CBRE’s latest survey reveals that capitalization rates across property sectors in Asia Pacific are expected to continue rising over the next six months due to delayed rate cuts and investors’ limited risk appetite.

These trends have impacted purchasing activity in Q1 2024, resulting in a 14% year-on-year decline in Asia Pacific commercial real estate investment volume to US$24 billion. Japan with its low cost of finance and solid market fundamentals, has replaced mainland China as the most active investment market, accounting for 30% of the total regional volume. Mainland China saw a 23% year-on-year decline in investment volume, with most acquisitions being completed by domestic corporations.

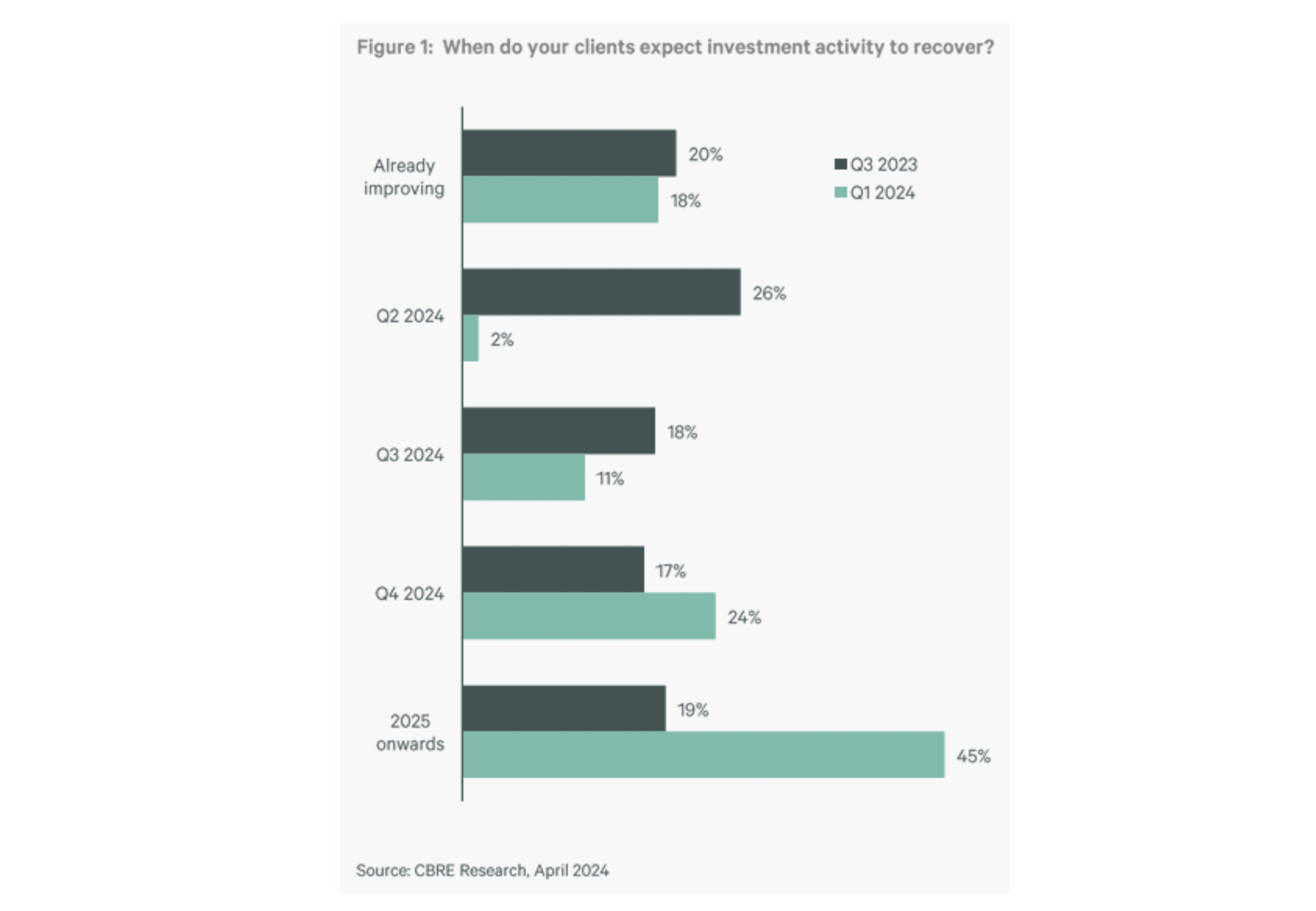

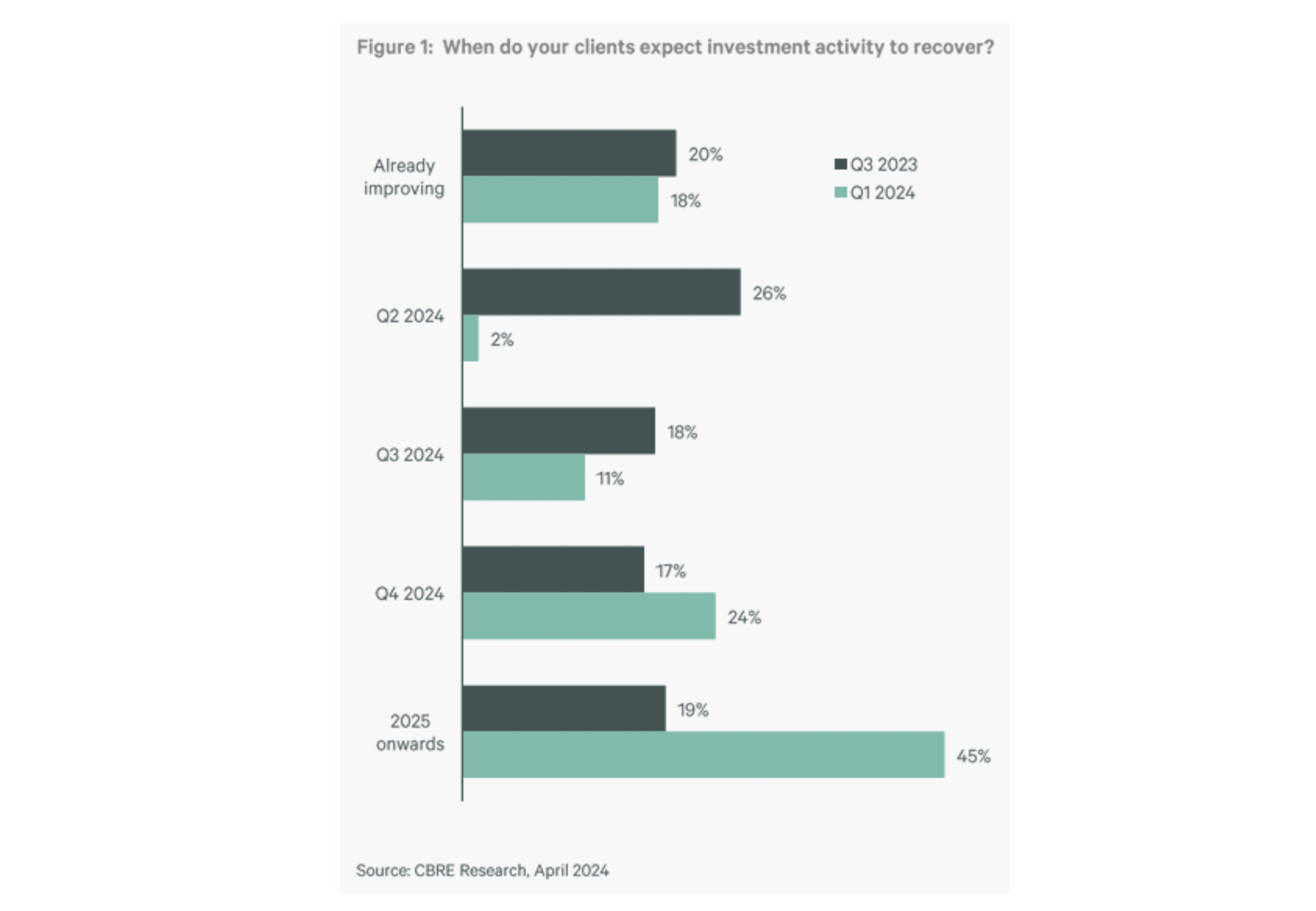

While investment remains robust in Japan, India and Singapore, the recovery in other major regional markets is likely to be delayed to late 2024 or early 2025, as investors remain cautious due to the delayed interest rate cuts. The rebound is expected to commence in Korea and the Pacific, followed by Greater China.

“Interest rates in Asia Pacific have likely peaked, and financial pressure is easing. With investors displaying a stronger focus on underlying asset performance, prime assets in core locations are keenly sought after. Hotel and multifamily assets are also in demand given current cyclical and structural tailwinds. In contrast, debt strategies are falling out of favour due to the limited funding gap in Asia Pacific compared to the U.S.,” said Dr. Henry Chin, Global Head of Investor Thought Leadership & Head of Research, Asia Pacific for CBRE.

