JLL's Ong Tek Hui has helped to distil the findings from the 3Q17 statistics from the latest report from Singapore's Urban Redevelopment Authority, in particular, for the residential sector.

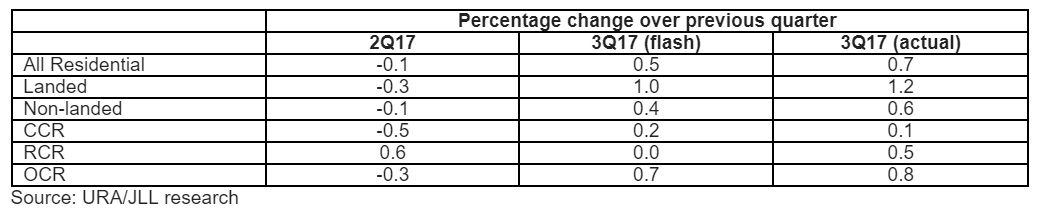

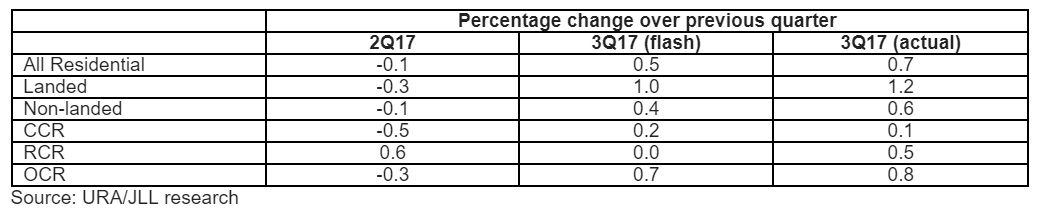

Prices indices – upgrade from flash estimates shows prices rising at a firmer pace

The 3Q17 price indices reflect an upgrade from the flash estimates released earlier in the month. Except for non-landed properties in CCR, the actual indices for all the other segments are higher than the flash estimates resulting in the overall index rising by a higher 0.7 percent than the previous 0.5 percent flash estimate. Flash estimates lagging the actual means that price movements subsequent to the flash estimates were moving at a firmer pace. With the indices of all segments in positive territory, the price recovery appears to be broad-based supporting the likelihood of prices continuing to rise.

Sales Volume – strongest first nine months in five years, with secondary market dominating

In the first three quarters of 2017, 18,800 private homes were transacted in both the primary and secondary markets, 56.8 percent higher than the same period last year, and the strongest first nine months in five years. As the market recovers, secondary market sales have been growing more significantly. For the first nine months of this year, 10,098 secondary market transactions were recorded, a 59.3 percent increase y-o-y and it comprised 53.7 percent of the total sales volume, compared to 52.8 percent in 2016 and 46.5 percent in 2015. 8,702 units were sold on the primary market in the first three quarters, a 53.9 percent y-o-y increase. New sales launches have been lagging take-up with 5,143 units placed on the market in the first nine months, a mere 4.3 percent increase y-o-y. With new launches remaining low-key and more buyers returning to the market, resale market activity is expected to strengthen and lead the primary market. As prices recover, some new launches may be expected to be held back and this would lead to more buyers sourcing in the resale market.

Rental index stabilizes after nearly four years

The residential rental index was flat in 3Q17 following a 0.2 percent decline in 2Q17. The index stabilized mainly due to the landed rental index rising 0.6 percent and the non-landed RCR index climbing 0.9 percent. The non-landed rental indices for CCR and OCR fell -0.8 percent and -0.3 percent respectively. These could be signs of the residential leasing market starting to bottom but vacancy remains at a high level at 8.4 percent in 3Q17, an increase of 8.1 percent in the previous quarter. Some owners have withdrawn their units from the leasing market prompted by the turnaround in prices in the sales market. This could have reduced leasing options for some tenants and have a positive impact on rents.

Executive condominium primary market strengthens while supply dwindles

In 3Q17, developers sold 1,539 new ECs, 61.3 percent more than in 2Q17, and the highest quarterly volume since 4Q12. The 3,565 new ECs sold in the first nine months of the year is the highest for similar periods since such data was available in 2001. This was despite a large decline in the number of ECs launched from 2,656 units in the first three quarters of 2016 to 1,555 units for the same period in 2017. With stronger EC sales, the unsold units in launched EC projects with pre-requisites for sale and completed EC projects has dropped to 698 in 3Q17 from 1,620 in 2Q17. Supply of new ECs is tight with only one remaining new EC project, Rivercove Residences, in the launch pipeline. An increase in new EC prices may be expected given the limited supply and upbeat demand.

For more information email Mr. Ong Teck Hui, National Director, Research & Consultancy at JLL via the contact details below

Similar to this:

Florence Regency at Hougang Avenue 2 Singapore sold for SGD $629 million in collective sale

Singapore’s residential property sales fall

Exclusive Sentosa Cove residence with island resort as playground