Leasing and investment activity in Seoul 'remains stable' despite pandemic impact - CBRE

Contact

Leasing and investment activity in Seoul 'remains stable' despite pandemic impact - CBRE

New research from CBRE Korea has shown commercial real estate transaction volume in Seoul stood at 3.0 trillion won in Q2 2020, a marginal decrease compared to the same quarter last year.

The COVID-19 pandemic may have slowed deals for hotel and retail assets in Seoul but the city's office and logistics markets remain well positioned heading into the second half of the year, new research has found.

According to CBRE Korea's Seoul Market View Q2, 2020, commercial real estate transaction volume in Seoul stood at 3.0 trillion won in Q2 2020, a marginal decrease compared to the same quarter last year.

The report indicates offices accounted for 74 per cent of investment volume, mainly in Gangnam Business District (GBD) with several major deals including Glass Tower & SEI Tower, Hite Jinro Seocho Buidling and Young City.

CBRE Korea's Seoul Market View Q2, 2020 - At a glance:

- Commercial real estate transaction volume in Seoul stood at 3.0 trillion won in Q2 2020, a marginal decrease compared to the same quarter last year.

- The report indicates offices accounted for 74 per cent of investment volume, mainly in Gangnam Business District (GBD).

- Logistics properties accounted for 10 per cent of this quarter’s transaction volume with most deals involving local institutional investors.

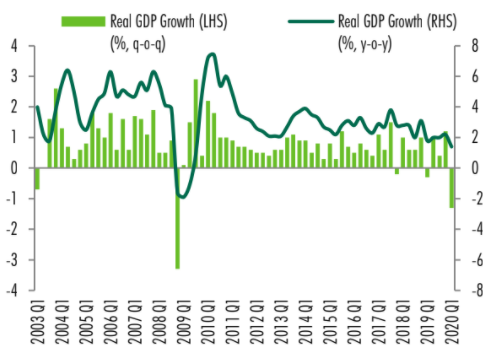

Real GDP Growth in Seoul. Source: CBRE Korea

At the same time, logistics properties accounted for 10 per cent of this quarter’s transaction volume with most deals involving local institutional investors.

Deals for hotel and retail assets, which slowed due to COVID-19, were mostly at around the 20 billion won mark and completed by individual investors.

CBRE Korea Managing Director Don Lim said office transaction volume is expected to remain solid amid stable demand from investors seeking core assets in Seoul’s major districts.

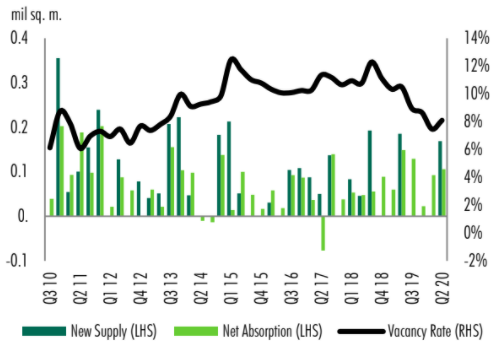

Seoul office supply/demand dynamics. Source: CBRE Korea

"Several major deals including Hyundai Insurance Gangnam Building, Parc1 Tower 2, and CJ CheilJedang HQ are in the pipeline for H2 2020," he said.

CBRE reports that COVID-19 pandemic continues to spur robust demand for logistics space from e-commerce platforms as well as third-party logistics (3PL) operators, with recent quarters showing a shift towards logistics development in the form of mixed assets.

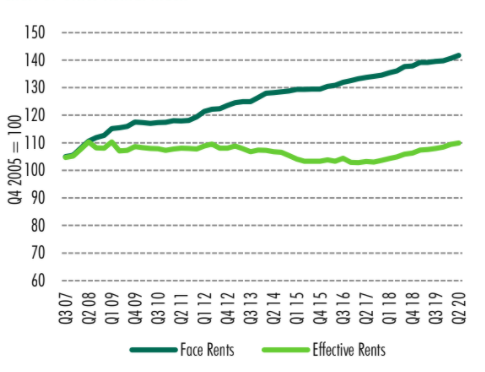

The office rental index. Source: CBRE Korea

CBRE Korea Head of Research Claire Choi said Average Grade A office vacancy in Seoul rose by 0.6 per cent q-o-q to 8.1 per cent in Q2 2020.

“While two new buildings were supplied in Q2, several buildings in the area secured new commitments this quarter," she said.

"Around 510,000 sq. ft. gross floor area (GFA) of new supply is due to come on stream in the Yeouido Business District (YBD) in H2 2020, which is likely to trigger stronger competition among landlords to secure tenants and may affect overall Grade A market dynamics in Greater Seoul.”

Click here to view the full report.

Similar to this:

Digital transformation of retail in the Asia Pacific accelerating due to COVID-19 -CBRE Survey

COVID-19 Implications for Flexible Space: What’s Next? – CBRE Report

CBRE Korea signs Memorandum of Understanding with design and engineering firm