The Summary Highlight of 1H 2023

- Only 1 new super prime condominium project opened by the mid-2023 with only 180 new units while there was no new supply of prime condominiums segment.

- Average selling rate of both super prime and prime condominiums was 80%

- The return of the Chinese causes the market to come back to life and an additional factor used in selecting the project is the proximity location to international schools.

Market Overview

The super prime and prime condominium market continues to grow steadily. Although the land for development is scared, demand is still high among Thai and foreign buyers where location is the key buying factor. Condominiums in this segment are continually increasing in value. As such, buyers still prefer to buy these condominiums for resale in the future because they believe that their value will keep increasing. Even though it is a second-hand condominium, the potential of land in prime areas causes constant high demand. Meanwhile, condominiums near international schools in the CBD area are playing a crucial part and becoming more popular among foreigners (especially the Chinese) as they are keeping an eye on this area.

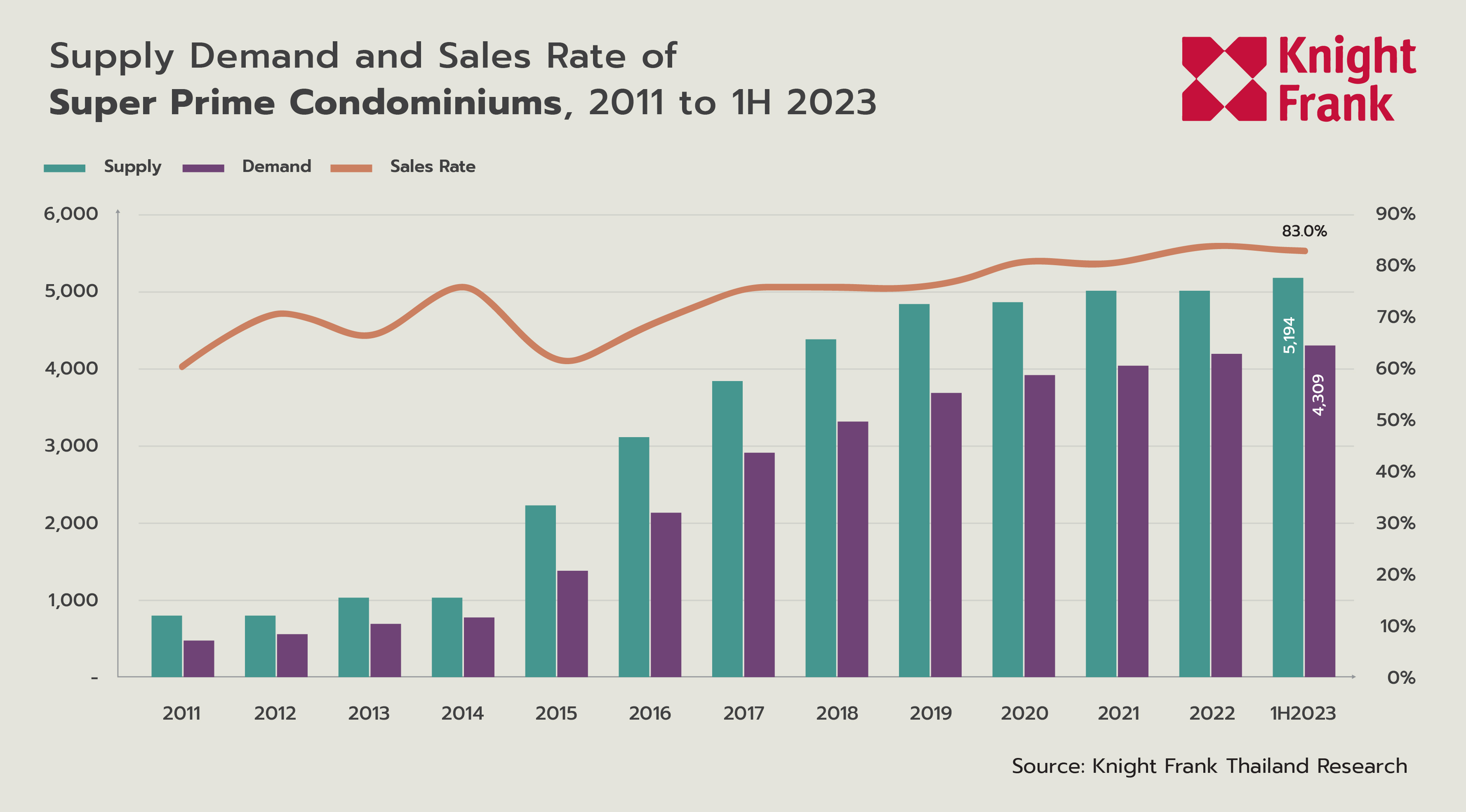

Supply

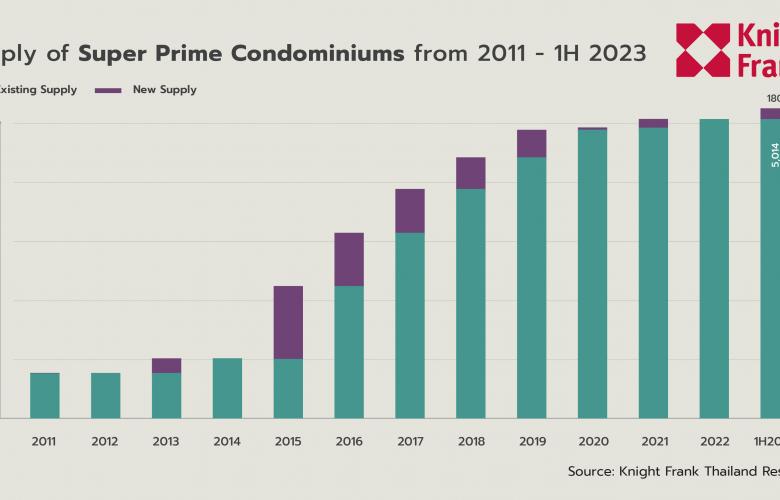

