Thailand's logistics property market slows slowdown

Contact

Thailand's logistics property market slows slowdown

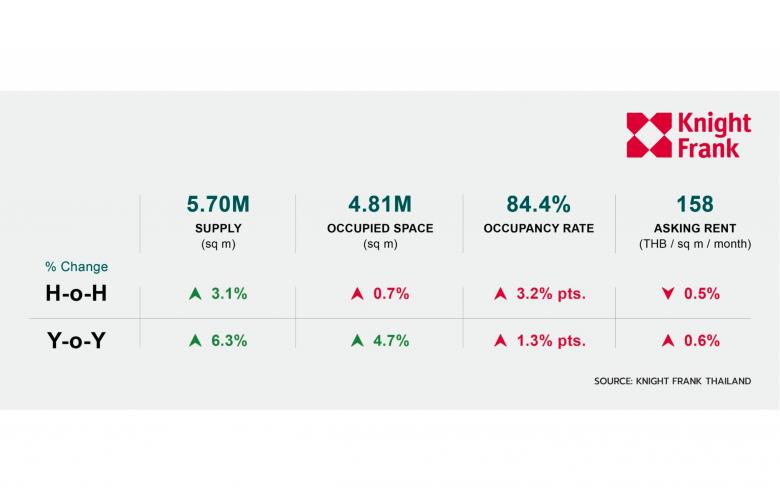

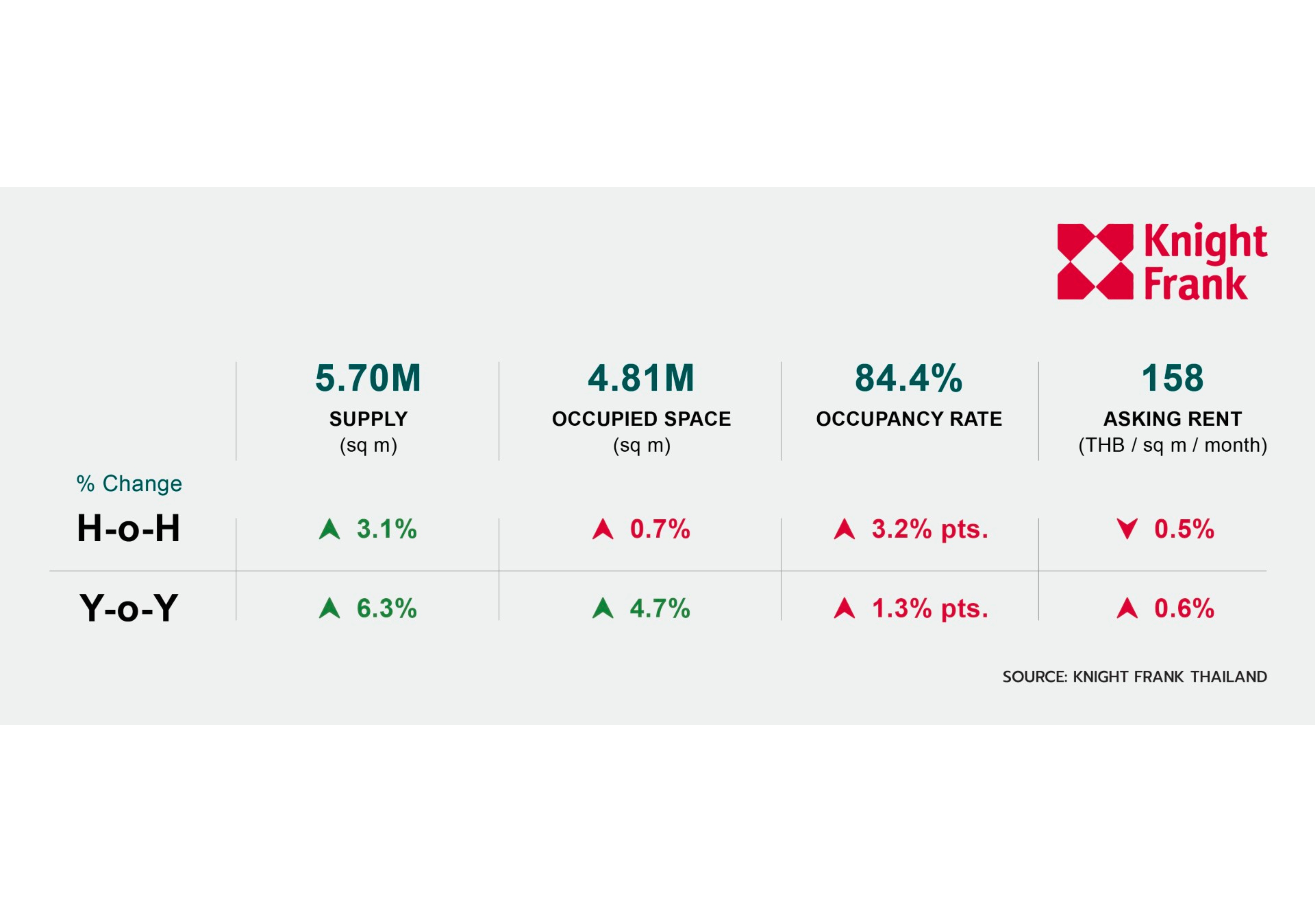

According to Knight Frank Thailand, occupied space decreased by 0.7%, leading to a 3.2 percentage point drop in the overall occupancy rate to 84.4% due to geopolitical tensions and rising freight rates.

Thailand's logistics property market showed signs of a slowdown in its growth trajectory during the second half of 2023, with 3PL and e-commerce sectors scaling back to align their operations with demand outlooks. External factors such as the Red Sea conflict and other geopolitical tensions raise concerns for the global supply chain, and the magnitude of their impact on Thailand's logistics activities will likely be observed in 2024.

Economic Overview

The Office of the National Economic and Social Development Council (NESDC) announced the 2023 GDP growth of 1.9%, citing weakened public investment and spending in the latter half of the year.

Private consumption remains a significant driver of the Thai economy, with the service sector experiencing notable expansion, evidenced by growth exceeding 15% YoY. In contrast, investment has decelerated, with an increase of 1.3% YoY, attributed largely to a decrease in public investment. In addition, public spending has also seen a