Four of the top five global cross-border capital destinations for land and development site investments in the first quarter of 2024 were in Asia Pacific, according to a new report from Colliers.

The report, Asia Pacific Global Capital Flows May 2024,listed China, Singapore, Australia and India within the top five destinations globally for cross-border capital investment in land/development sites in Q1 2024.

In terms of standing assets overall, China and Japan ranked third and fourth respectively, in the list of top 10 cross-border capital destinations globally in Q1 2024. Within Asia Pacific, the top 10 capital destinations include China, Japan, Singapore, Hong Kong, Australia, Malaysia, Indonesia, South Korea, Indian and New Zealand.

Chris Pilgrim, Colliers’ Managing Director of Global Capital Markets in Asia Pacific, said the results reflected the APAC region’s continued expansion, robust economic growth and lower supply level per capita.

“APAC continues to show strong growth with stable forecasts, a factor that is driving the strength of the land and development market in particular,” Mr Pilgrim said. “More broadly, investor confidence is returning both in terms of deploying capital and the belief that some economic headwinds have stabilised or are now factored into risk adjusted returns.

“We have seen significant capital allocation into opportunistic, value-add and core-plus strategies both in this region and from capital in Asia Pacific targeting US, UK and European markets. This is reflected in the UK and US, ranking No.1 and No.2 respectively for cross-border transactional activity in Q1 2024, totaling US$8.48b. Additionally, the rise in investors returning to core assets since the start of this year reflects the market reset and demonstrates confidence returning to many markets and sectors in the region and beyond.

“Equally, global investors from the US and UK remain focused in Asia Pacific’s office sector – 64% of office sector investments in the region were from global capital. Investors from Asia Pacific are keen on specialised industrial and logistics, particularly data centres and cold storage, and are more likely to invest in existing ESG assets than the global average.”

