COVID-19 Implications for Flexible Space: What’s Next? – CBRE Report

Contact

COVID-19 Implications for Flexible Space: What’s Next? – CBRE Report

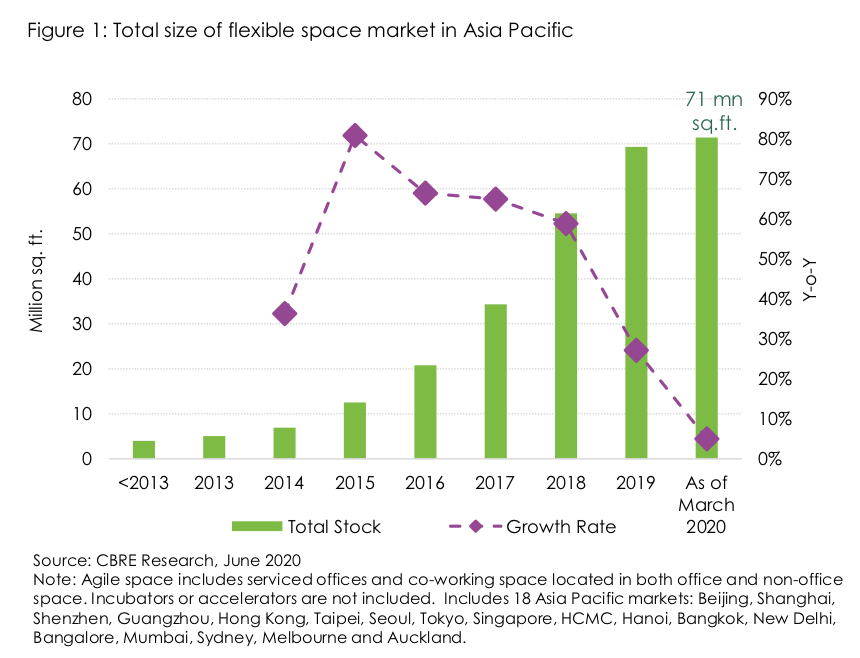

Lockdowns, social distancing requirements and a new culture of working from home has impacted the aggressive growth previously seen by these operators.

Across Asia Pacific flexible space, both co-working centres and serviced offices has been profoundly impacted by COVID-19.

Lockdowns, social distancing requirements and a new culture of working from home has impacted the aggressive growth previously seen by these operators.

Companies such as WeWork appear to be feeling this pressure. It has been rumoured they are seeking to close their Jongno Tower Soul offices in which they have leased a combined 18,895 square meters of space across 8 floors since September 2018 [as told by The Korea Times].

CBRE Reported, “COVID-19 has exerted a profound impact on the Asia Pacific office market in 2020, with effects ranging from a sharp short-term decline in new demand to the rapid adoption of remote-working.”

Although consolidation has replaced the rapid growth previously seen, CBRE reports that the “sector’s long-term fundamentals remain sound” and resilient in what was an already crowded market.

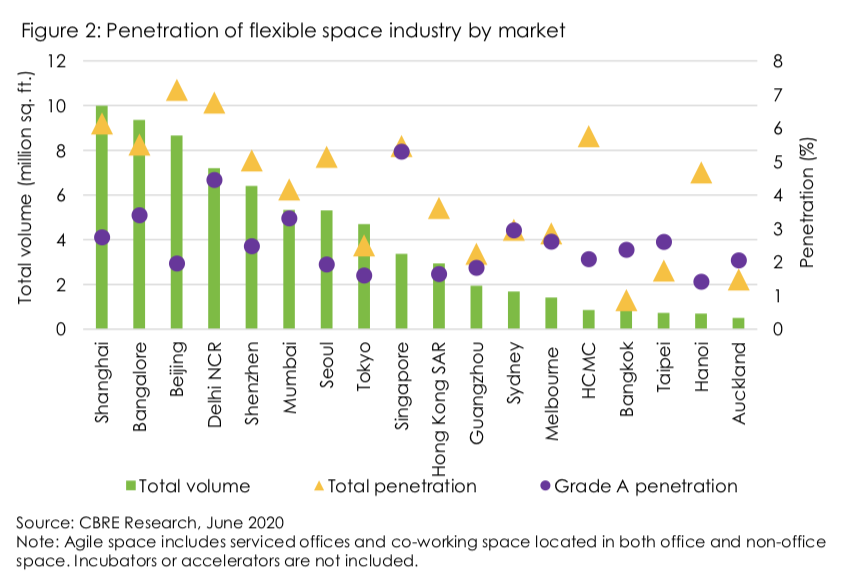

Smaller users will continue to need affordable serviced space while large occupiers, less exposed to cashflow risk will be looking for more freedom and agility in their office portfolio.

Large companies could end up having a mix of leased space, flexible space and remote-working, including a Head Office in the business district and several satellite offices in fringe districts for their staff to use when it suits.

Click here to view the report.

Similar to this:

COVID-19 restrictions set to push up demand for logistics in Tokyo - CBRE

CBRE Releases "In and Out Japan 2019" Report

Majority of Asia Pacific office markets record drops in activity during April - Knight Frank