Leading diversified professional services and investment management firm Colliers (NASDAQ and TSX: CIGI) today releases its Q2 2022 Industrial Market Report. Key highlights include:

- JTC all industrial property price and rental indices continued their seventh consecutive quarter of growth in Q2 2022.

- The rental index rose by 1.5% QoQ in Q2 2022 – the fastest quarterly pace of growth registered since Q3 2013.

- The price index rose by 1.5% QoQ during the quarter, easing from the previous quarter’s 3.1% QoQ growth.

- Islandwide vacancy declined to 10% from the previous quarter’s 10.2% due to higher demand for multiple-user factories and warehouses.

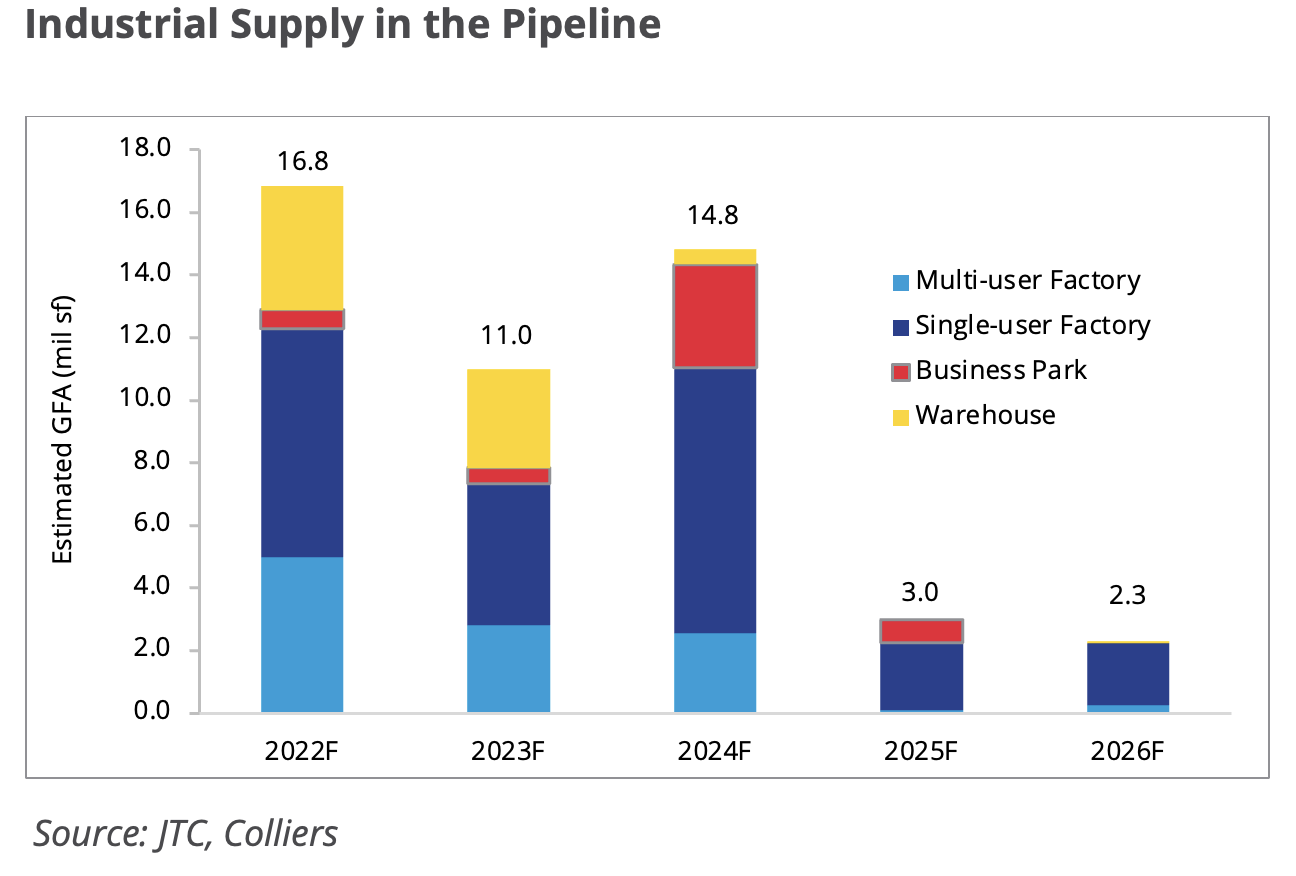

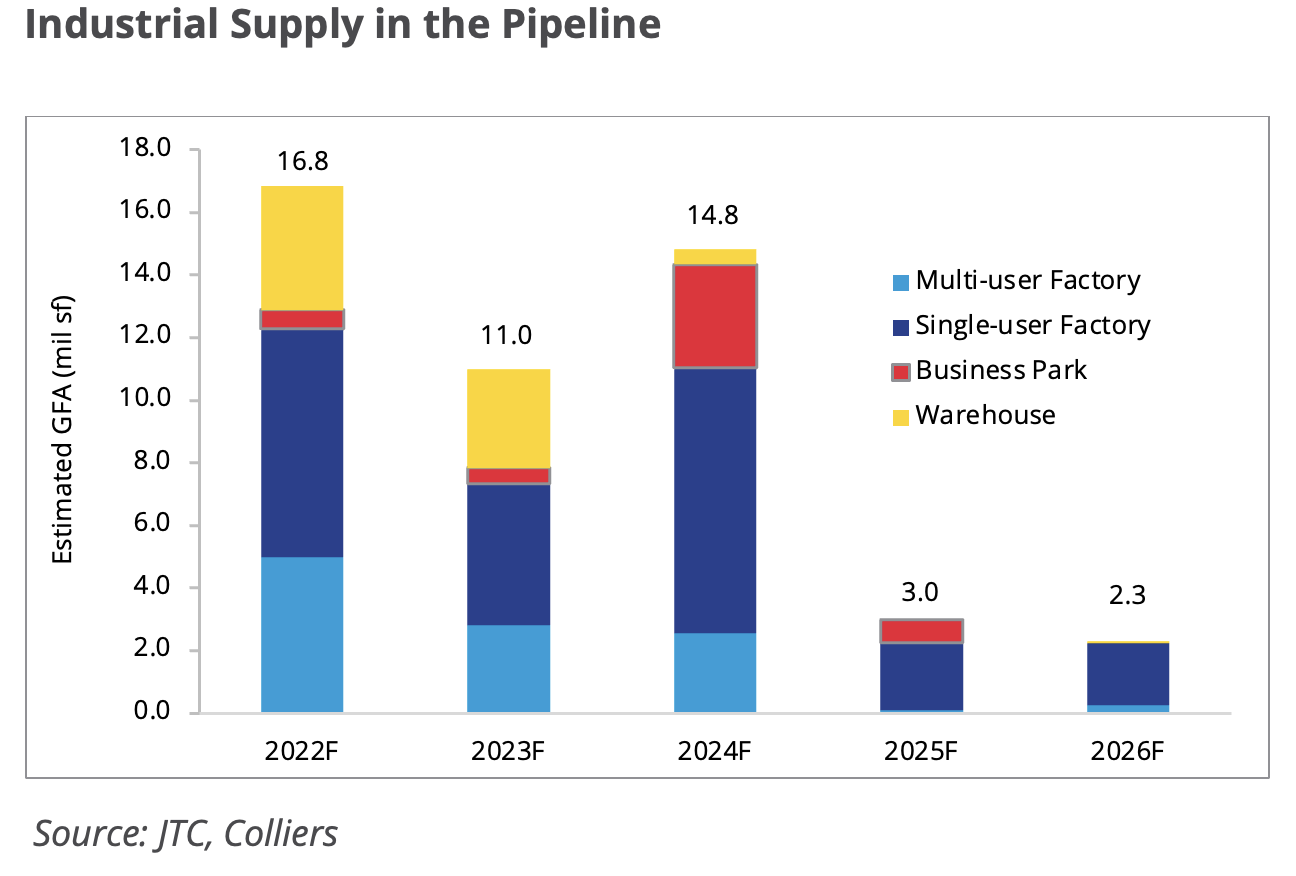

- Higher average annual new supply of approximately 12.9 mil sq ft coming onstream between now and 2025 (compared to 7.5 mil sq ft over the past three years). This could potentially temper the pace of growth for rents and price.

