Rising U.S. hedging costs decrease Asian real estate investment

Contact

Rising U.S. hedging costs decrease Asian real estate investment

CBRE Market Flash reveals rising U.S. interest rates have driven up hedging costs making Japanese and South Korean investment in U.S. real estate difficult.

Rising U.S. interest rates and an uncertain outlook for the dollar have driven up hedging costs significantly over the past year for investors from Japan and South Korea, making it more difficult for them to compete for U.S. real estate deals. With two more U.S. interest rate hikes planned for 2018, and rates in Japan and South Korea expected to remain static, hedging costs will likely increase further.

CBRE Market Flash at a glance:

- Annual hedging cost against dollar depreciation for yen and won investors has increased 60 basis points (bps), and 165 bps respectively over last six months.

- At current exchange rate, won investor faces hedging costs of 1.9% per year, yen investor faces 2.8% per year.

- As of Q1 2018, U.S. investment volume from Japanese and South Korean investors decreased by 62% YoY.

- Q1 2018, South Korean investment totalled $90 million, compared to $498 million in Q1 2017.

- Q1 2018, Japanese investment fell to $51 million from $1.2 billion Q1 2017.

Source: CBRE U.S. Market Flash

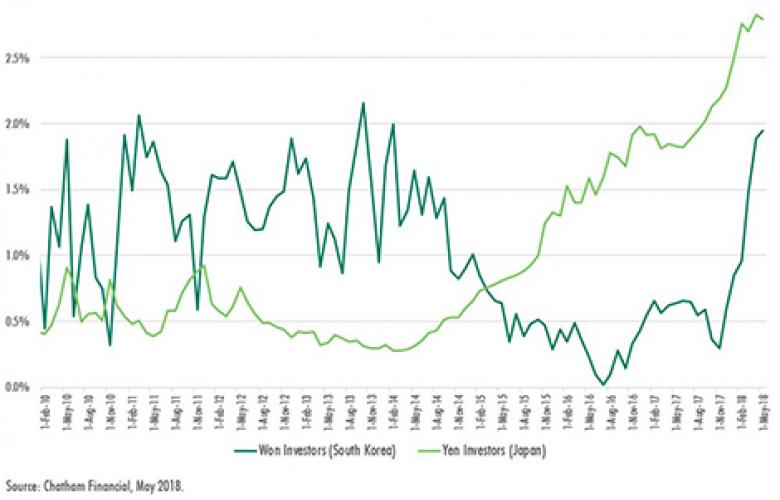

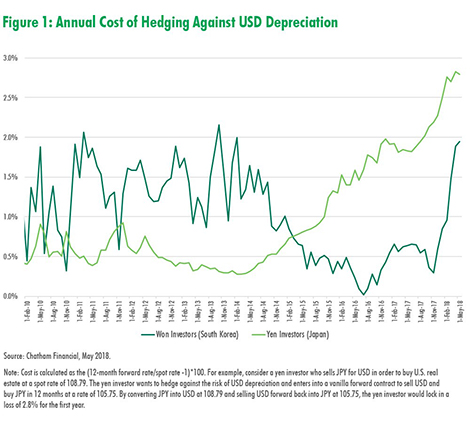

The annual cost of hedging against dollar depreciation for yen investors (Japan) has increased by 60 basis points (bps) over the past six months, while the cost for won investors (South Korea) has increased by 165 bps.

At current exchange rates, a won investor faces hedging costs of about 1.9% per year, while a yen investor faces about 2.8% per year. When considering a property with a cap rate of around 5%, hedging costs would erase about half the cash-on-cash yield.

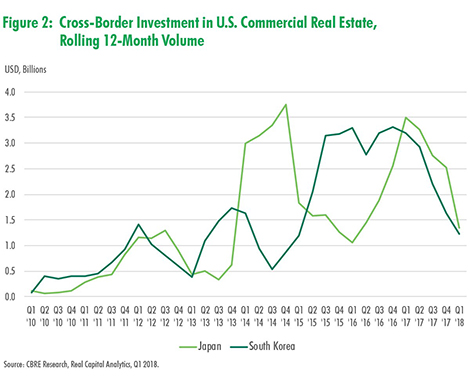

This is beginning to impact the market. As of Q1 2018, rolling 12-month U.S. investment volume decreased by 62% year-over-year for both Japanese and South Korean investors. Although volume had been declining throughout 2017, the drop-off accelerated in early 2018.

Source: CBRE U.S. Market Flash

In Q1 2018, South Korean investment totalled just $90 million, compared to $498 million in Q1 2017; Japanese investment fell to just $51 million from $1.2 billion. This is not to say that Asian investors are out of the game. Deals are still getting done, but the pace has slowed as investment strategies adjust.

Higher hedging costs may reduce competition for core product in gateway cities with very low cap rates, while potentially fueling greater interest in secondary markets where yields are higher.

WILLIAMS MEDIA spoke with Richard Barkham, PhD. Global Chief Economist for CBRE who said, "U.S. investors might keep in mind that a cost from one direction is a gain when investing in the opposite direction."

"At current forward exchange rates, USD investors could lock in additional returns when purchasing won or yen-dominated assets due to expected currency appreciation," he added.

These currency dynamics might, in turn, provide profitable opportunities for U.S.-based investors in Japan and South Korea. At current forward exchange rates, dollar investors could lock in additional returns when purchasing won- or yen-denominated assets and these gains increase as the spreads between interest rates widen.

For more information on Asian investment in U.S. real estate, phone or email Richard Barkham, PhD Global Chief Economist, CBRE via the contact details listed below.

Source: CBRE U.S. Market Flash

Similar to this:

Transparency Index reveals Asia Pacific shows fastest progress - JLL

Bangkok ranked 92nd most expensive city

Singapore rents rise with increasing demand and reduced supply - Savills reports