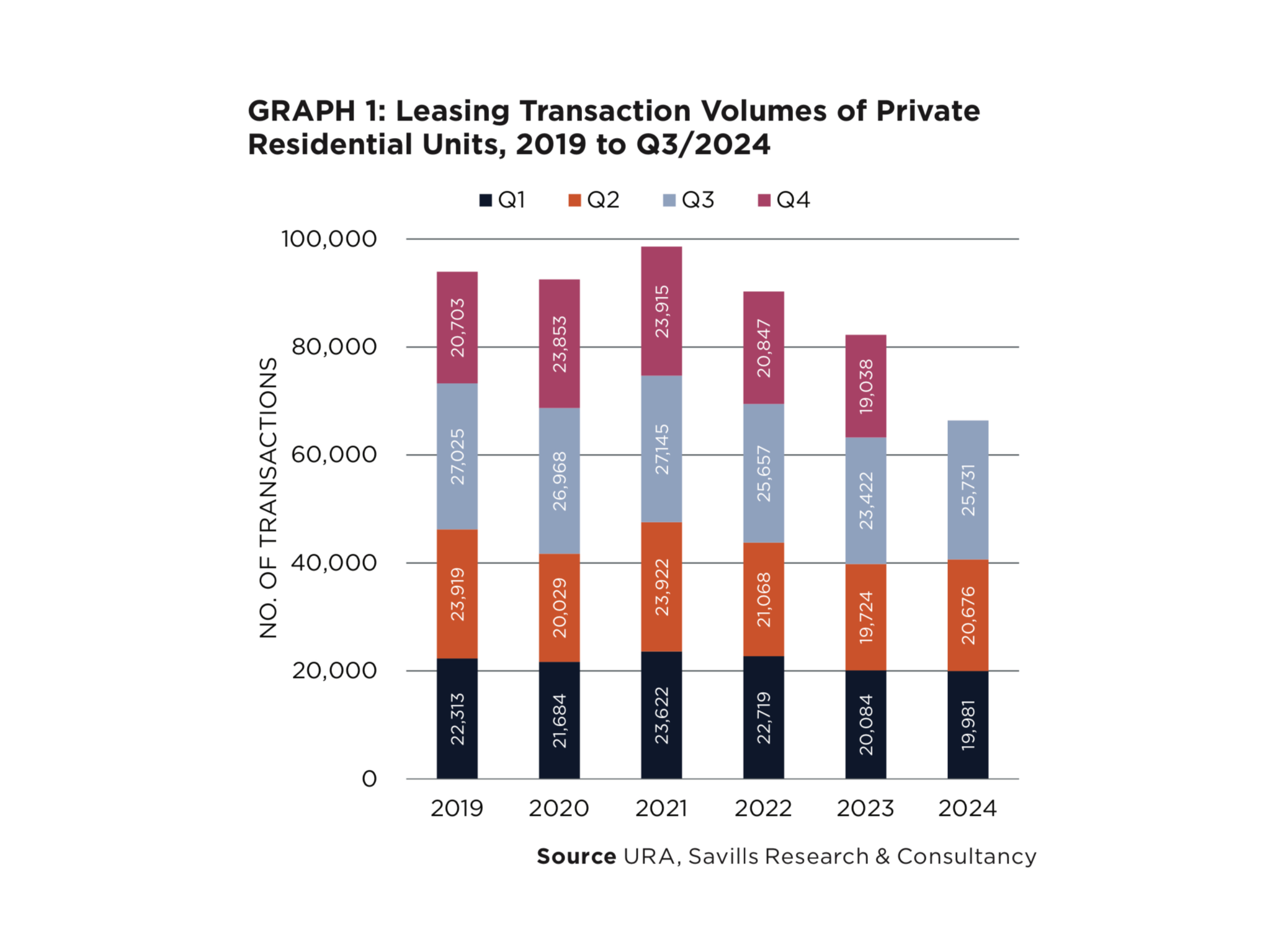

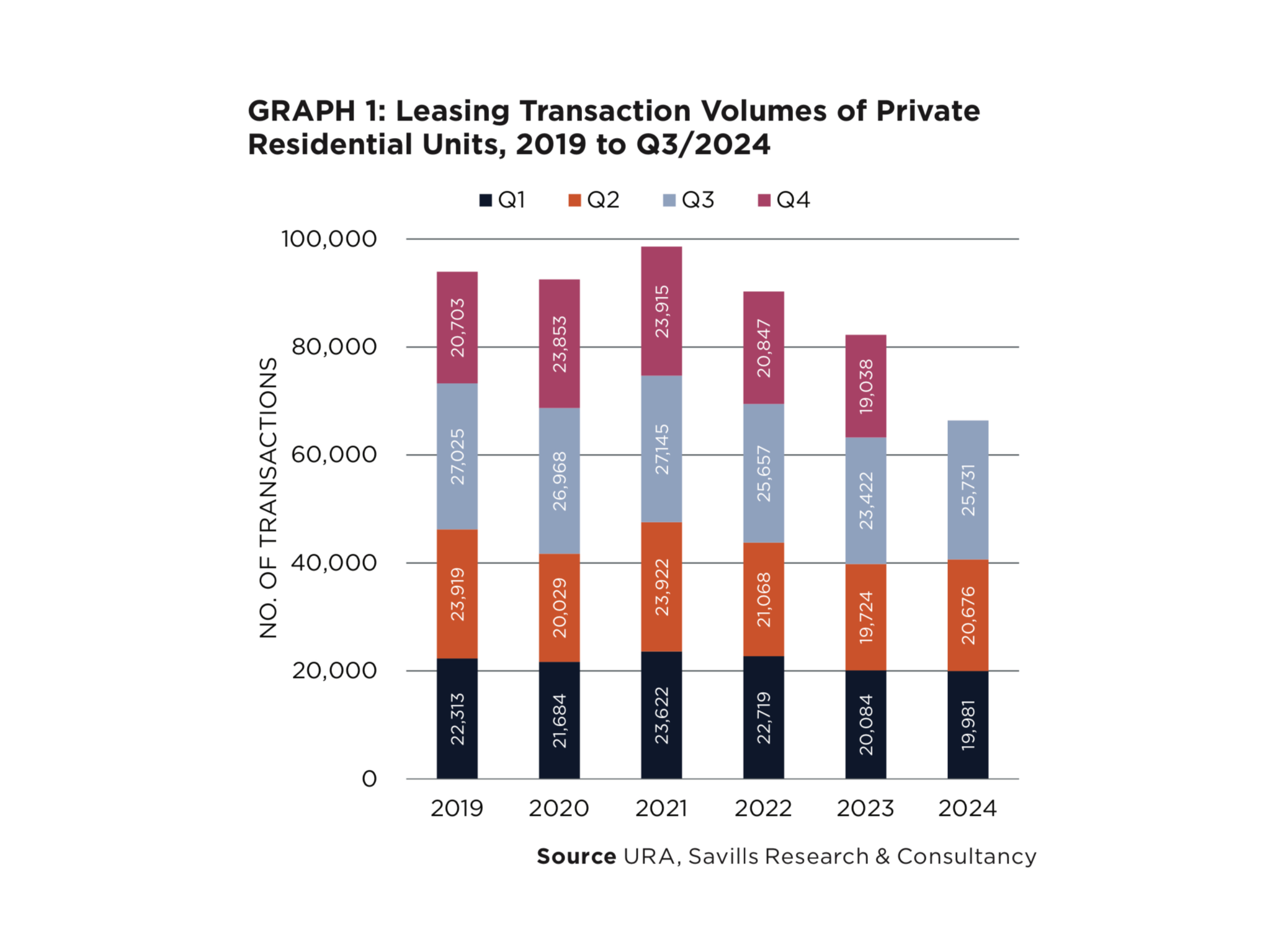

Savills Research shares that the leasing volume of private residential properties (excluding executive condominiums) climbed 24.4% quarter-on-quarter (QoQ) to 25,731. This is due to seasonal factors such as the school year and corporate relocation cycles, as well as lease expiries and renewals.

The number of rental contracts was also 9.9% higher than the 23,422 recorded in the same period in 2023. The QoQ growth in the third quarter was observed across various property types and market segments. Rental contracts for landed properties surged by 46% QoQ, while that for non-landed residential properties rose by 23.2% QoQ.

A further breakdown in the non-landed residential property segment revealed that Rest of Central Region (RCR) led the quarterly growth with an increase in leasing transactions by 25.2%. This was followed by the Core Central Region (CCR) at 23.5% and the Outside of Central Region (OCR) at 21.2%.

Overall, the robust growth for lease volume in Q3 continued to be mainly driven by more people upgrading their accommodation. This was fuelled by more palatable rents and an ample supply of units from new completions. With rents having fallen for the four prior quarters, more tenants have begun to look for one to two-bedroom units, instead of sharing a larger unit with others.

