International real estate continues to serve as an attractive asset class for investors, with Asian outbound investment into the sector posting significant year-on-year gains in the first half of 2017. This was led largely by the preference of investors for big ticket deals in the global real estate sector.

Asian outbound investors are rebalancing real estate portfolios internationally. “The appetite of Asian investors for high quality cross-border real estate assets remains solid and sustainable for the foreseeable future,” said Tom Moffat, Executive Director, Capital Markets, CBRE Asia. “However, the type of transactions and the geographic and sectoral diversity is where we see the most significant change in 2017.”

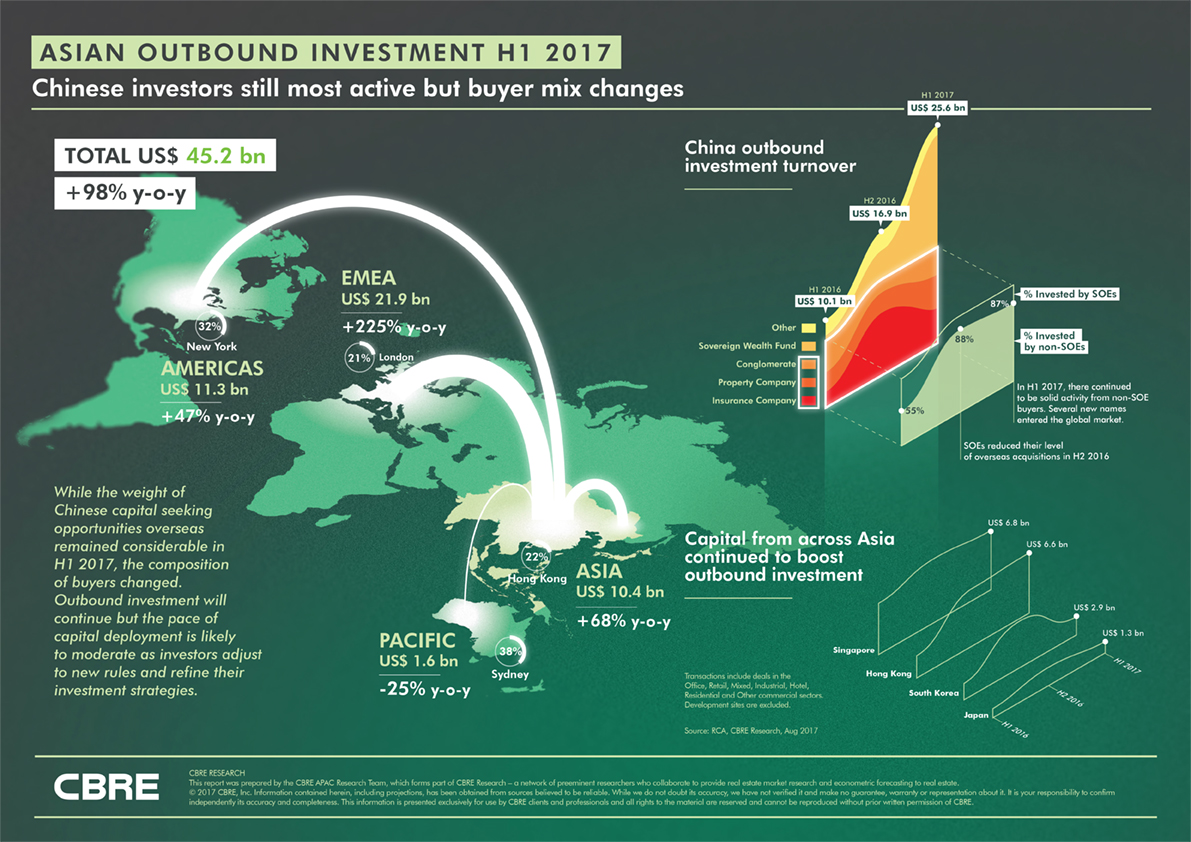

Asian investment H1 2017 at a glance (according to CBRE):

- Around US$45.2 billion outbound capital was invested in global property

- This is a 98.4% rise year-on-year against US$22.8 billion allocated in the first half of 2016

- 74% of committed investments were transitions valued at US$250 million+

- This is versus 56% in the corresponding period in 2016

Where Asian funds were invested (first half of 2017):

- Europe, Middle East and Africa (EMEA) and the Americas drew US$21.9 billion

- This was driven largely by a single US$13.2 billion from the logistics portfolio purchase—and US$11.3 billion in capital

- Intra-Asia investments finished the first half at US$10.4 billion, a 23% growth in total capital

- Pacific markets were less attractive, dropping 25% year-on-year to US$1.6 billion

- 64% of all EMEA capital deployments and 35% of Americas capital was from institutional investors

- Office and logistics were most attractive sectors accounting for 44% and 34%

- Followed by residential (7%), hotels (7%), retail (6%) and niche investments globally

Asian outbound investment H1 2017. Picture credit: CBRE

Asian outbound investors additional key findings:

Non-China investors more active: Singapore (US$6.8 billion), Hong Kong (US$6.6 billion) and South Korea (US$2.9 billion) remain active outbound investors and continue to deploy capital as Chinese investors rebalance portfolios.

Number of portfolio deals rising: They are now more likely to deploy capital via portfolio transactions. In the first half of 2017, 26 portfolio deals were committed versus 13 in the first half of 2016.

Destinations becoming more diverse: They now look beyond gateway cities when deploying capital into real estate. In the first half of 2017, the top five urban destinations comprised of 31% of all total Asian outbound capital compared to 54% in the first half of 2016.

China outbound diversity: Chinese capital continues to be deployed differently relative to the region. In the first half of 2017, the primary destinations of outbound investment were office (Americas), logistics (EMEA) residential (Japan) and hotels (Australia), representing the pull of diverse and quality real estate assets globally.

Source: CBRE

Similar to this:

JLL names Shanghai, Beijing, Guangzhou and Bangkok as Rising Giants of growth cities.

What does China’s infrastructure masterplan mean for Asia?

Rail connections to spur growth in Southeast Asia