downturn, declining by 3.1% YoY, primarily due to delays in disbursing the 2024 fiscal budget. In terms of international trade, Thailand has managed to maintain a positive trade balance. This is shown in a 1.7% decrease YoY in exports of goods and services, which offset a greater decline of 3.1% YoY in imports.

Looking at the indicators related to logistics, statistics from the Office of Industrial Economics (OIE) indicate that the production index experienced a decline from 94 in June 2023 to 88 in December 2023. In the meantime, the finished goods inventory index also reduced from 139 to 127. This combination of reduced production and inventory levels indicated that while consumption has recently been strong, future projections appear less optimistic.

Supply

Current Supply

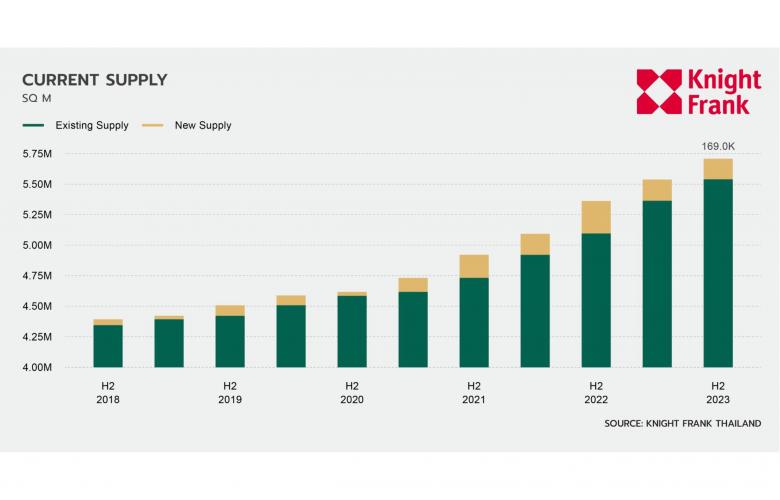

The total supply of ready-built warehouses reached 5.70 million sq m, an increase of 169,000 sq m in warehouse space from the previous half-year. This addition represented growth of 3.1% HoH and 6.3% YoY. The new supply included KR Warehouse - Beung sub-district and Alpha Laemchabang in Chonburi, Fraser Bangna 2 in Chachoengsao, ESR Asia Suvarnabhumi in Samut Prakan, and Alpha Rangsit – Phaholyothin KM. 33 in Pathum Thani. The addition of supply also came from the expansion of existing projects like KR Warehouse – Bowin in Chonburi and RBF’s Buildwell in Pathum Thani.