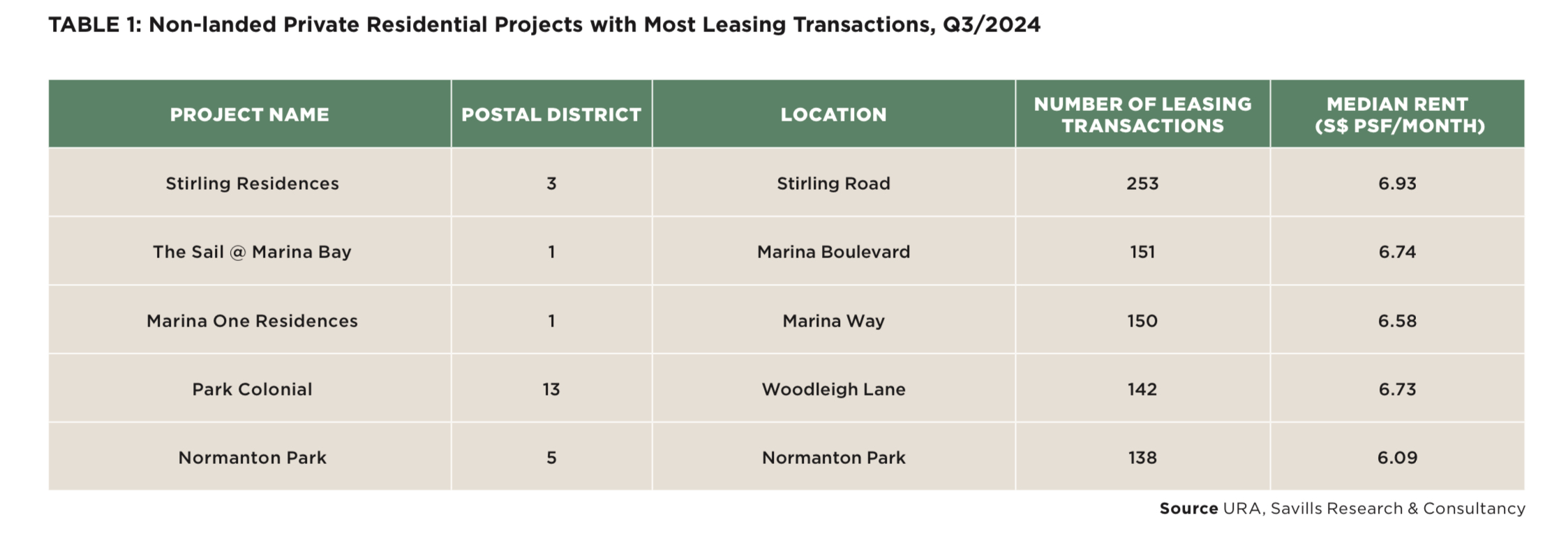

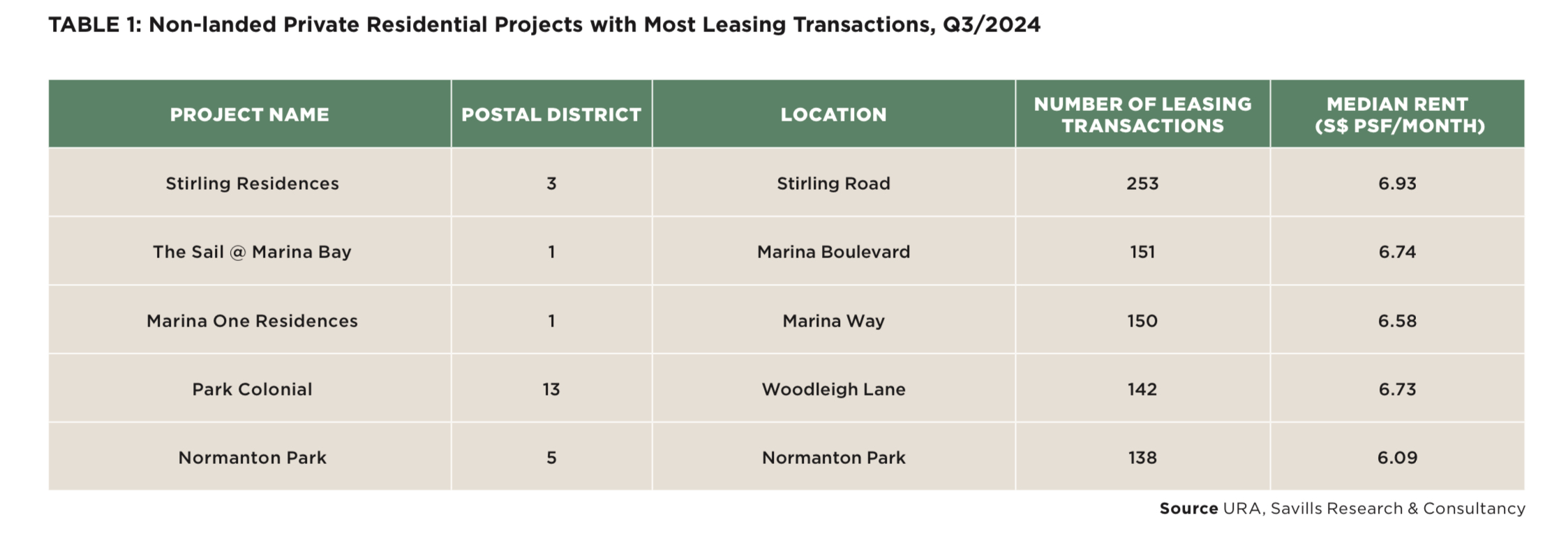

The top three projects with the highest leasing volume this quarter were: Stirling Residences, The Sail @ Marina Bay and Marina One Residences. (see Table 1)

TABLE 1: Non-Landed Private Residential Projects with Most Leasing Transactions, Q3/2024

After three consecutive quarters of decline, the URA’s rental index for island wide non-landed private homes saw its first uptick in Q3/2024, rising 0.5% QoQ. Both the RCR and the OCR drove the strong performance, posting 1.7% and 2.2% QoQ growth respectively. Again, seasonal factors and a shift from public housing units to entry level condominiums driven by a surge in new supply in 2023 and more reasonable rents may have caused the rental growth in these two market segments.

In contrast, the Core Central Region (CCR) lagged with a 1.6% QoQ rental decline, marking its fifth consecutive quarter of decrease. This decline was largely consistent across units with varying numbers of bedrooms. Given the global economic uncertainty and the relatively limited pool of professional expatriates with substantial housing allowances, this suggests that the CCR still lacks the fundamental conditions for rental growth in the near term.

Similarly, rents for high-end non-landed private residential projects tracked by Savills continued to decline by 0.9% QoQ in Q3/2024. Combined with the contractions recorded since Q3/2023, the average monthly high-end rents have dropped by a cumulative 7.2% from the last peak in Q2/2023 to S$5.75 per sq ft in the third quarter this year.

George Tan, Managing Director, Livethere Residential, Savills Singapore says, “The private residential rental market saw a healthy amount of leasing activity. Rental demand remains positive, particularly for the smaller and mid-tier units, as they appeal to expatriates and professionals, keeping rents steady. The luxury segment showed a slight dip in rental rates, probably due to softer demand and fewer expatriates with budgets for large, high value units. Overall, the private rental market may continue to see stable demand, especially at the more affordable levels.”