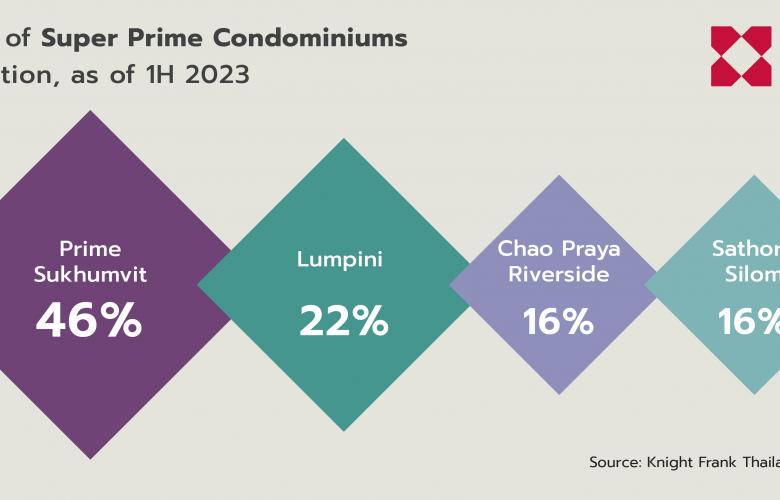

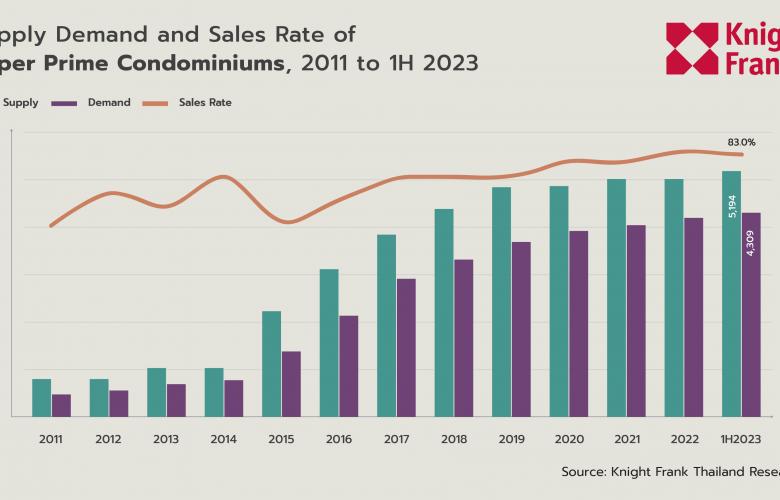

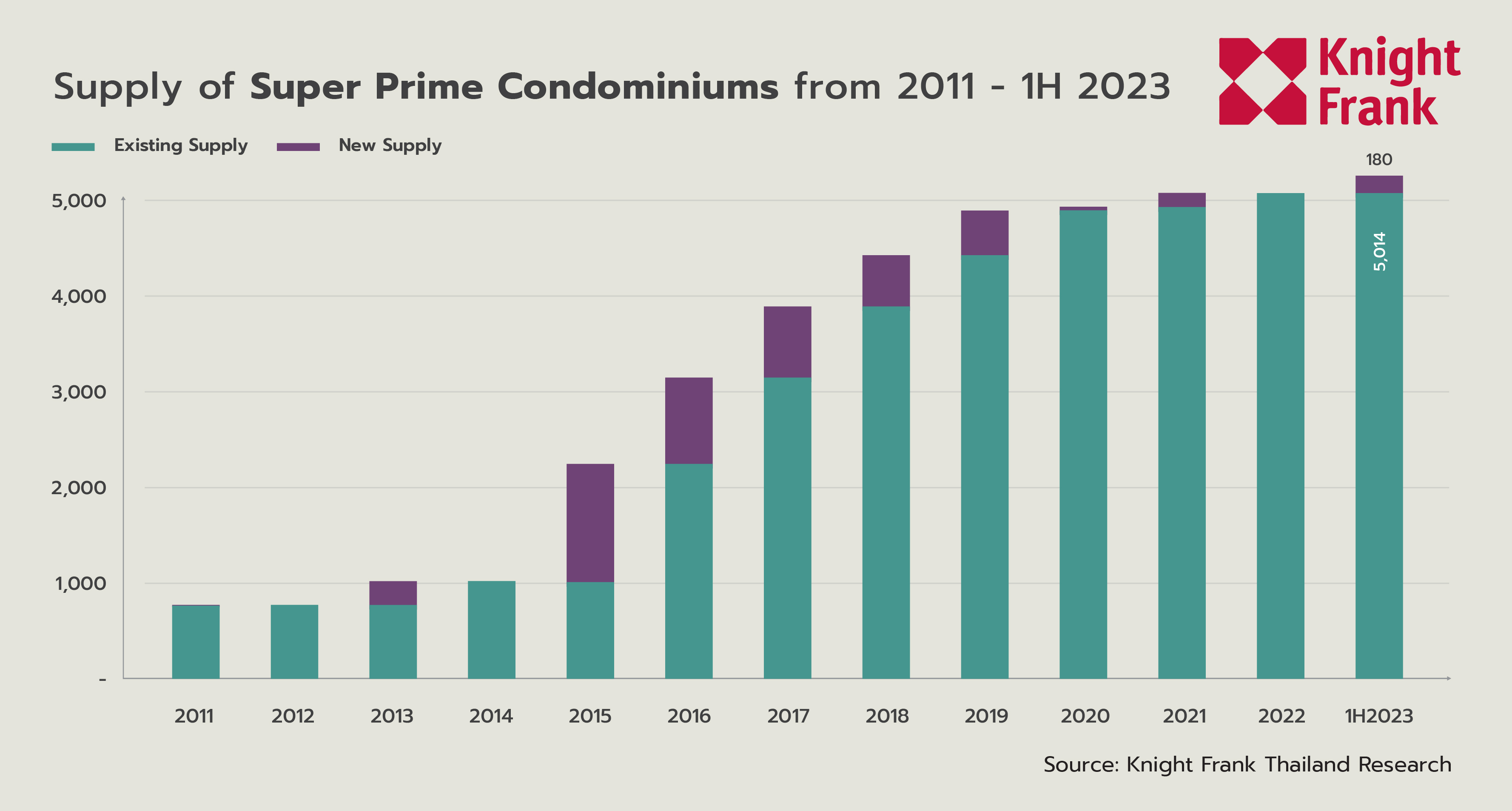

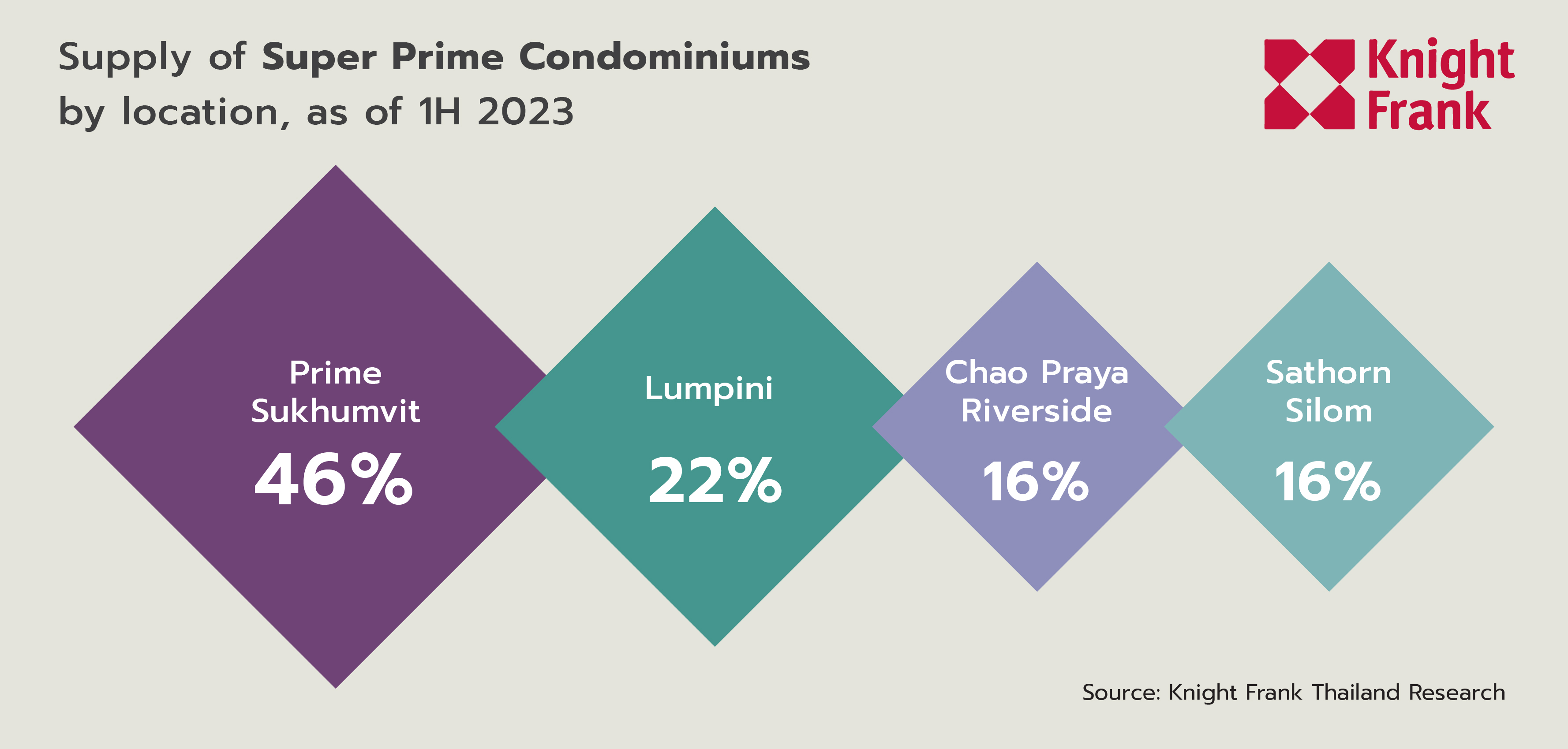

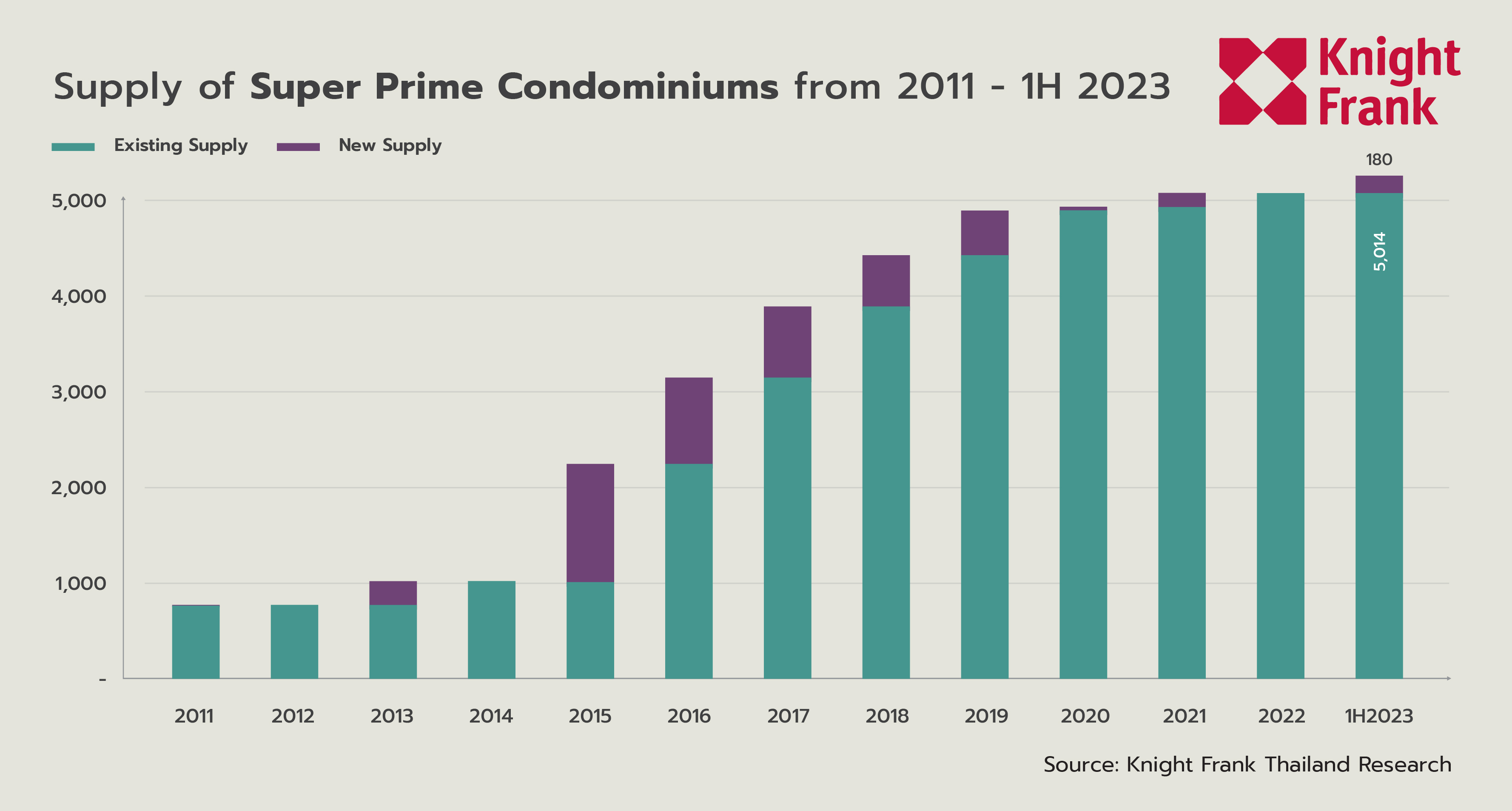

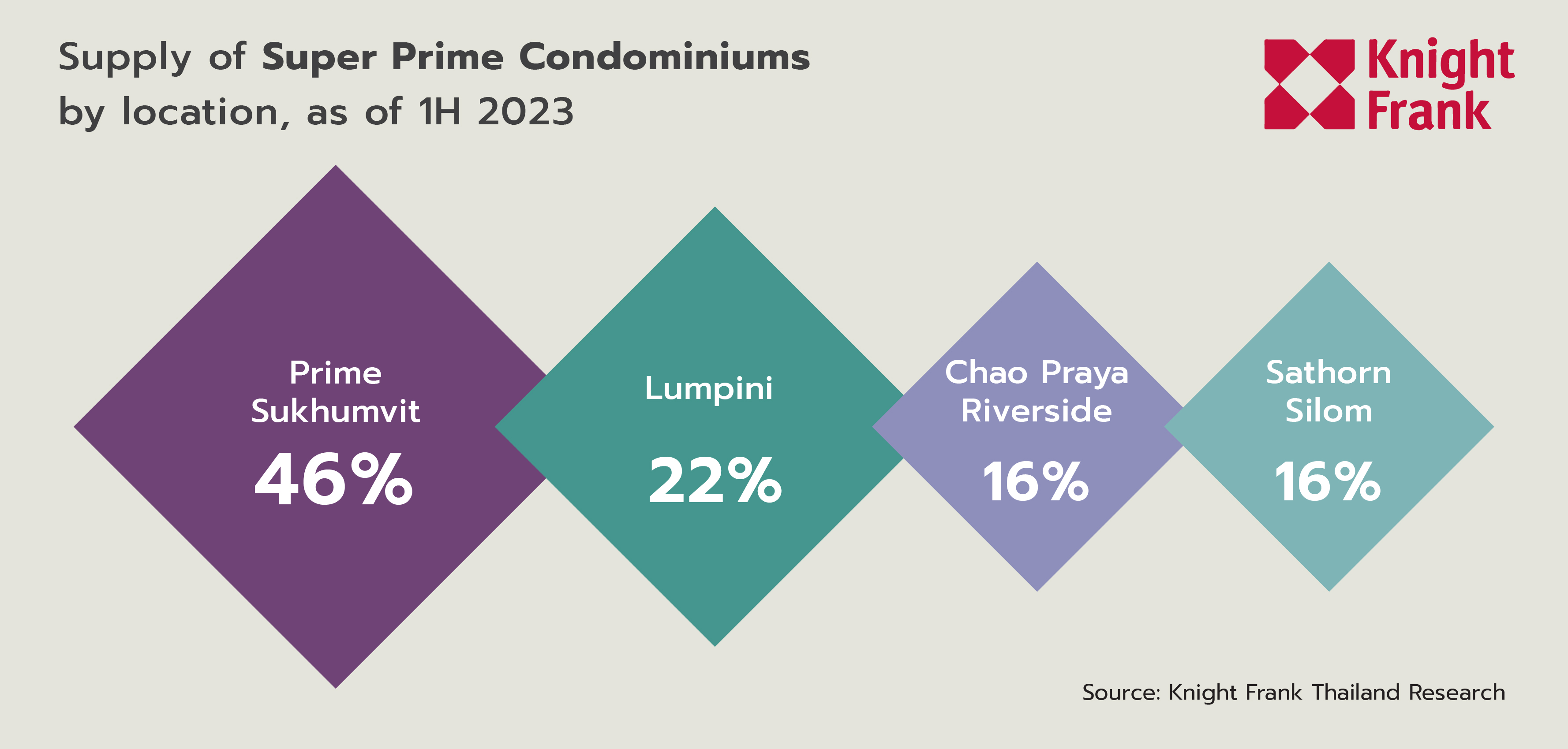

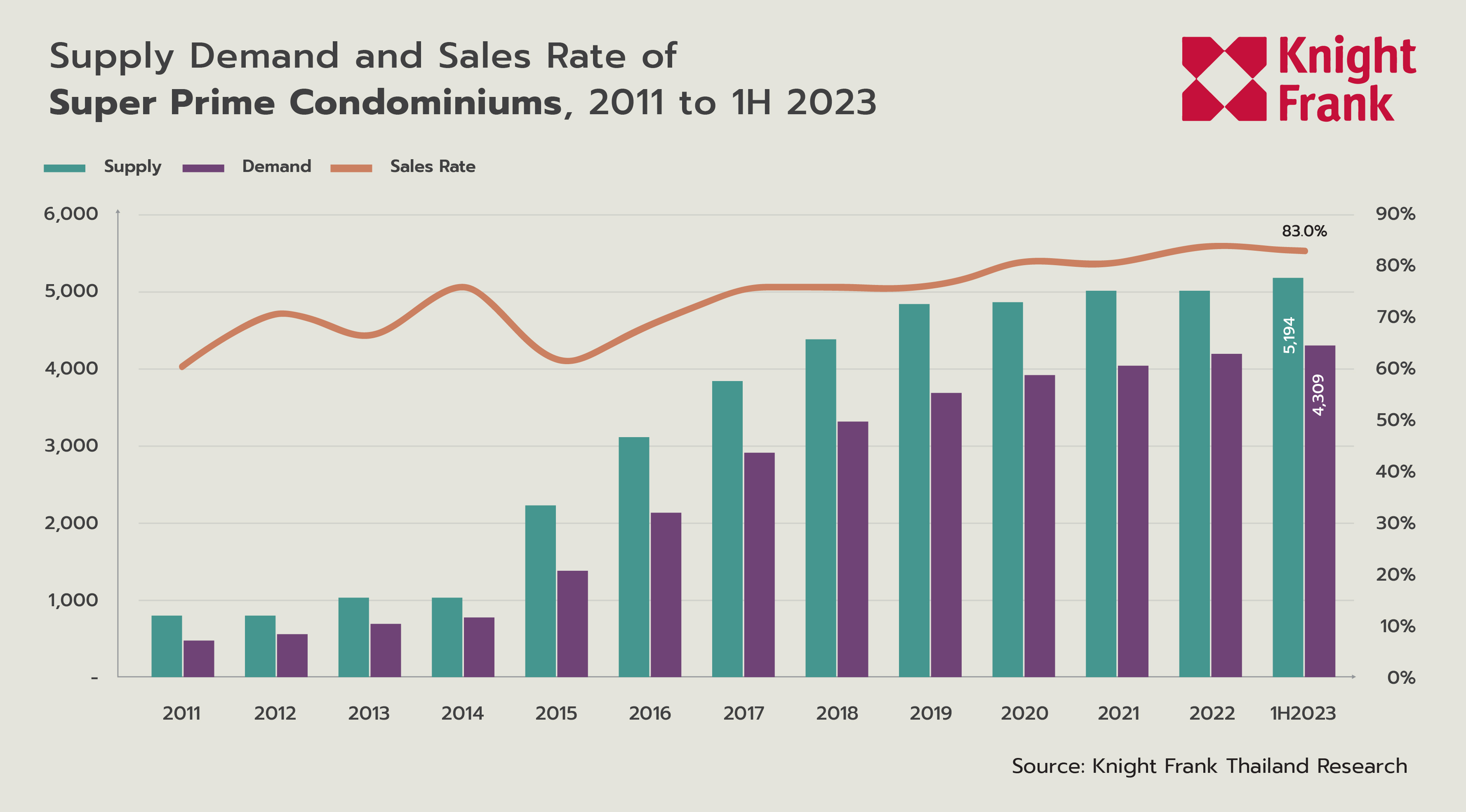

The total supply of super prime condominiums in mid-2023 was 5,194 units and only 180 new units (1 project) were added to the market. Most super prime condominiums are still located in the Sukhumvit area accounting for 46%, followed by the Lumpini area at 22%, while along the Chao Phraya River and Sathorn/Silom area accounted for 16% each.

