Asia boasts the majority of the world’s top leading cities

Contact

Asia boasts the majority of the world’s top leading cities

JLL’s Jeremy Kelly’s ‘The Business of Cities Report’ reveals four Asian cities are among the top seven most competitive cities in the world.

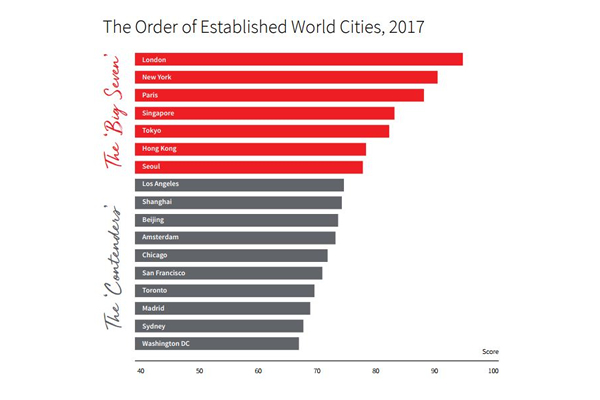

Four Asian cities are among the top seven most competitive cities in the world, says a new report by real estate consultant JLL and city intelligence and strategy group, The Business of Cities. The study analyses 44 of the most robust city indices, revealing Singapore, Tokyo, Hong Kong and Seoul are among the ‘Big Seven’, following behind London, New York and Paris. The ‘Big Seven’ form a group with shared challenges and imperatives relating to affordability, infrastructure financing, regional growth management and relationships with their nation-states.

Top competitive global cities:

- London

- New York

- Paris

- Singapore

- Tokyo

- Hong Kong

- Seoul

Seoul is a new addition in 2017. “Seoul has stepped up by increasing openness, exceptional digital connectivity, the presence of innovative global firms and robust infrastructure,” says Jeremy Kelly, Director in Global Research, JLL. “Seoul is widening its international talent base with the presence of many multinationals, making the city highly competitive on a global level.”

Singapore is building its position as a truly global gateway, emphasising being a smart city. According to Mr Kelly: “To retain its ranking as a global city, Singapore needs to continue fostering its innovation economy and presenting itself as a hub for talent and business.”

Hong Kong punches above its weight as a global city, but faces competition from other Chinese cities, with questions raised over political uncertainties, and affordability issues. “Hong Kong faces both challenges and opportunities from increasing integration with China,” explains Dr Megan Walters, Head of Research, Asia Pacific, JLL. “On the one hand, it faces huge competition from the likes of Shanghai and Shenzhen. On the other, there are new opportunities especially when it comes to internationalising the Chinese economy, notably with the Belt and Road Initiative.”

Tokyo improved to fifth place from sixth position in 2015. “Tokyo has faced challenges with limited economic growth over the past few decades,” explains Dr Walters. “But the Olympics in 2020 is providing an impetus for Tokyo’s revival as it improves its infrastructure and internationalises further.”

Poor air quality and income inequality in Asia could hamper governments’ efforts to move up the city rankings. City growth is also impacted by geopolitical uncertainties - the rise of protectionism across the globe and military escalations in Asia have all altered perceptions about which cities appear to be ‘safe bets’ or present higher risks for investment.

A second tier group of 10 ‘Contenders’ has emerged. According to the report, China’s ‘Alpha Cities’ – Beijing and Shanghai – are part of this rising group of emerging hubs as the country’s Belt and Road Initiative represents the next step in these cities’ global pathway. The other ‘Contender’ cities identified globally are Los Angeles, Amsterdam, Chicago, San Francisco, Toronto, Madrid, Sydney and Washington DC.

“These indices have a bearing on how we understand city dynamics and serve to guide investors, businesses and employees as they make location choices. They point to which cities have the ingredients for future success and help steer the real estate industry in its response to the rapidly changing urban landscape,” concludes Mr Kelly.

Click here to view more on city indices from JLL

Similar to this:

Southeast Asia increasingly in the investor spotlight, reveals data from real estate firm JLL

Rail connections to spur growth in Southeast Asia

Why should we expect further growth in the Asian property market?