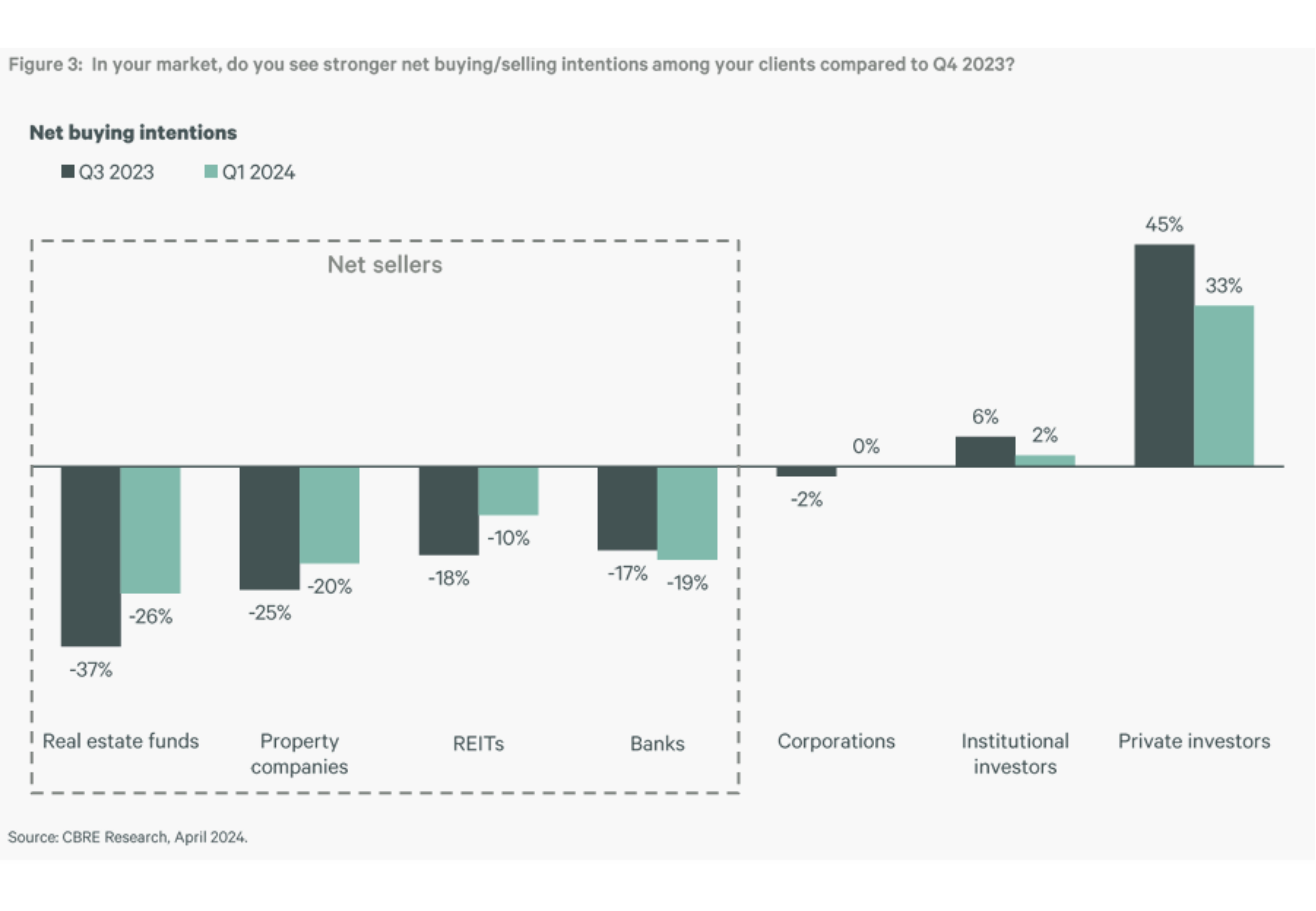

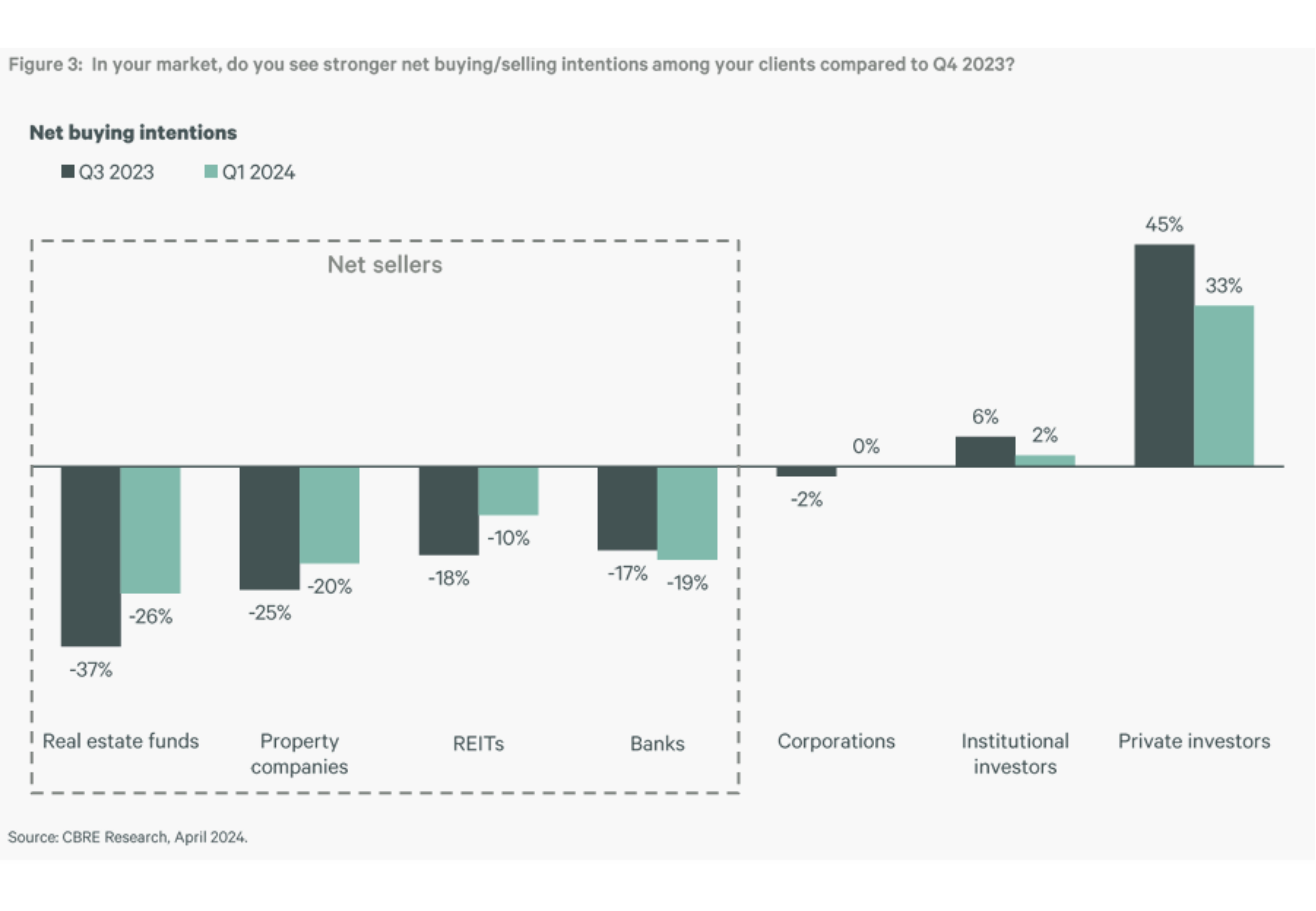

Private investors remain the most active source of capital, while real estate funds and Real Estate Investment Trusts (REITs) reposition their portfolios by selling secondary assets in preparation for future buying opportunities when cap rates have stabilised.

“Investors should target buying opportunities in the second half of 2024 and focus on prime assets. Motivated sellers will adopt a more flexible stance towards asking prices, helping narrow the gap with buyers. This will support deal closure as purchasers aim to take advantage of pricing discounts before rate cuts arrive,” said Greg Hyland, Head of Capital Markets, Asia Pacific for CBRE.

While cap rate expansion is expected across most asset classes, the magnitude will be more prominent for decentralised and secondary assets. The only asset class forecasted to see cap rate compression is Japan data centres.

CBRE’s survey examined investment sentiment towards market conditions and capitalization rates for stabilised properties. Capitalization rates—usually called cap rates—measure a property’s value by dividing its annual income by its sale price. A lower cap rate generally indicates a higher value.

To read the full report, click here.

For further information, please contact Greg Hyland, Head of Capital Markets, CBRE Asia Pacific as the details below.