Supply Distribution

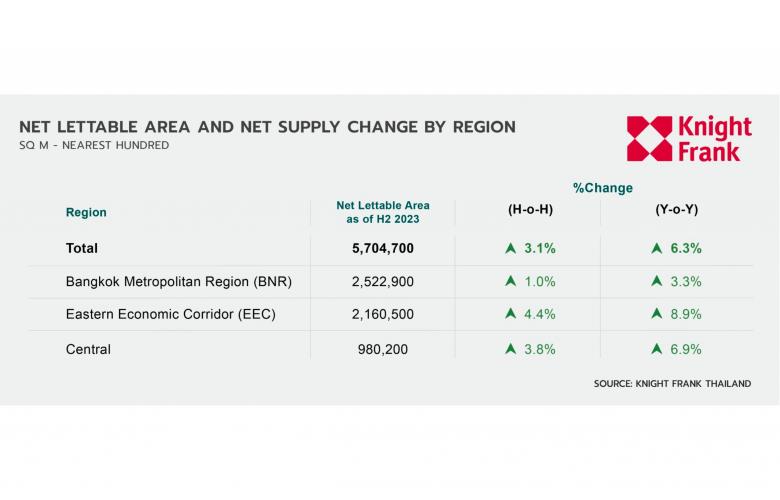

The distribution of ready-built warehouses in Thailand is primarily concentrated in three key regions. The Bangkok Metropolitan Region (BMR) represents the largest sub-market, commanding a 45% share of the total market, with Samut Prakan holding the majority share within the BMR at 41%. The Eastern Economic Corridor (EEC) stands as the second-largest sub-market, accounting for 38% of the overall warehouse supply.

In the second half of 2023, there was a consistent rise in supply across the major sub-markets. The net leasable area in the BMR experienced a 1.0% HoH increase, reaching 2.52 million sq m. The EEC saw the most rapid expansion this half-year at 4.4%, reaching almost 2.16 million sq m. Finally, the Central region and others experienced robust supply growth of 3.8% HoH, totaling 944,700 sq m.

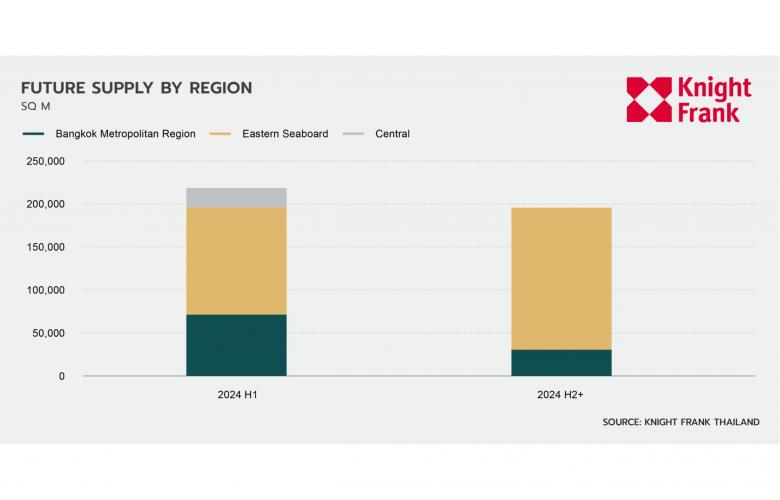

Future Supply

The total size of the lettable area expected to be completed in 2024 is 413,900 sq m, with 218,100 sq m in H1 and 195,800 sq m in H2. This new space is set to constitute 7% of the current supply. The EEC is poised to host around 70% of the upcoming supply, followed by the BMR, with a share of 25%. This trend underscores a shift towards the EEC, which could potentially impact the region's occupancy performance.