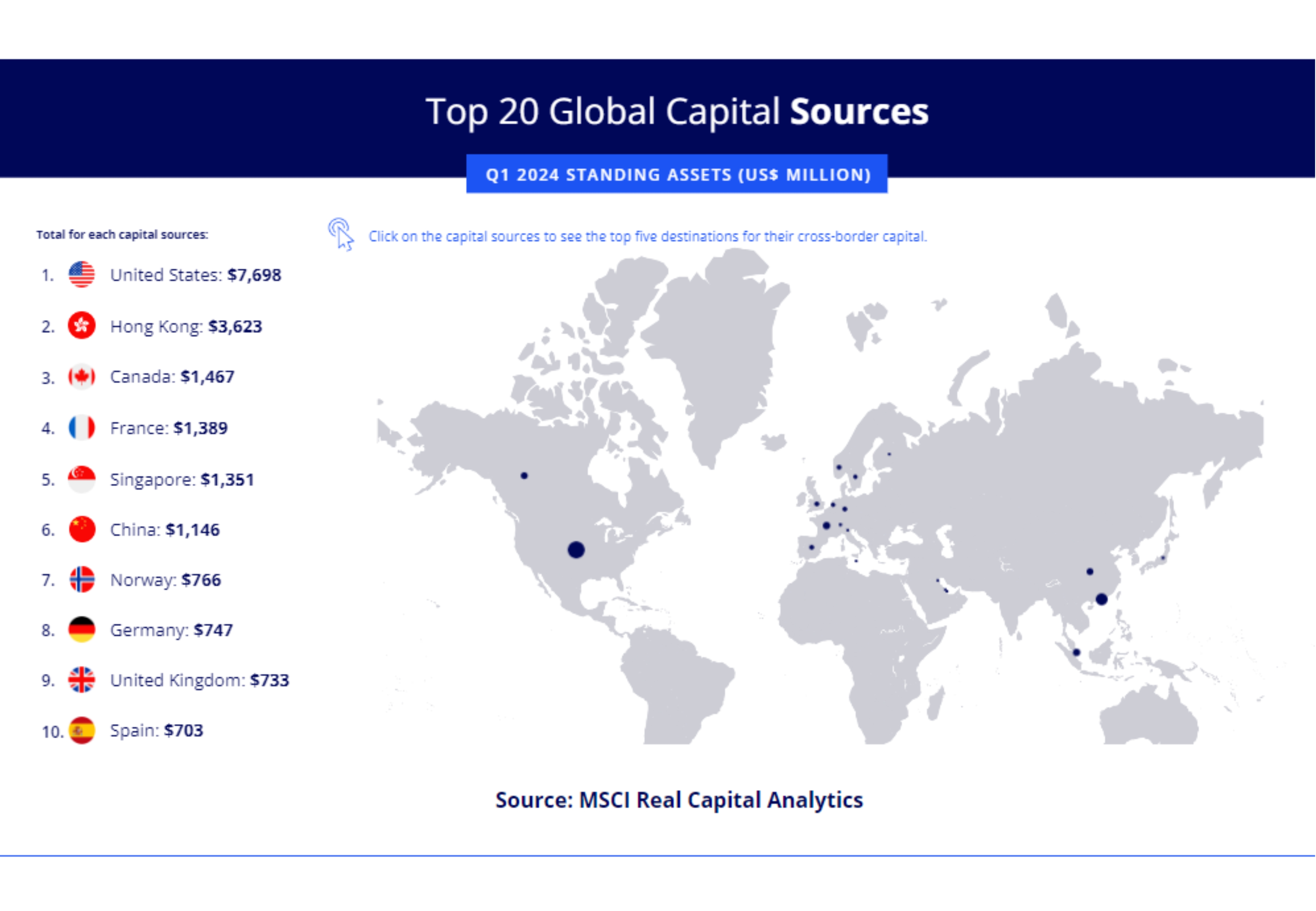

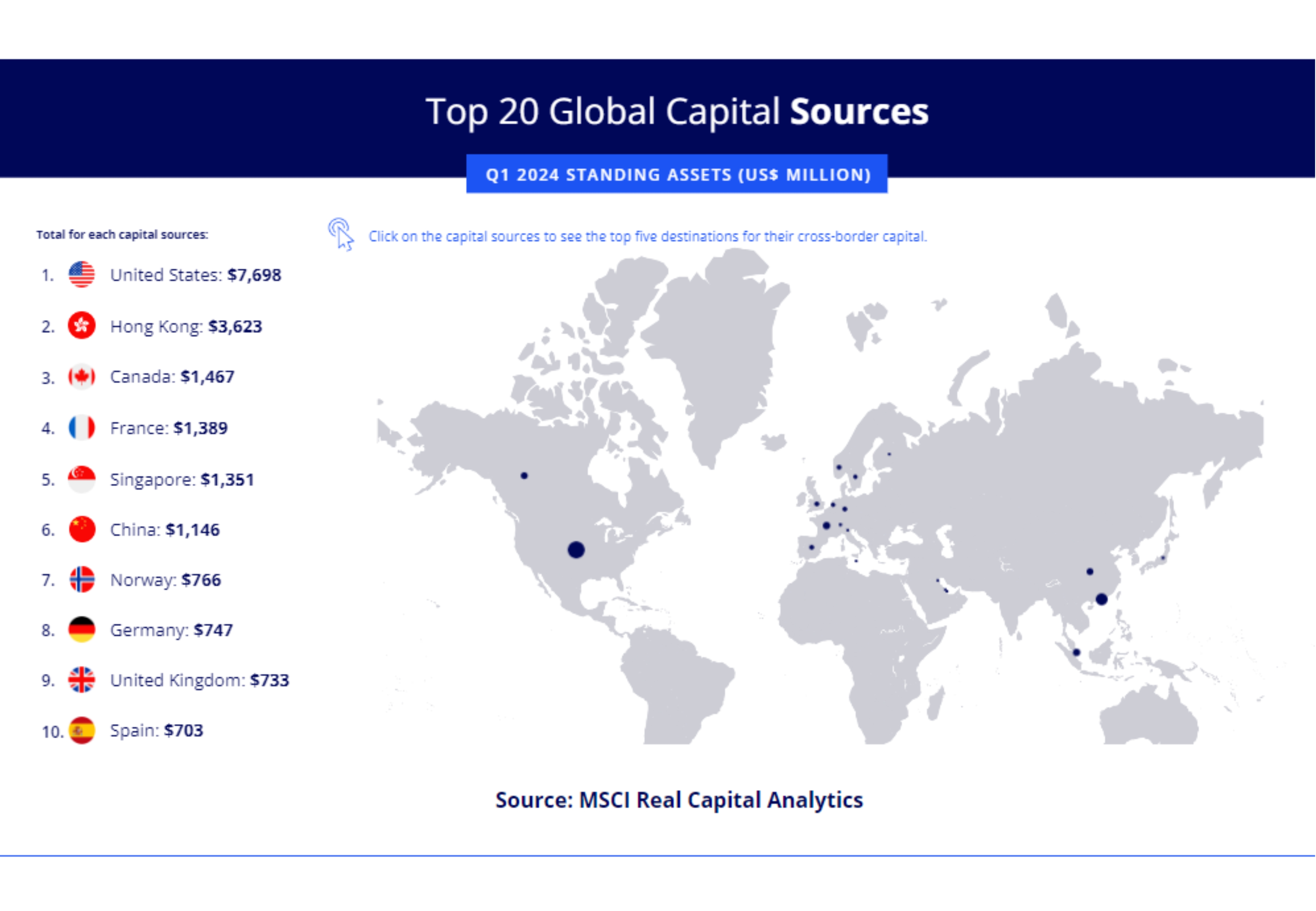

The APAC region also remains a significant source of global cross-border capital. In the first quarter this year, Hong Kong emerged as the second largest source of global capital while Singapore and China ranked fifth and sixth respectively.

Colliers’ research identified five top destinations to watch in terms of global cross border capital in 2024 – the US, Japan, India, Spain and Germany.

“Japan’s real estate investment market offers a stable yield spread in every sector, making this the most significant draw for investors,” Mr Pilgrim said.

“Strong demand fundamentals are also driving significant investor interest in India where office assets remain at the core, while industrial and residential assets are seeing heightened activity.”

For further information, please contact Chris Pilgrim, Colliers’ Managing Director of Global Capital Markets Asia Pacific as the details below.