rate has remained resilient at around 95% over the last three quarters. Colliers predicts that the net take-up for whole year will reach a new record high of more than 110,000 sq m, more than double the number recorded in 2016.

Source: Colliers International Myanmar

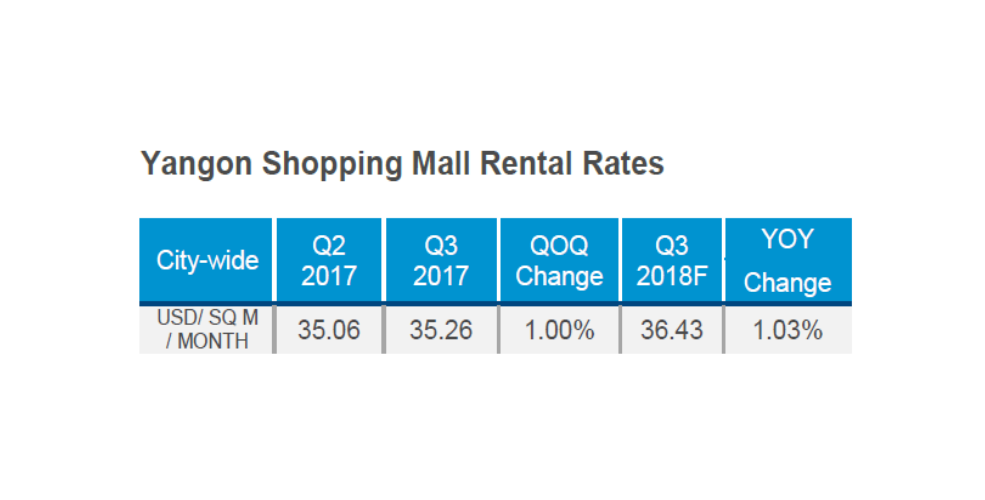

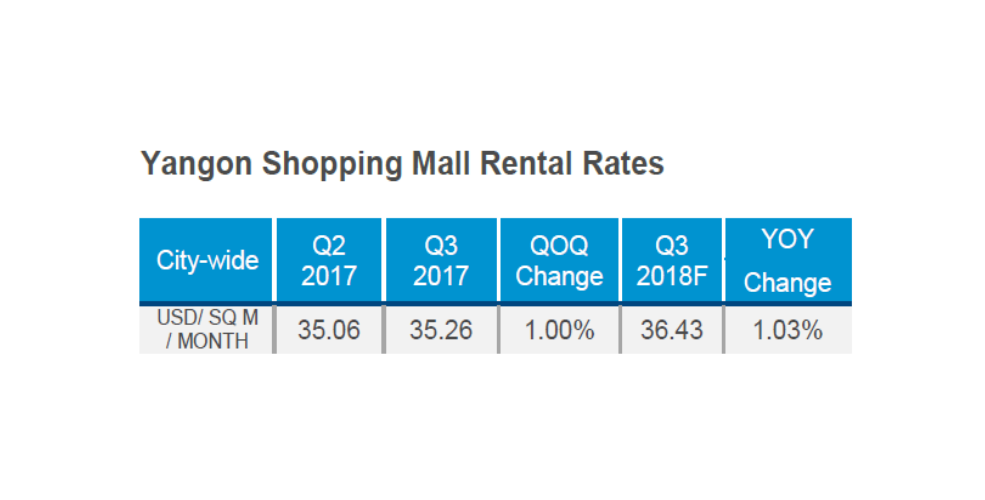

Meanwhile, the average rental rate has continually trended upwards, reaching USD31 per sq m per month in Q3 2017. The rate is up by 1.5% QOQ and a significant 14% YOY. Further introduction of higher quality projects could also support premium rents in the near term. However, this is likely to be capped at modest levels in 2018 as competition among landlords may start to heighten.

Click here to download the Colliers Quarterly Review Yangon Retail Q3 2017 Report

If you would like more specific information about this report, email Karlo Pobre from Colliers International via the contact details below.

Similar to this:

Upward Trending Demand amid Stabilised Rents

Renting property in Myanmar

Yangon’s new upscale hotels must fuse colonial charm with modern comfort