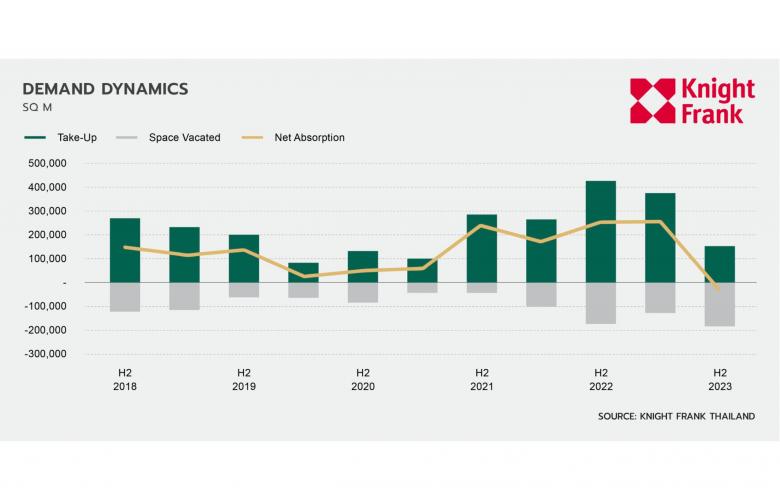

Demand

In the second half of 2023, the logistics property sector experienced a slowdown, evidenced by lower take-up rates and increased space vacated. Net absorption, which is the net change in the market-wide occupied space, in H2 recorded a negative figure of 31,800 sq m, marking the first occurrence in the last five years. Consequently, the total occupied space decreased by 0.7% HoH to 4.81 million sq m.

Rental Rates

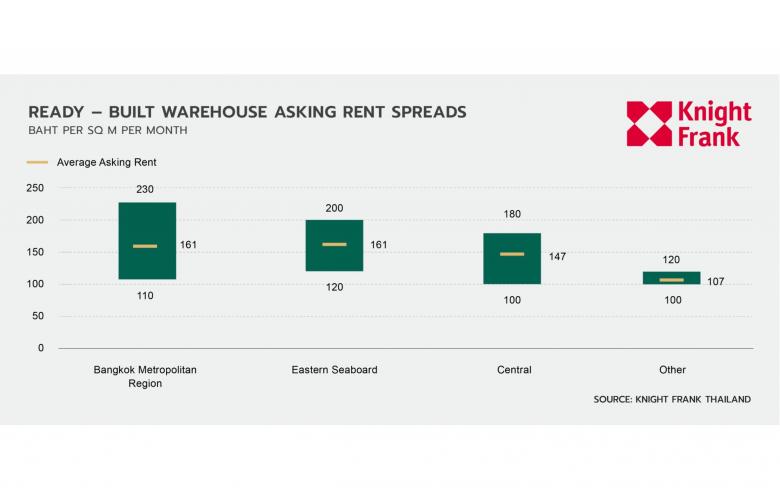

In the second half of 2023, the average asking rent for ready-built warehouses in Thailand experienced a marginal decrease, settling at 158 THB per square metre per month. This slight adjustment was primarily due to a small number of existing properties reducing rents by 5-10 THB, alongside new properties entering the market at lower rental rates. Despite these changes, average rental rates across different regions remained stable. The BMR and the EEC both maintained an average rent of 161 THB, while the Central region saw a slightly lower rate at 147 THB, and other areas of Thailand were even more affordable at 107 THB. Notably, there was no change in the maximum and minimum rents across all regions, indicating a stable rental market.

Review & Outlook

Toward the close of 2023, a rise in geopolitical tensions was observed across different parts of the world. The Drewry World Container Index (WCI) has captured a recent sharp rise in freight rates, with the price for a 40 ft container soaring from $1,661 at the end of 2023 to $3,964 by the end of January 2024, marking a more than twofold increase within a month. The most impacted shipping route is estimated to be between Asia and Europe, with significant effects felt in sectors such as agriculture (perishable goods), automotive (with major exporters in Europe and Asia), electronics (due to their time-sensitive nature), and textiles and apparel (which operate on lower profit margins).

Amidst subdued global consumption and widespread uncertainty, Thailand's logistics property market, closely linked to import and export conditions, experienced a plateau in its growth trajectory during the second half of 2023. Net absorption figures fell to a negative 31,800 square metres after an extended period of growth. This has led to a decline in market occupancies to 84%, approximately 3% lower than in the first half of 2023. A significant factor in this reduced demand was the 3PL and e-commerce sectors scaling back to align their operations with demand outlooks after extensive expansion in earlier periods.

For further information, please contact Marcus Burtenshaw, Executive Director Head of Occupier Services & Commercial Agency, Knight Frank Thailand, as the details below.