The Market Snapshot: Asia Pacific 2017 highlights an overview of transaction activity in the region and presents 13 markets’ current hospitality landscape; each covering demand and supply dynamics, hotel performances, and key transactions.

Transactions in Asia Pacific

Over the past twelve months from October 2016 to September 2017, HVS has noted close to 240 transactions across Asia Pacific worth approximately US$12 billion. In comparison to the same period the previous year, transaction volume in Asia Pacific has increased by almost 12% with China contributing to 40% of the hotel transaction volume in the region. The largest transaction recorded was the portfolio of over 75 properties under Dalian Wanda China.

Over the period from October 2016 to September 2017, Asia Pacific (excluding China and India) witnessed a total hotel transaction volume of almost US$4.4 billion as compared to approximately US$8.6 billion in the previous year. Reasons for slower transactional activity in the region include owners holding onto hospitality assets due to future growth potential, lack of capital strength from buyers, desire to hold onto ownership of marquee hospitality assets, amongst others.

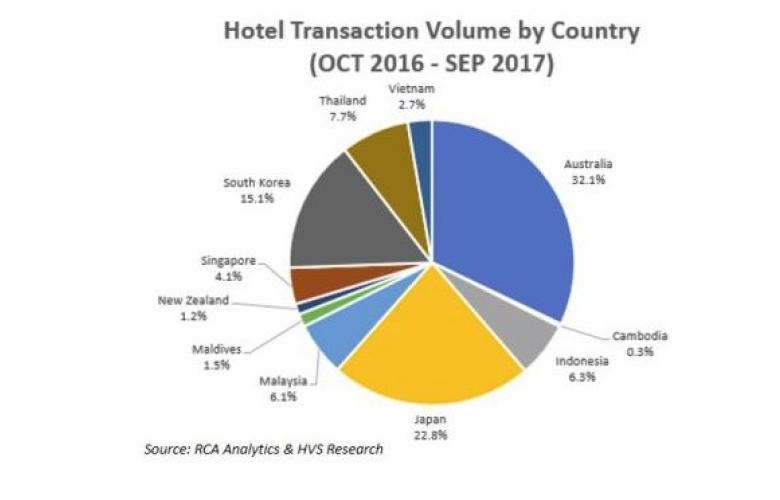

Regional Share of Hotel Transaction Volume

HVS note that the majority of hotel transaction volume is still directed towards Australia, Japan and South Korea, similar to the previous period of October 2016 to September 2017.

As compared to the previous period, hotel transaction volumes in Indonesia, Malaysia and Thailand have seen strong positive growths while Australia, Cambodia, Maldives, South Korea and Singapore have remained fairly stable. Markets such as Japan, Myanmar, New Zealand, Philippines and Vietnam were found to be less active.

Investor Profile

With a share of approximately 24%, the “developer/owner” dominates the hotel transactions in Asia Pacific and the “real estate operating companies” follows closely after at 23.5%. The majority of the investors who invest heavily within the Asia Pacific region are located in more developed countries such as Australia, Japan and Singapore.

Click here to view the full HVS Asia Pacific Market Snapshot report

To discuss the report or the Asia Pacific hotel market email Hok Yean Chee from HVS via the contact details below

Similar to this:

Speculation that Wanda is preparing for A$2bn Australian exit

China narrows down selected sectors for investment creating a geographic impact on hotel and tourism assets in non-core markets

The Myanmar tourism sector is seeing necessary reforms and legislation put in place that will facilitate its sound development in the future