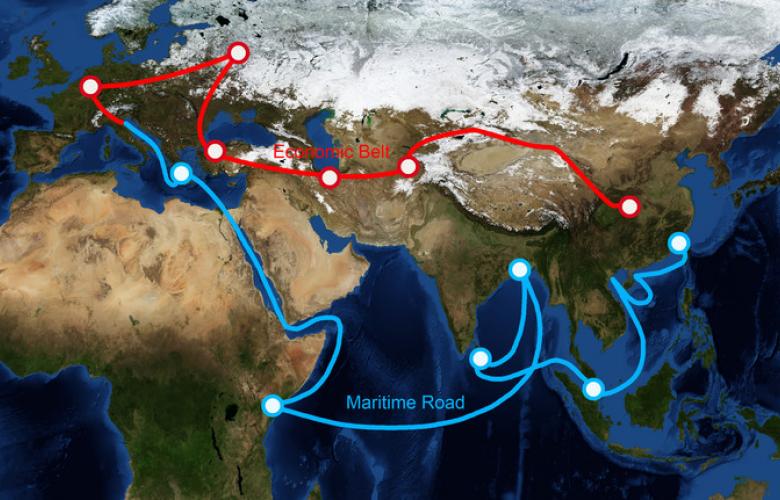

China’s Belt and Road project, unveiled in 2013, was created to build a modern-day “Silk Road”, connecting China to Southeast Asia, Pakistan and Central Asia, and beyond to the Middle East, Europe and Africa.

Thomson Reuters data reports that Chinese acquisitions in the 68 countries officially linked to President Xi Jinping’s signature foreign policy totalled $33 billion as of Monday, surpassing the $31 billion tally for 2016, but the volume of all outbound mergers and acquisitions from China has dropped 42 percent year-on-year as of Monday. Chinese companies targeted Belt and Road countries for 109 deals this year, compared to 175 in the whole of last year and 134 in 2015, the Thomson Reuters data showed.

At a glance:

- China’s Belt and Road project acquisitions totalled $33 billion so far

- Outbound mergers and acquisitions from China dropped 42 percent yoy

- Regulators are now reviewing deal agreements in minute detail

- This is restricting the flow of capital outside the country

- Belt and Road investments take only 3-4 months for approval while most outbound deals can take 6 months

According to Reuters, Beijing’s move to prop up the yuan by restricting the flow of capital outside the country and clamp down on debt-fuelled acquisitions to ensure financial stability has made it tougher for buyers to win approvals for deals abroad.

Regulators have tightened the screws further since June, reviewing deal agreements in minute detail and ordering a group of lenders to assess their exposure to offshore acquisitions by several big companies that have been on overseas buying sprees, including HNA Group, Dalian Wanda Group and Fosun Group.

In 2016, Chinese companies spent a record $220 billion on assets overseas including movie studios to European football clubs, and this has led to this heightened regulatory scrutiny. But the companies are still looking beyond the Belt and Road corridor.

“People are thinking in a long-term approach when making investments along Belt and Road countries,” said Hilary Lau, a corporate and commercial lawyer and partner at the law firm Herbert Smith Freehills. “The acquisitions are also policy-driven. There are funds allocated by Chinese banks and state funds for Belt and Road deals,” he said.

“If you are doing One Belt, One Road, that becomes the first sentence in the document” to the regulators, said a senior investment advisor at a Chinese company that has acquired several overseas businesses, which leads to a relatively smooth approval process for deals.

“It is a wise thing to point out early on,” said the advisor, who requested anonymity because he was not authorized to speak to the media.

While outbound deals can take six months to be approved by Chinese regulators, Belt and Road investments tend to take only three or four months, according to a Hong Kong-based senior M&A banker.

The belt and road acquisitions are predominantly in energy and infrastructure sectors, said Hilary Lau of Herbert Smith Freehills.

“We’ve seen a lot of activities recently in Indonesia, Malaysia and Myanmar. The whole Sri Lanka, India and Bangladesh corridor is also hot as it’s connecting the East and West,” he said.

Source: Reuters

Similar to this:

ASEAN infrastructure investment set to increase region’s growth

China narrows down selected sectors for investment creating a geographic impact on hotel and tourism assets in non-core markets

What does China’s infrastructure masterplan mean for Asia?