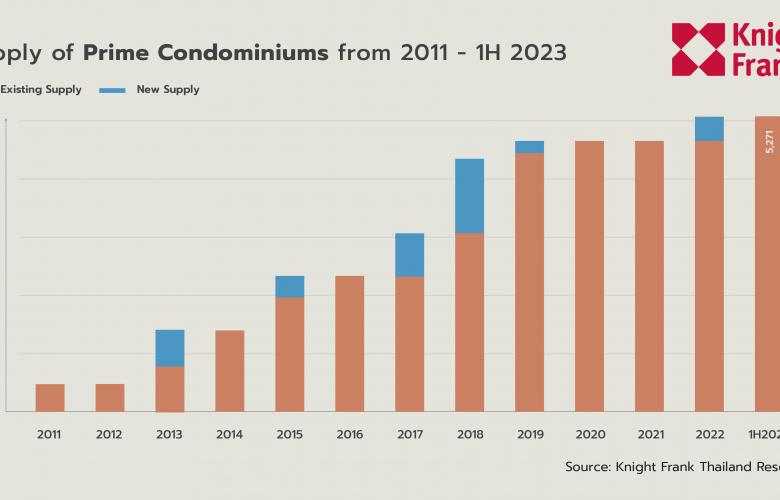

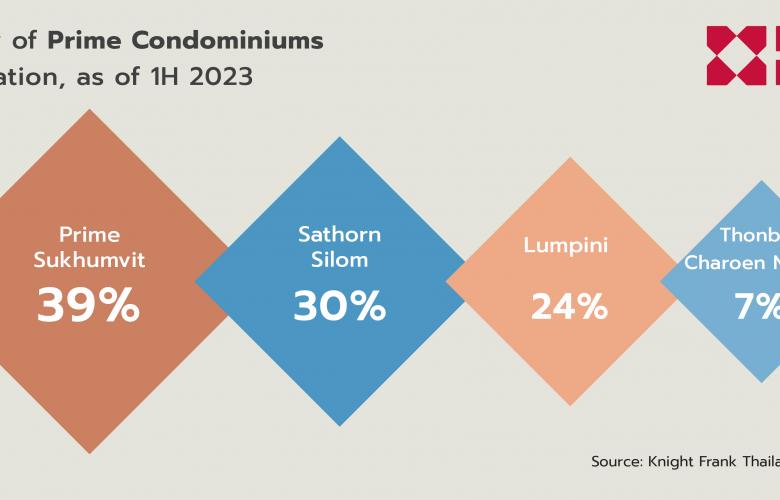

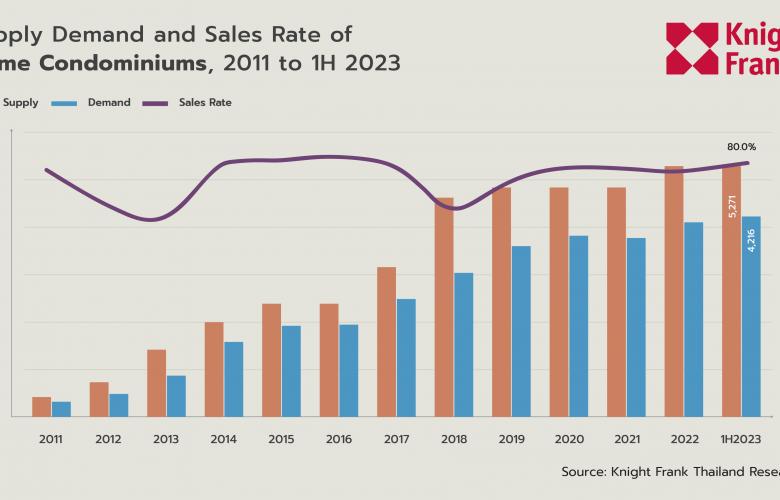

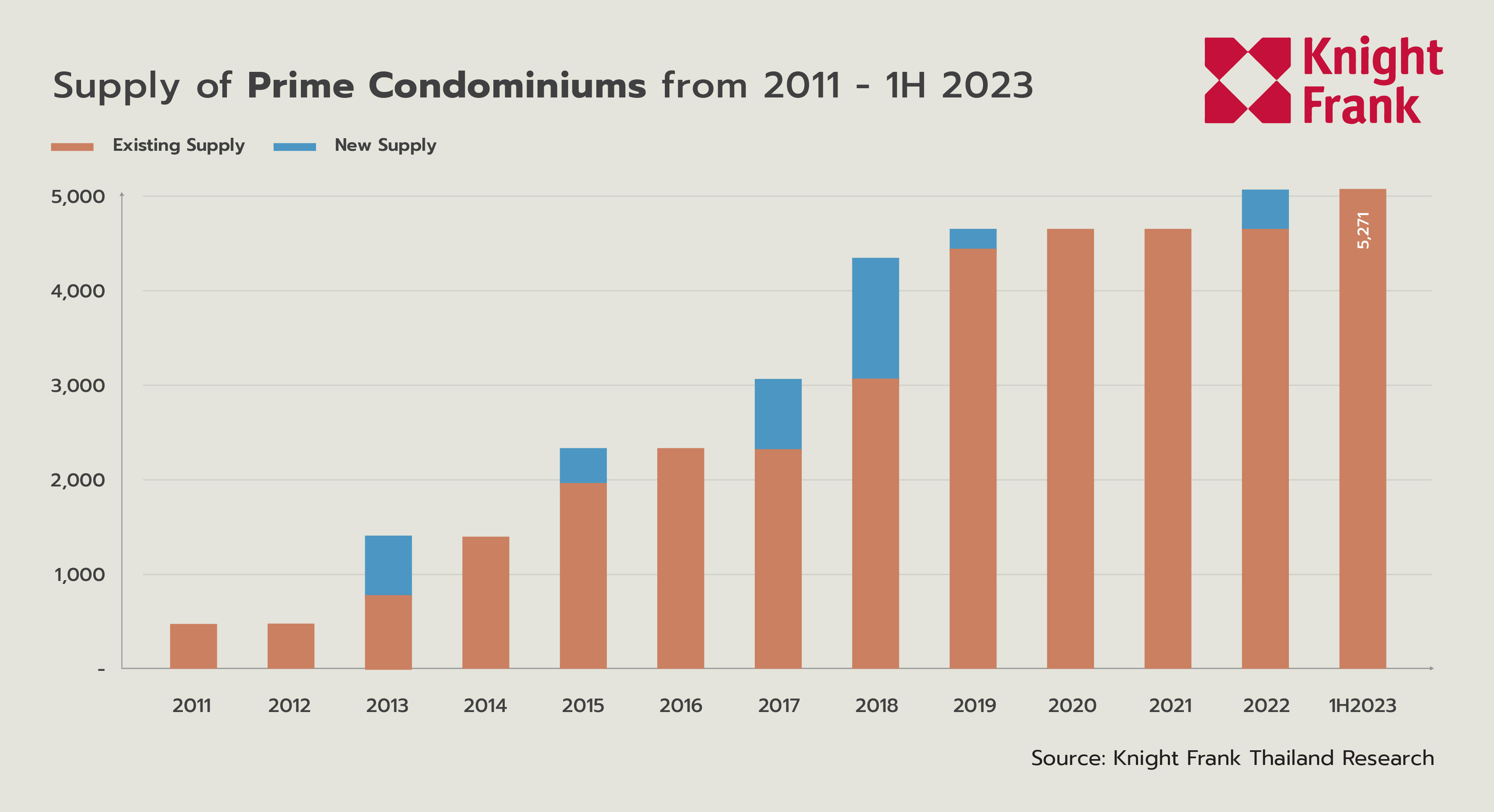

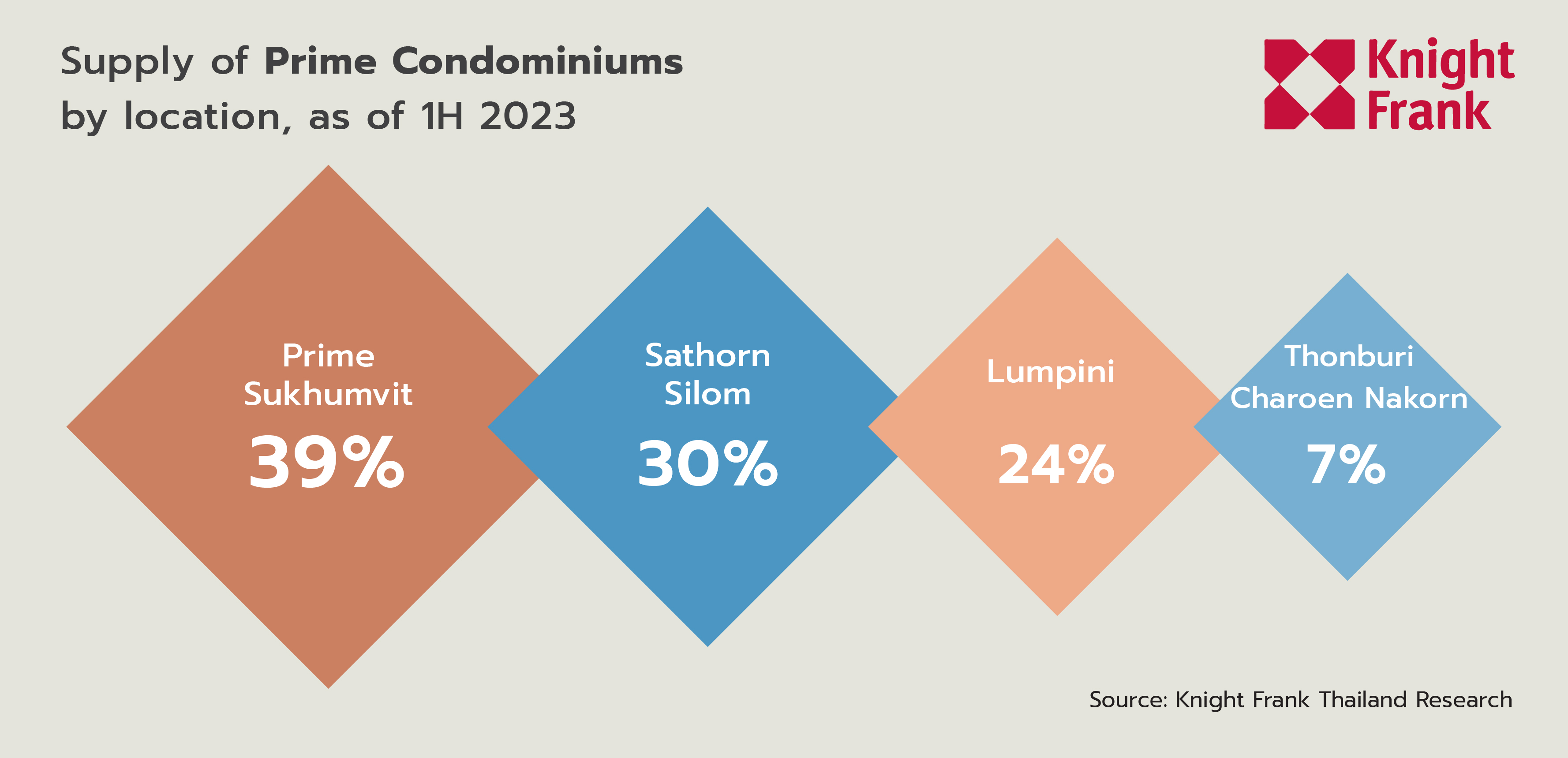

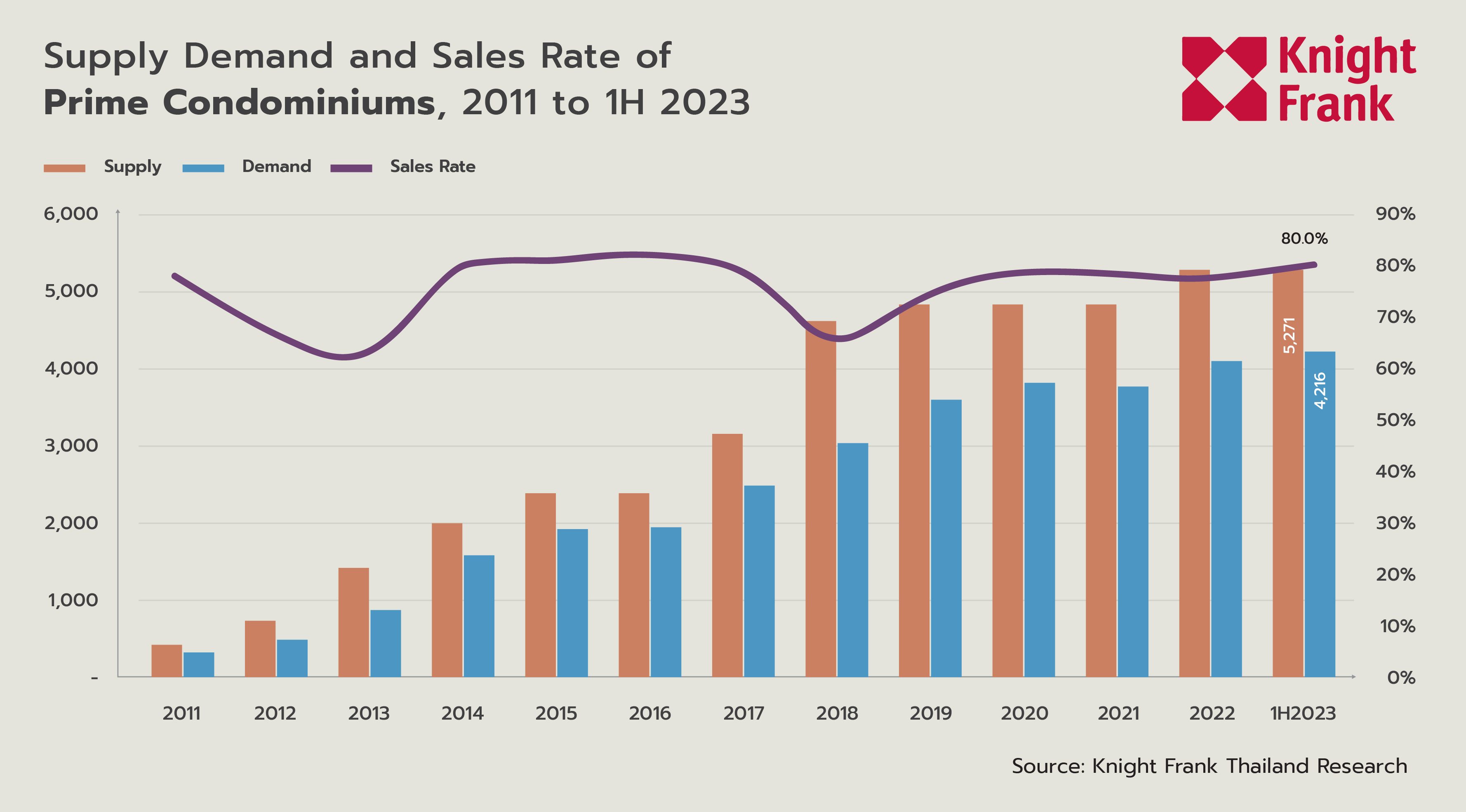

