Hong Kong office market remains weak as vacancy rates continue to rise - CBRE

Contact

Hong Kong office market remains weak as vacancy rates continue to rise - CBRE

Increased vacancy rates has some major landlords softening their lease negotiations as well as offering rental discounts and fit-out subsidies to attract tenants says CBRE Report.

Office leasing momentum remained weak in the third quarter of 2020 for Hong Kong.

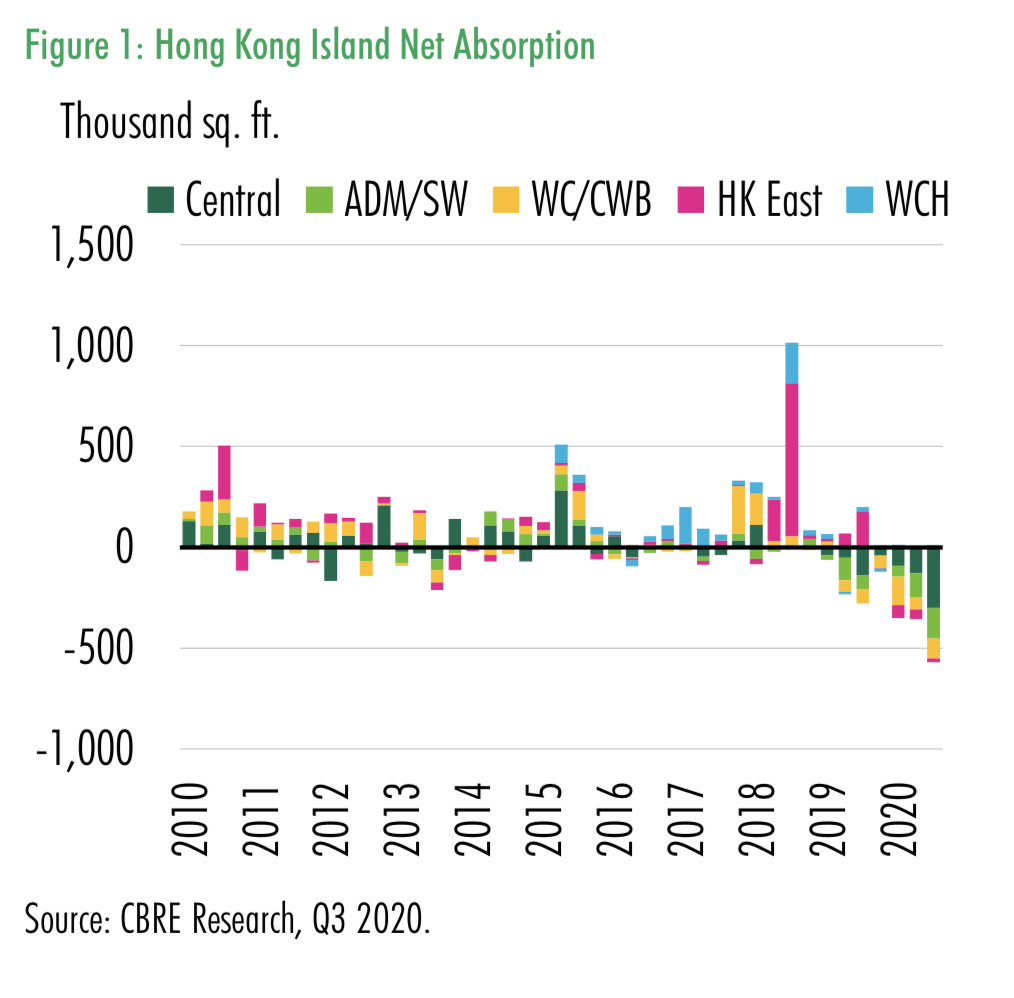

Transactions of large commercial spaces of over 20,000 square feet were limited and whole floor transactions were also reduced. Downsizing still seems to be a trend for a lot of retail tennants, this is expected to continue for the next six months says CBRE.

The city recorded a gross increase of 36 per cent quarter on quarter (q-o-q) but only reach half of the quarterly average for the last five years.