Factory

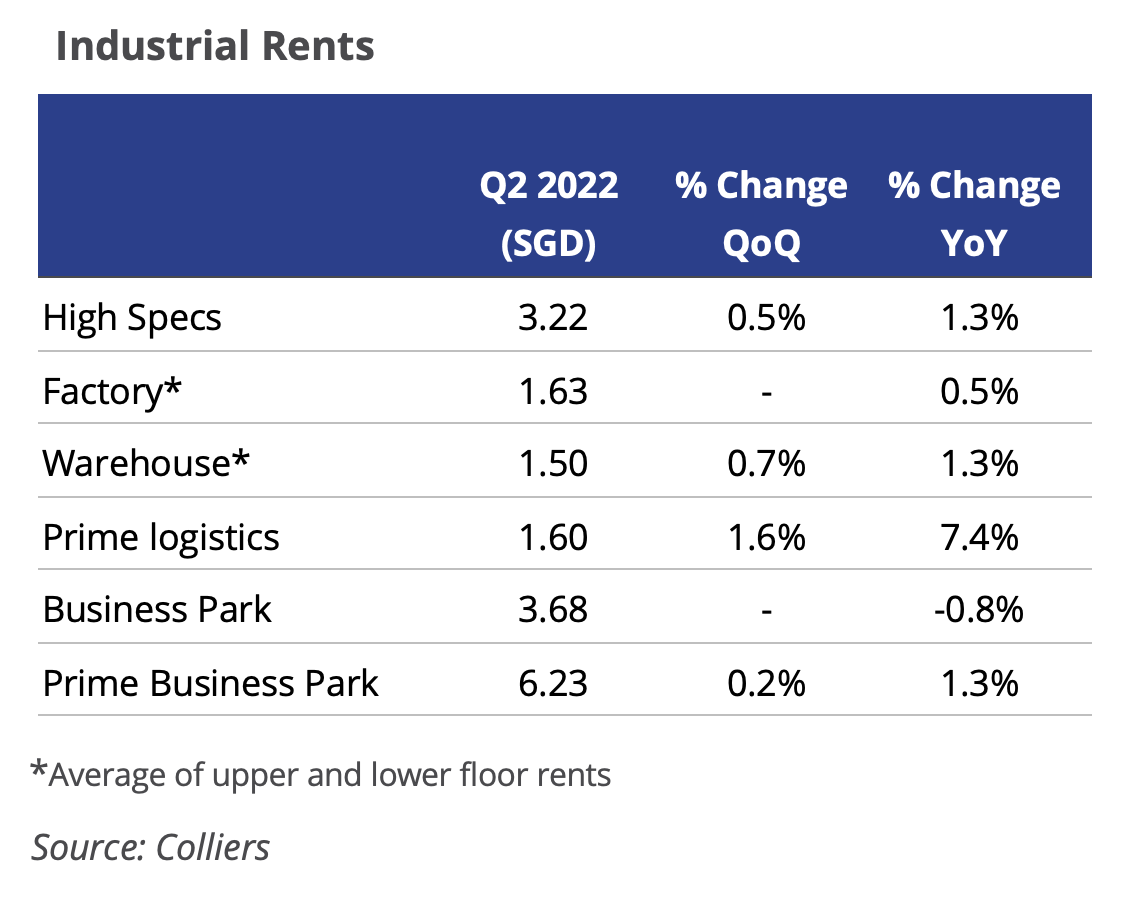

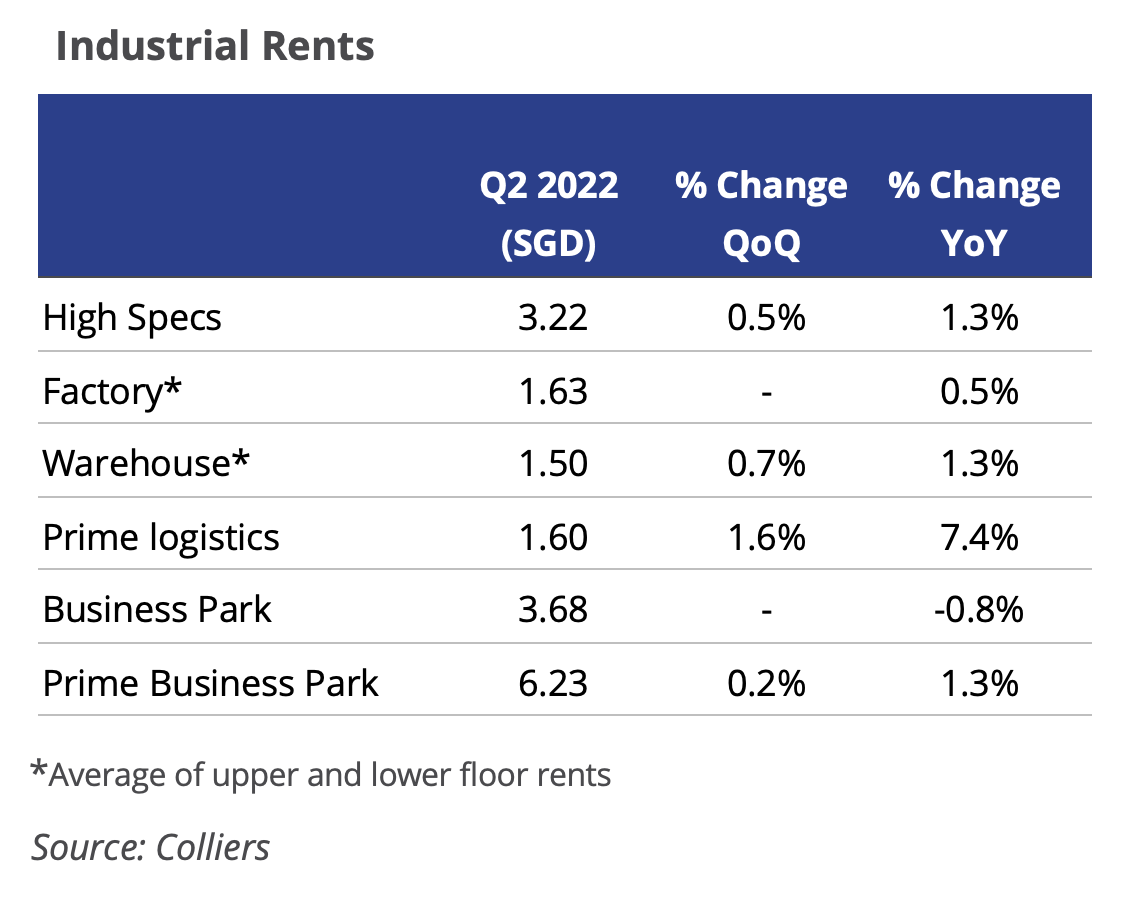

Rental indices for both multiple-user and single-user factories have increased with multiple-user factories registering its highest quarterly and annual growth at 2.1% QoQ and 3.7% YoY, respectively. Demand during the quarter was well-supported by continued growth seen for the food, electronics and precision engineering industries. Sustained growth in the manufacturing and wholesale trade sectors will continue to lend support to demand for factory space.

Warehouse

Occupancy for private warehouses during the quarter increased from 90.9% in Q1 to 91.4%. Rents for this segment also saw a 2.1% QoQ increase. Prime logistics rents will continue to experience a healthy growth on the back of strong demand, as vacancy remained tight with high pre-commitment rates on upcoming supply.

Business Park

Business park’s occupancy dropped 55 percentage points during the quarter and rents saw a 0.2% QoQ growth on the back of improved demand from knowledge and high-value sectors such as biomedical and technology firms.

During the quarter, net absorption came to 4.3 mil sq ft (up from 0.76 mil sq ft in the previous quarter), due to the strong demand for warehouses and multiple-user factories. Despite the higher demand seen in the quarter, the equally high supply pipeline could potentially temper the pace of growth for rents and price. The average annual supply of industrial stock in the next three years is expected to be around 12.9 mil sq ft as compared to the average 7.5 mil sq ft seen for the last three years.

Mr Lynus Pook, Executive Director and Head of Industrial Services, Singapore at Colliers says, “Strong demand and favorable prices could lead to more sale and leaseback activities in the market. For investors looking to diversify their real estate investment portfolio, high specification warehouses for essential goods storage can provide good buffer in times of macroeconomic uncertainties, as they are more defensive and resilient compared to other asset types.”

“In addition, freehold industrial assets are attractive pick for long-term wealth preservation and growth. Given the limited supply of industrial assets with freehold tenure, investors should take advantage of the opportunity created by an economic crisis to buy into freehold assets to hedge against inflation. Prices of freehold industrial assets have exhibited their ability to reach a new high when the economy bounces back and their value could rebound by more than 10%,” adds Mr Pook.

According to Ms Catherine He, Director and Head of Research, Singapore at Colliers, “The healthy demand for industrial premises will be driven by tailwinds as Singapore continues to focus on the high-value manufacturing and biomedical sectors. For the full-year period, industrial rents are anticipated to grow by between 2% and 4%. With investors drawn to the high yields for this asset class, coupled with limited availability of stock in the market in the near-term, prices are likely to experience an upward trend of about 5% to 7% for the full year.