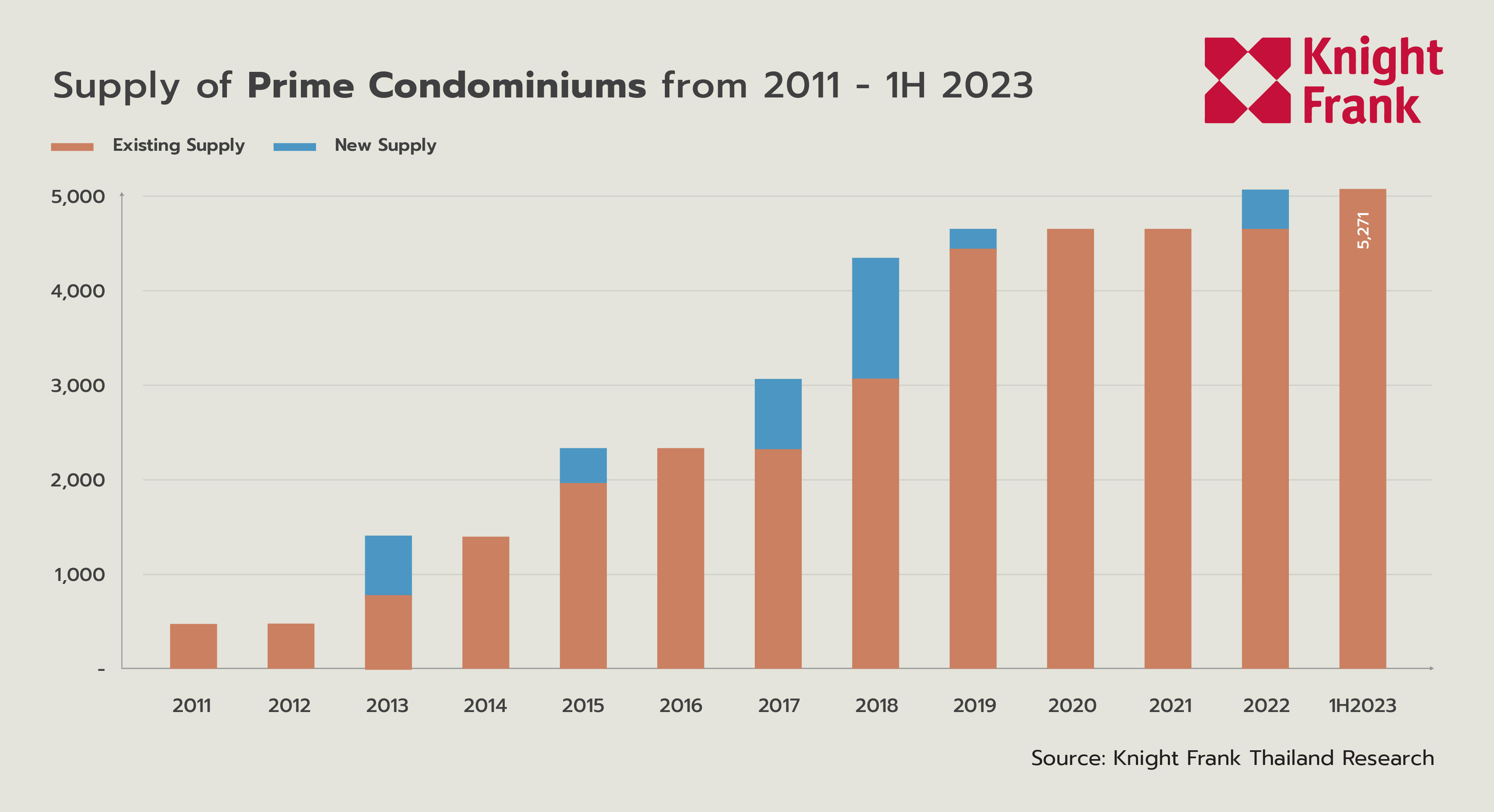

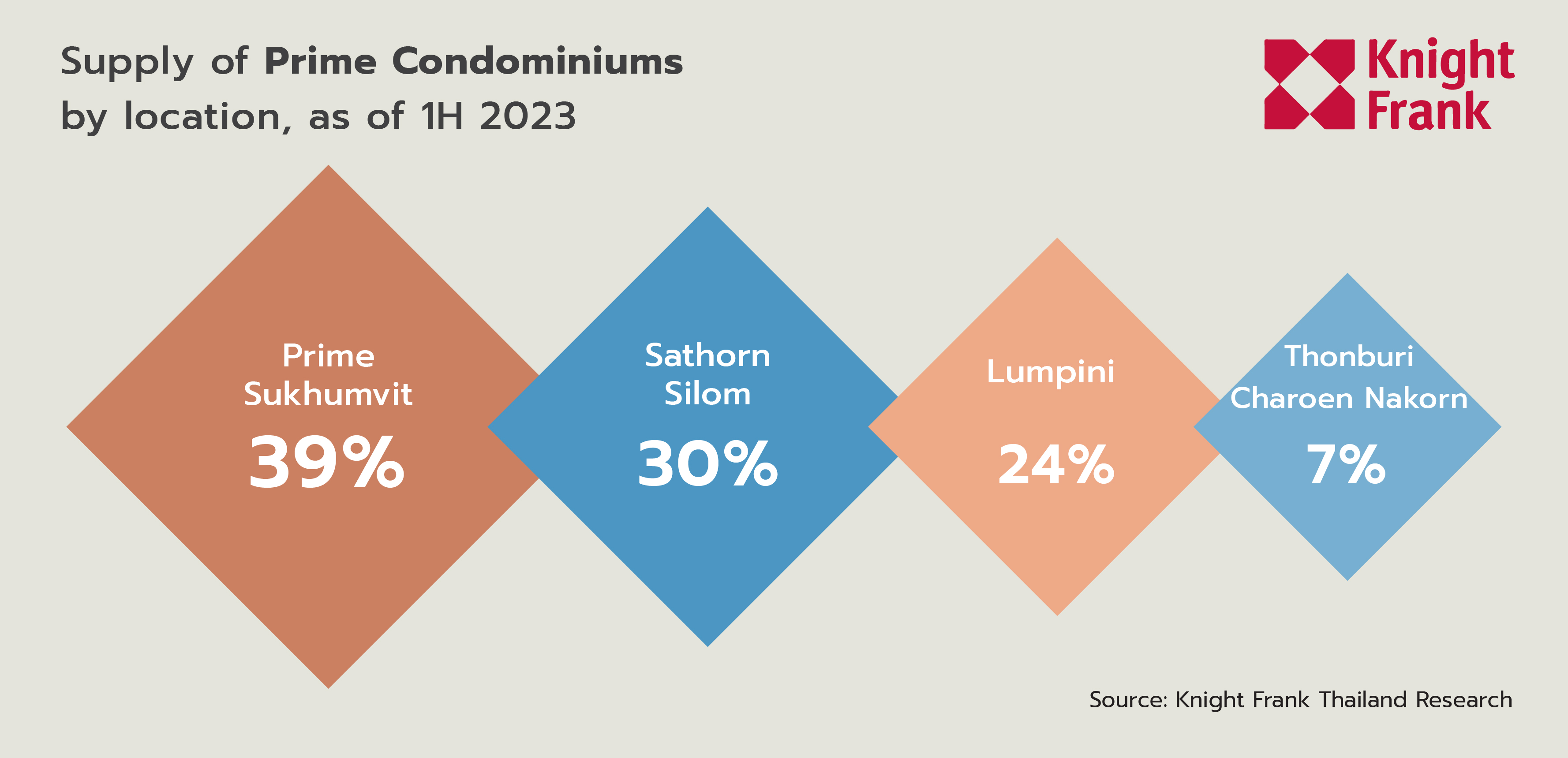

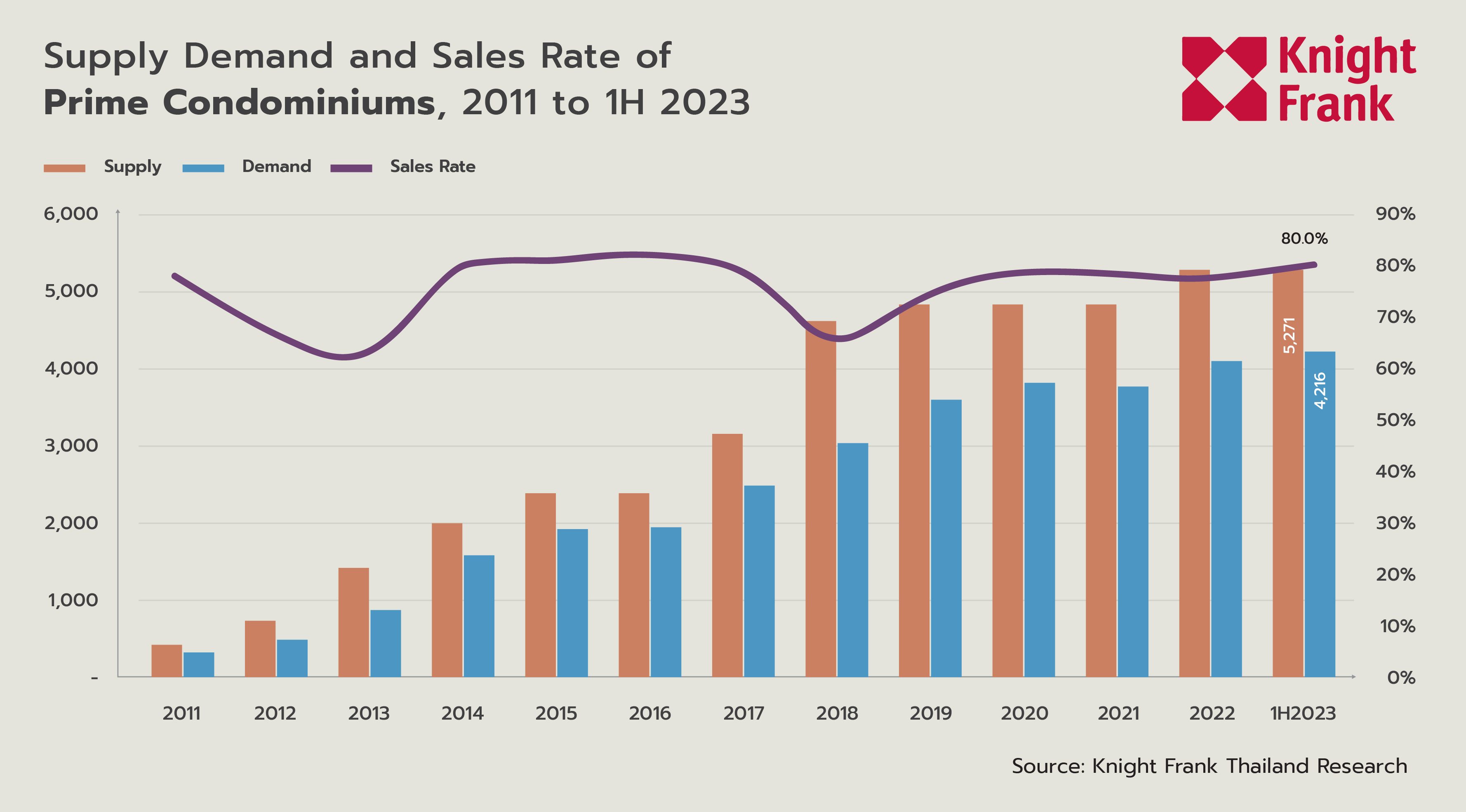

As of mid-2023, the total supply of prime condominium units stood at 5,271, with no new units added to the market. The majority of these prime condominiums are located in the Sukhumvit area, accounting for 39% of the total, followed by the Sathorn/Silom area at 30%, the Lumpini area at 24%, and the Chao Phraya River area, which accounted for only 7%