Alan Cheong, Executive Director, Research & Consultancy, Savills Singapore comments, “For 2024, about 9,100 units could be completed and this rapid climbdown in new supply is probably the main reason for the turnaround in rents. However, we believe the upside will be capped by several factors, chief amongst which is the climb back up to 3,000+ per quarter unit completions. This will increase the competition level for potential tenants. With Employment Pass holders moving to personal private unit leases as rents have softened, demand from this group may start to ease in the coming quarters. Moreover, as more companies are moving their shared services offshore, the demand from foreigners working in this sector of the economy is expected to weaken.

While companies continue to cost cut by reducing headcount, landlords are now paying higher property taxes, and this may lend some measure of support to the rental market. Inflationary pressure is also driving up conservancy charges, giving landlords another reason not to give in to low ball rental offers. We had anticipated an end to the slide in rents towards the end of the year. However, given the fact that it came early in Q3/2024, we now amend our forecast of a 5% year-on-year decline in rents to a 2.5% drop. For 2025, we expect rents to stay sideways as businesses face headwinds and thus continue to watch their labour costs.”

Download Singapore Residential Leasing Briefing Q3 here.

For further information, please contact Alan Cheong, Executive Director, Research & Consultancy, Savills Singapore and George Tan, Managing Director, Livethere Residential, Savills Singapore as the details below.