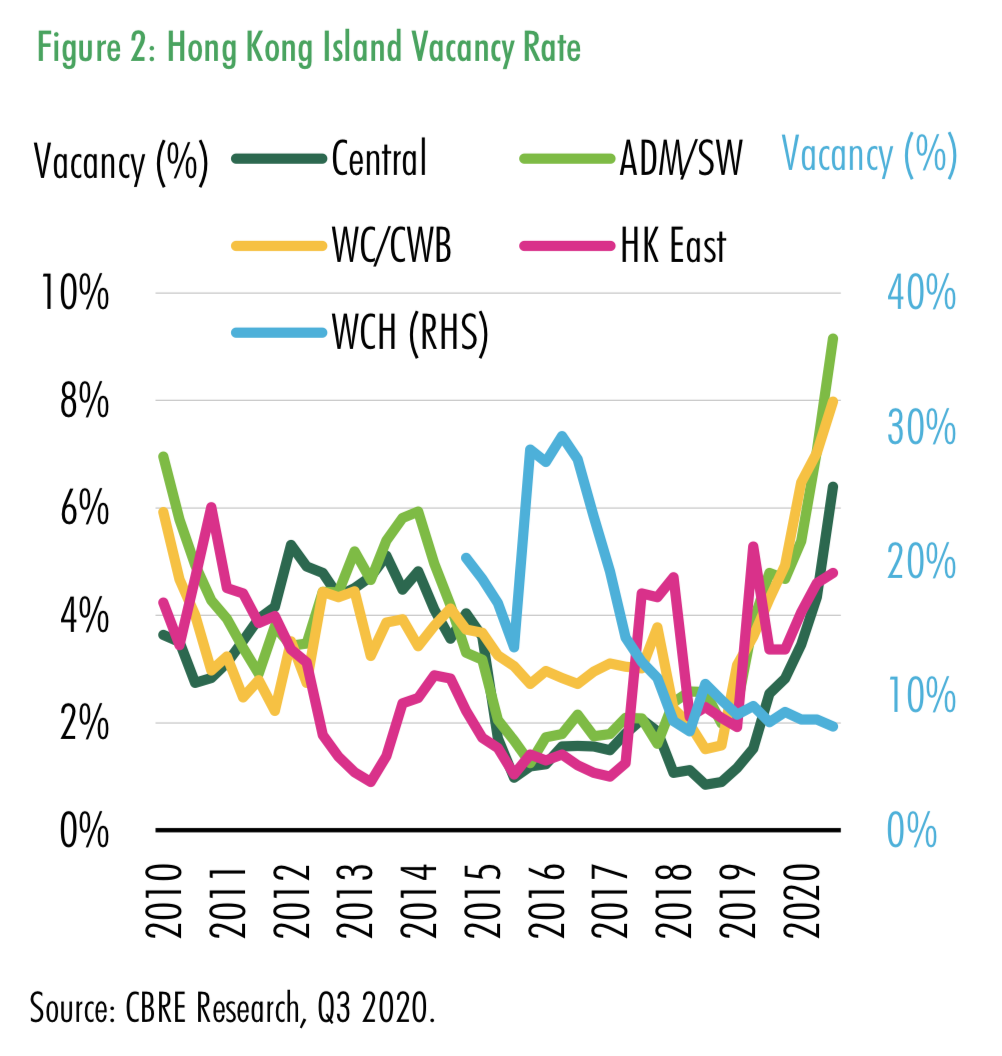

Vacancy rates hit 7.8 million square feet which is the highest it has been seen since 1999.

CBRE predicts that the leasing demand is "to remain subdued for the remainder of the year. Multinationals, especially US companies will stay cautious ahead of the US presidential election in November, the result of which may exert a strong influence on business strategy."

"Ongoing geopolitical conflict between the US and Mainland China will continue to weigh on multinationals decision making in Hong Kong SAR, particularly regarding headquarter offices.

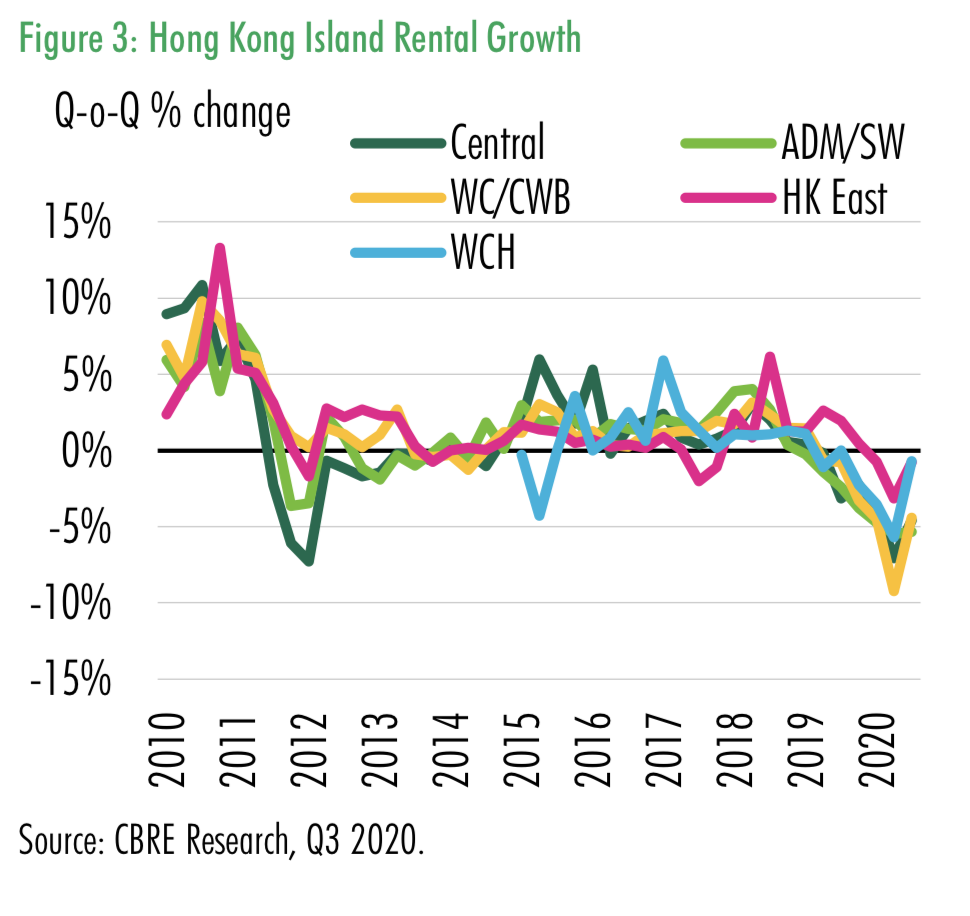

With the rising vacancy some major landlords are looking to more creative leasing packages, discounts and some even offering fit-out subsidies.

For more information and to download the report click here.

Similar to this:

CBRE Appoints Jonathan Chau as head of Investment Property & Private Office for Hong Kong

Global investment volumes in industrial and logistics sector increase sixfold in a decade - Savills

Mediacorp Places Andrew Road Site Singapore for Sale by CBRE and Showsuite Consultancy