Demand

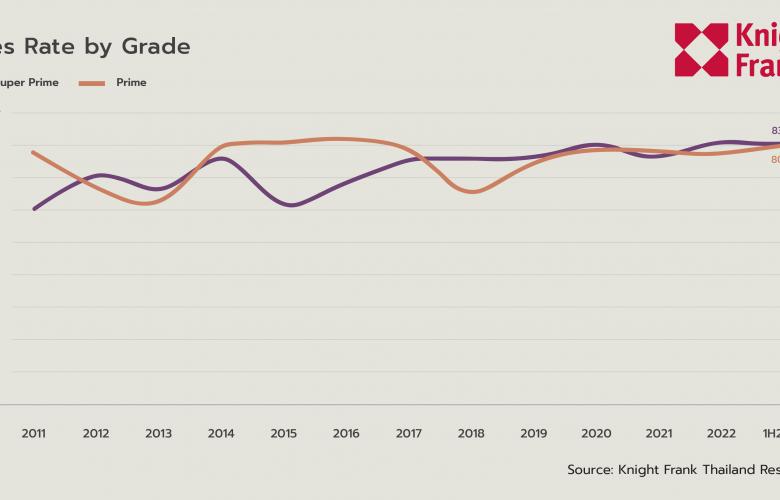

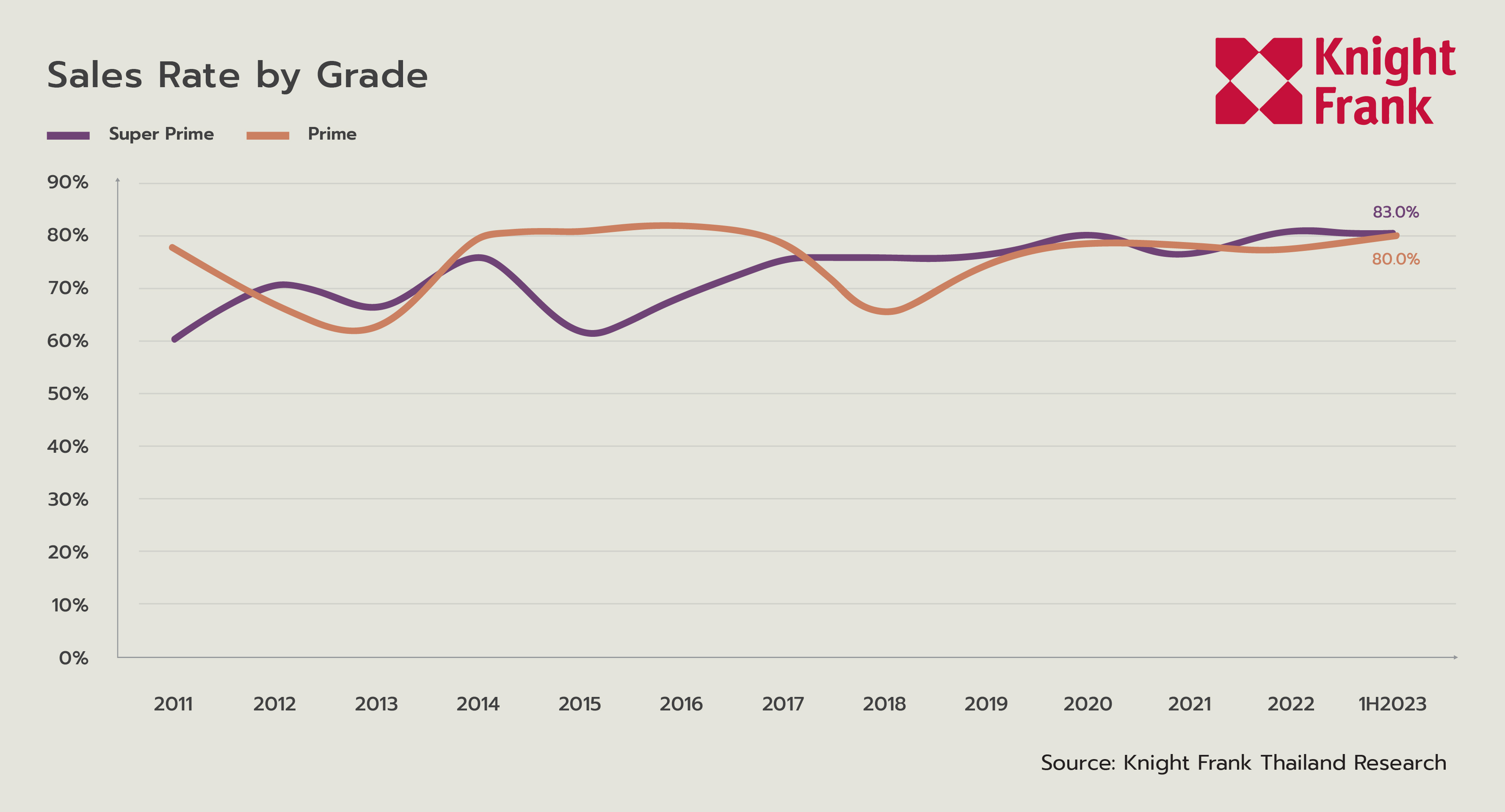

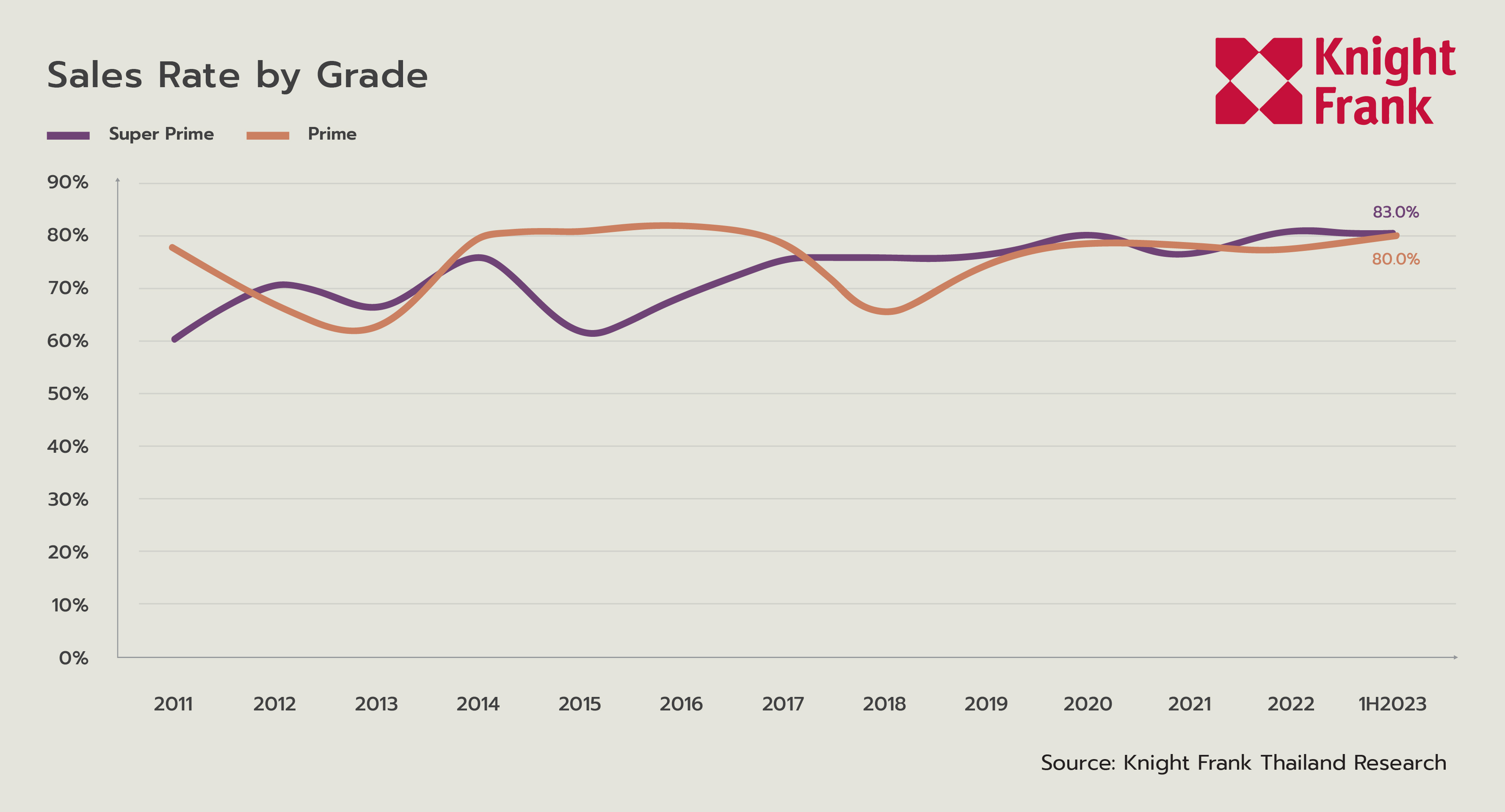

Demand for super prime and prime condominiums during the first half of the year continued to be strong mainly due to the addition of new supply, thus the sales rate slightly decreased. The total number of super prime condominiums sold amounted to 4,309 units out of a total supply of 5,194 units. The sales rate was at 83.0%, decreased by 0.3% from the previous year. The total number of prime condominiums sold amounted to 4,216 units out of a total supply of 5,271 units. The sales rate was at 80.0%, increased by 2.3% from the previous year. The main buyers were still Thai buyers who are wealthy as a group of real demand. In addition, we began to see Chinese groups returning to buy partially, reflected by the number of ownership transfers since the beginning of the year. And additional key buying decision factor is proximity location to international schools.

