Hong Kong's industrial market continues to decline due pandemic but demand for data centres surge - CBRE

Contact

Hong Kong's industrial market continues to decline due pandemic but demand for data centres surge - CBRE

CBRE report looks at how the prolonged pandemic continues to exert a negative impact on trade flows causing further decline in the Hong Kong industrial real estate market.

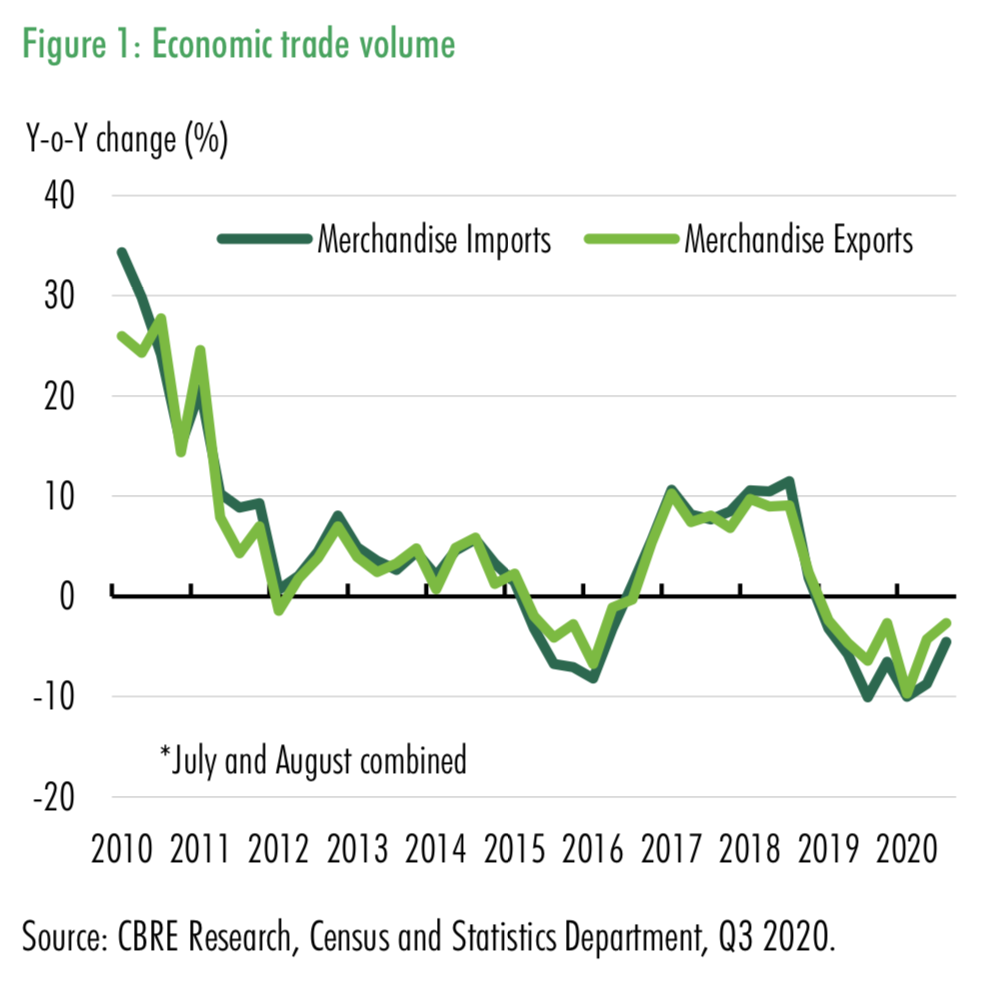

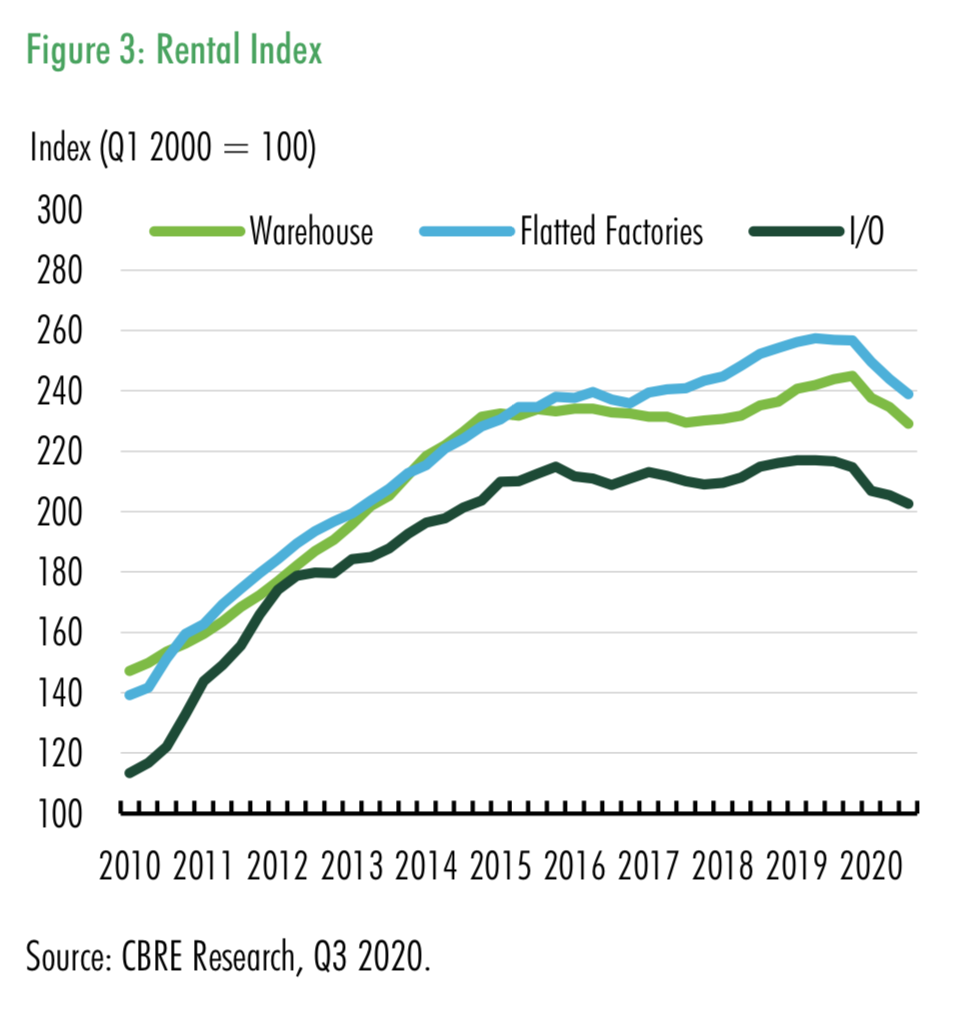

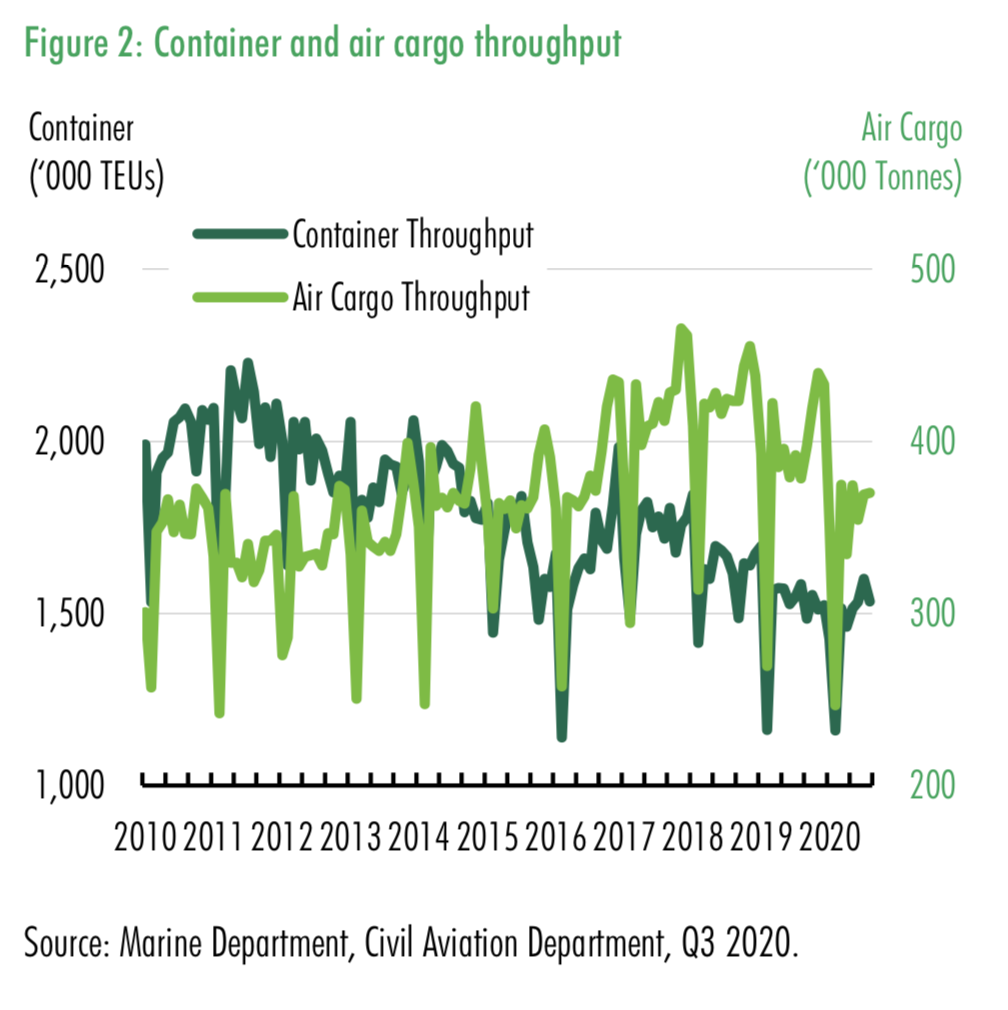

CBRE reports that the prolonged effects of COVID-19 continue to negatively impact the flow of trade from Hong Kong SAR for Q3 2020.

Despite leasing demand for industrial space remained low, there remained investment activity, with demand for data centres increasing due to shifts in using more cloud based systems.

CBRE report that "China Mobile acquired a government site for HK$5.6 billion, the most expensive government industrial land disposal on history".

Demand for cold storage facilities also saw an uptick in demand, with HSBC Life purchasing a scheme for HK$325 million.

Movement to new leases was mostly for cost cutting measures, where tennants more to more affordable locations or downsized.

Businesses serving the domestic economy remained relatively stable and self storage providers remained a strong source of leasing activity accounting for 33,000 square feet of new lettings.

CBRE predict "The pandemic will continue to cast a shadow over trading activity in the short to medium term. Other key macro events that could impact the Hong Kong SAR include November's US presidential election, the result of which may prompt a shift in US-China relations. Warehouse rents will likely edge down further over the next six months but are expected to be broadly stable in 2021."

For more information and to download the report click here.

Similar to this:

Hong Kong office market remains weak as vacancy rates continue to rise - CBRE

CBRE Appoints Jonathan Chau as head of Investment Property & Private Office for Hong Kong

Global investment volumes in industrial and logistics sector increase sixfold in a decade - Savills