Asking Price

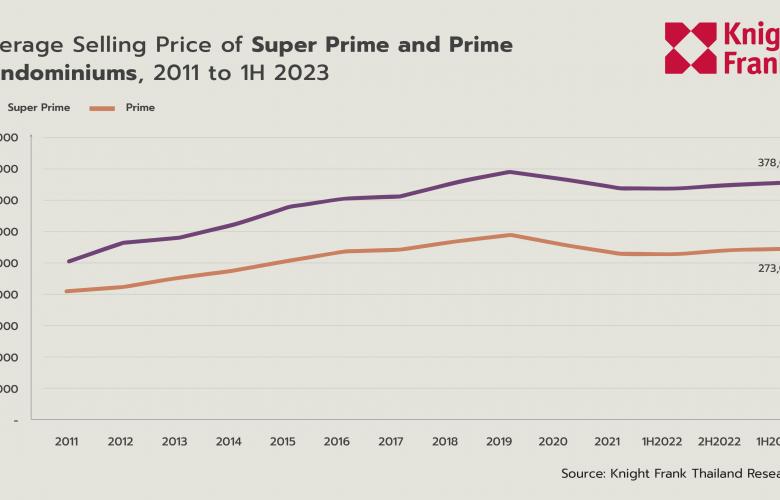

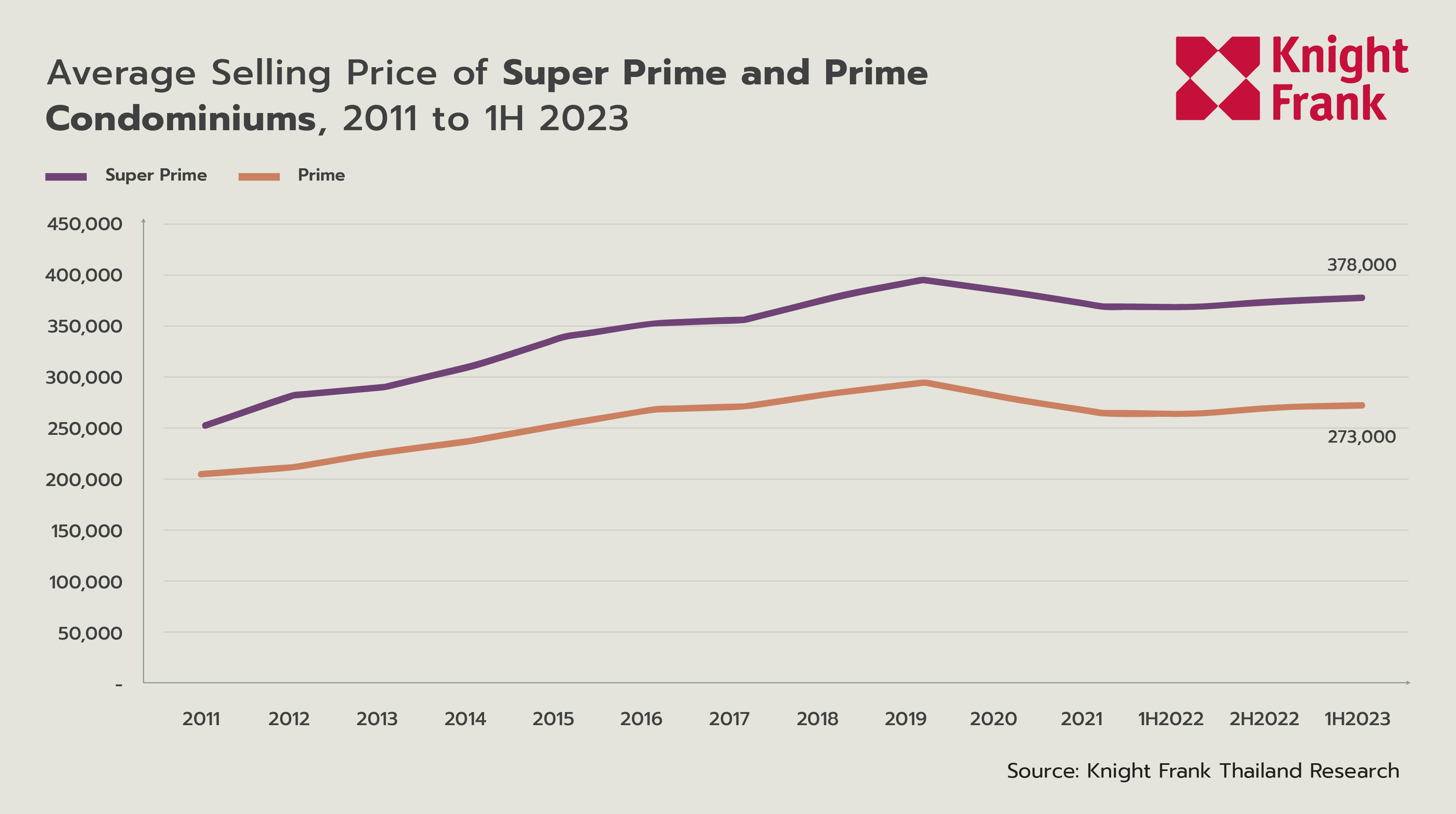

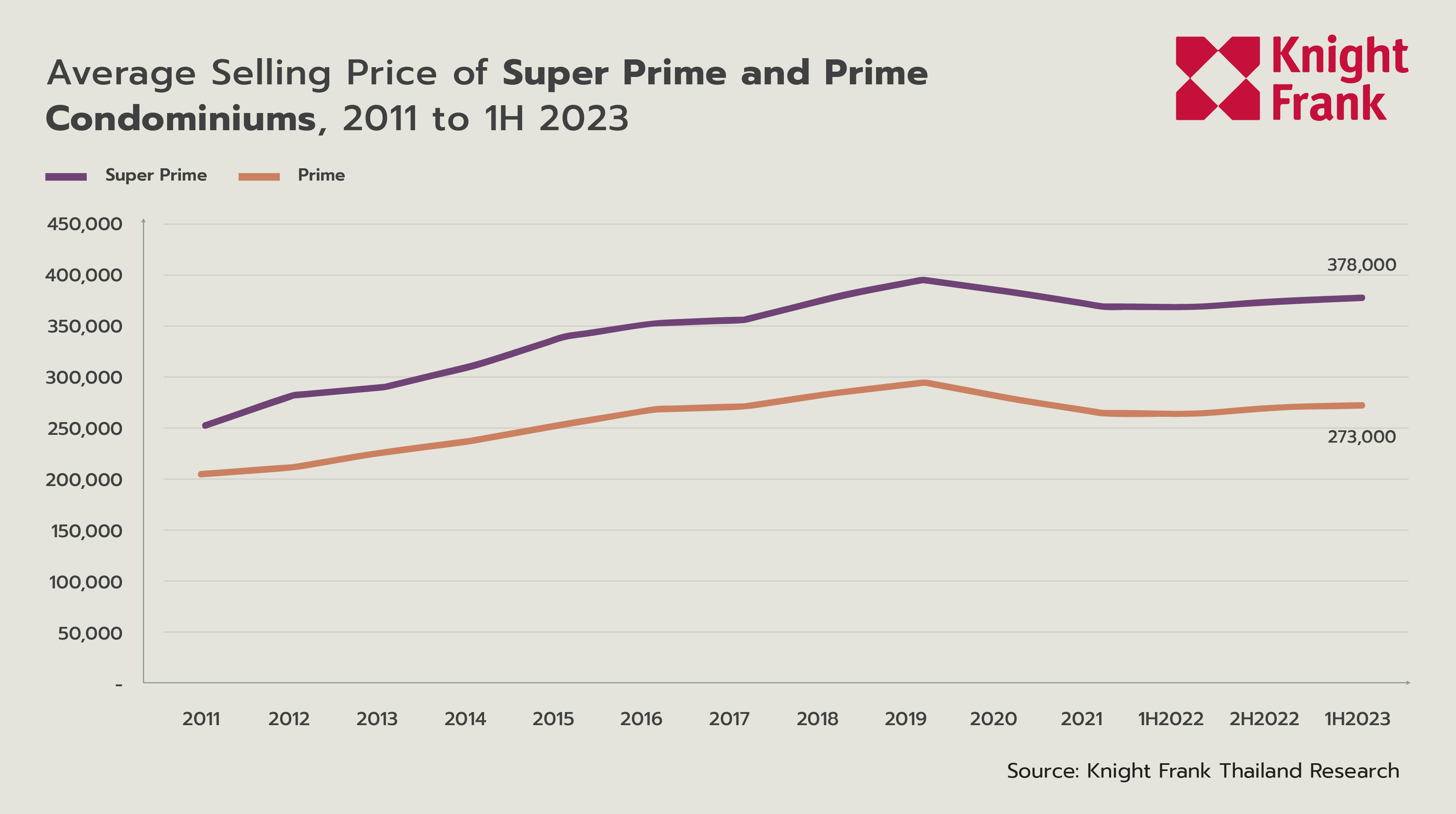

The average selling price of super prime condominiums in the mid of 2023 was 378,600 baht per square metre, which increased by 0.87% from the end of 2022 with the average selling price of 374,745 baht per square metre. The average selling price of prime condominiums in the mid of 2023 was 273,000 baht per square metre, increased by 0.96% from the end of 2022. As the market's absorption rate was pretty high, units remaining for sale were only 20%, leaving the market with limited options.

Market Outlook

There are continuous demands in this segment as it offers lucrative returns whether renting or reselling. Less outstanding supply and new upcoming supply may cause higher selling prices in the future. The operators need to develop projects that meet customers’ needs at the right time as well as to select a good location. A good location is a positive factor that creates continuous attention. The uniqueness of the location may result in a higher selling price as well. Furthermore, the return of Asian buyers, especially the Chinese, will bring this segment back to life again. This is expected to be a good sign for many operators who have previously put plans on hold to develop projects in prime locations and prepare to develop new projects in response to real demand and investors, both Thai and foreign buyers.